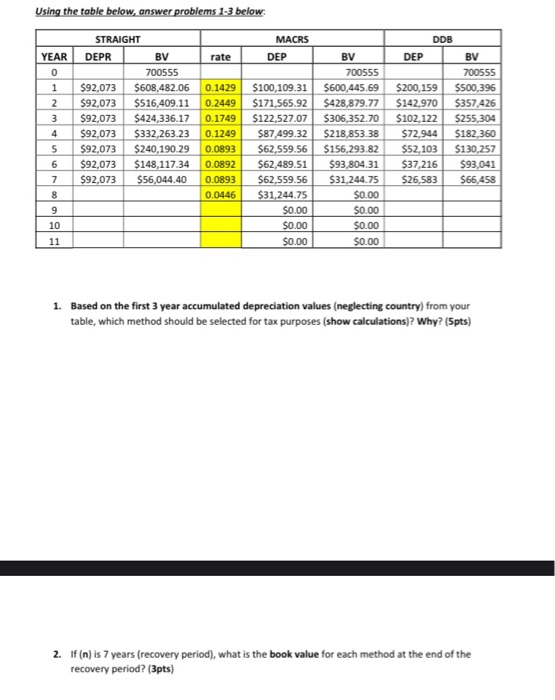

Question: Using the table below, answer problems 1.3 below MACRS DP | YEAR | rate | STRAIGHT DEPR | BV 700555 $92,073 $608,482.06 $92,073 $516,409.11 $92,073

Using the table below, answer problems 1.3 below MACRS DP | YEAR | rate | STRAIGHT DEPR | BV 700555 $92,073 $608,482.06 $92,073 $516,409.11 $92,073 $424,336.17 $92,073 $332,263.23 $92,073 $240,190.29 $92,073 $148,117.34 $92,073 $56,044.40 0.1429 0.2449 0.1749 0.1249 0.0893 0.0892 0.0893 0.0446 $100,109.31 $171,565.92 $122,527.07 $87,499.32 $62,559.56 $62,489.51 $62,559.56 $31, 244.75 $0.00 $0.00 $0.00 BV | 700555 $600,445.69 $428,879.77 $306,352.70 $218,853.38 $156,293.82 $93,804.31 $31,244.75 $0.00 $0.00 $0.00 $0.00 DDB DP | BV 700555 $200,159 $500,396 $142,970 $357,426 $102,122 $255,304 $72,944 $182,360 $52,103 $130.257 $37,216 $93,041 $26,583 $66,458 100 1. Based on the first 3 year accumulated depreciation values (neglecting country) from your table, which method should be selected for tax purposes (show calculations)? Why? (Spts) 2. If (n) is 7 years (recovery period), what is the book value for each method at the end of the recovery period? (3pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts