Question: Using the standard deviation of returns as a proxy for the total risk, by how much would the total risk change if you hold

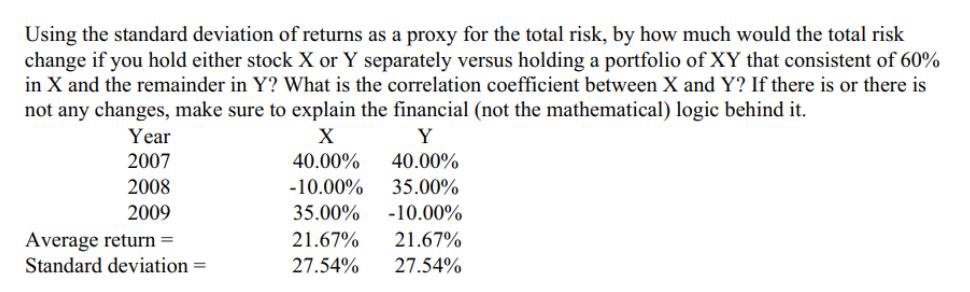

Using the standard deviation of returns as a proxy for the total risk, by how much would the total risk change if you hold either stock X or Y separately versus holding a portfolio of XY that consistent of 60% in X and the remainder in Y? What is the correlation coefficient between X and Y? If there is or there is not any changes, make sure to explain the financial (not the mathematical) logic behind it. X Y 40.00% 40.00% -10.00% 35.00% 35.00% -10.00% Year 2007 2008 2009 Average return = Standard deviation = 21.67% 27.54% 21.67% 27.54%

Step by Step Solution

3.58 Rating (165 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts