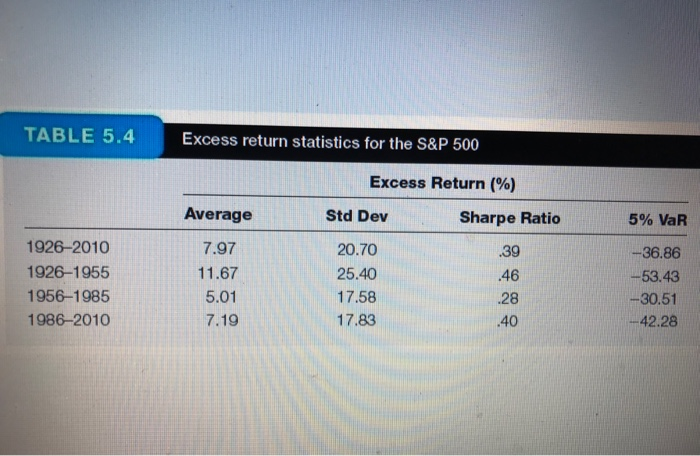

Question: Using the Table 5.4 as your guide, what is your estimate of the expected annual HPR on the S&P 500 stock portfolio if the current

| Using the Table 5.4 as your guide, what is your estimate of the expected annual HPR on the S&P 500 stock portfolio if the current risk-free interest rate is 5.8%? (Round your answer to 2 decimal places.) |

| Expected annual HPR | % |

TABLE 5.4 Excess return statistics for the S&P 500 Excess Return (%) Average Std Dev Sharpe Ratio 5% VaR 1926-2010 7.97 20.70 39 -36.86 1926-1955 11.67 25.40 .46 -53.43 1956-1985 5.01 17.58 28 -30.51 1986-2010 17.83 7.19 40 -42.28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts