Question: Using the specific identification imventory method and the Inventory Report Table 1 8 - 1 , catculate the cost of goods available for sale. (

Using the specific identification imventory method and the Inventory Report Table catculate the cost of goods available for sale.

point question Using the Inventory Report Table and the Cost of Goods Available answer from Question above:

a Find the Cost of Goods Sold it net sales were $

b Using the Cost of Goods Sold that you just found from a estimate the ending inventory value using the "gross proft method" if the gross profit on the net sales of $ were w

Using the specific identification inventory method and the Inventory Report Table calculate the cost of goods available for sale.

point question Using the Inventory Report Table and the Cost of Goods Available answer from Question above:

a Find the Cost of Goods Sold if net sales were $

b Using the Cost of Goods Sold that you just found from a estimate the ending inventory value using the "gross profit method" if the gross profit on the net sales of $ were

Inventory Report Table

tableDate of Purchase,tableUnitsPurchasedCost Per UnitBeginning Inventory,$

Using the "weightedaverage cost inventory" method and the Inventory Report Table calculate the cost of ending inventory if units remain in stock. Round only the final answer to the nearest cent.

Using the FIFO inventory method and the Inventory Report Table calculate the cost of goods sold if units are in ending inventory.

Inventory Report Table

tableDate of Purchase,tableUnitsPurchasedCost Per UnitBeginning Inventory,$

Using the LIFO inventory method and the Inventory Report Table calculate the cost of roods sold if units are in ending inventory.

point question Using the retail method, the Inventory Report Table and the Retail Value Table if retail sales were $ :

a Calculate the cost of ending inventory.

b Calculate the cost of goods sold round your final answer to the nearest cent

Inventory Report Table

tableDate of Purchase,tableUnitsPurchasedCost Per UnitBeginning Inventory,$

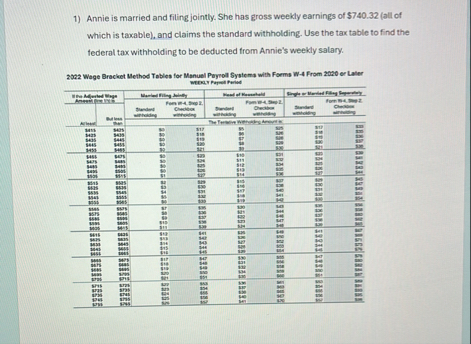

Annie is married and filing jointly. She has gross weekly earnings of $all of which is taxable and claims the standard withholding. Use the tax table to find the federal tax withholding to be deducted from Annie's weekly salary.

Wage Bracket Method Tables for Manuel Paynoll Systems with Foems W From er Later wecan Papmet Fund

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock