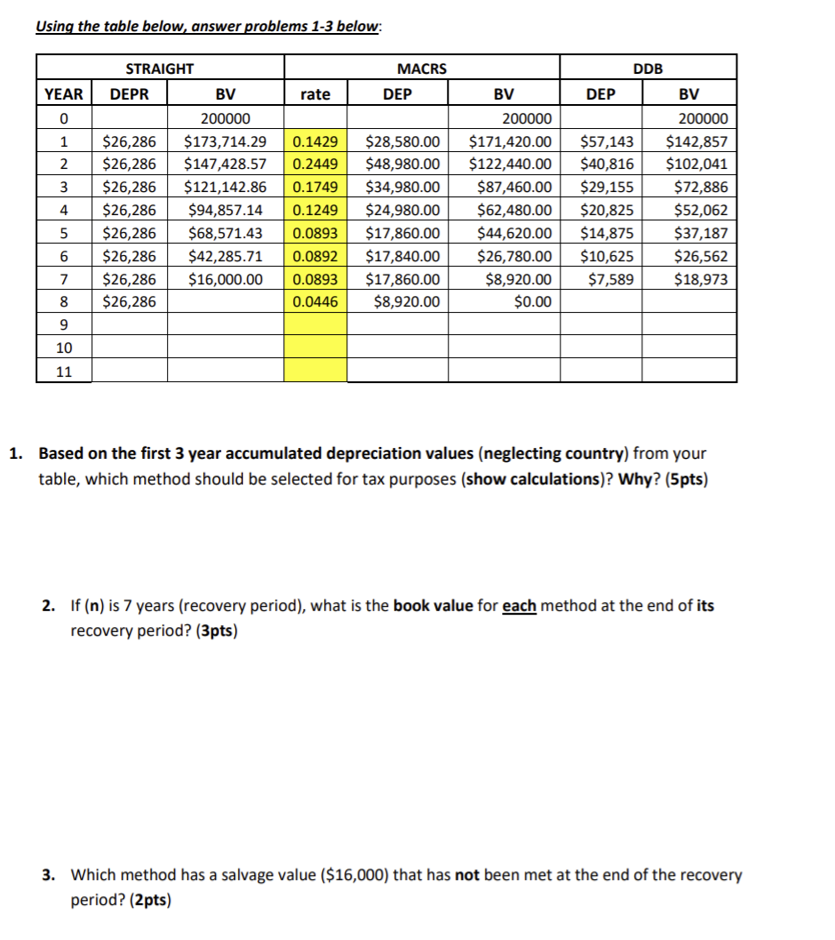

Question: Using the table below, answer problems 1-3 below: MACRS rate DEP YEAR 0 1 2 3 STRAIGHT DEPR BV 200000 $26,286 $173,714.29 $26,286 $147,428.57 $26,286

Using the table below, answer problems 1-3 below: MACRS rate DEP YEAR 0 1 2 3 STRAIGHT DEPR BV 200000 $26,286 $173,714.29 $26,286 $147,428.57 $26,286 $121,142.86 $26,286 $94,857.14 $26,286 $68,571.43 $26,286 $42,285.71 $26,286 $16,000.00 $26,286 0.1429 0.2449 0.1749 0.1249 0.0893 0.0892 0.0893 0.0446 BV 200000 $171,420.00 $122,440.00 $87,460.00 $62,480.00 $44,620.00 $26,780.00 $8,920.00 $0.00 $28,580.00 $48,980.00 $34,980.00 $24,980.00 $17,860.00 $17,840.00 $17,860.00 $8,920.00 4 DDB DEP BV 200000 $57,143 $142,857 $40,816 $102,041 $29,155 $72,886 $20,825 $52,062 $14,875 $37,187 $10,625 $26,562 $7,589 $18,973 5 6 7 8 9 10 11 1. Based on the first 3 year accumulated depreciation values (neglecting country) from your table, which method should be selected for tax purposes (show calculations)? Why? (5pts) 2. If (n) is 7 years (recovery period), what is the book value for each method at the end of its recovery period? (3pts) 3. Which method has a salvage value ($16,000) that has not been met at the end of the recovery period? (2pts) Using the table below, answer problems 1-3 below: MACRS rate DEP YEAR 0 1 2 3 STRAIGHT DEPR BV 200000 $26,286 $173,714.29 $26,286 $147,428.57 $26,286 $121,142.86 $26,286 $94,857.14 $26,286 $68,571.43 $26,286 $42,285.71 $26,286 $16,000.00 $26,286 0.1429 0.2449 0.1749 0.1249 0.0893 0.0892 0.0893 0.0446 BV 200000 $171,420.00 $122,440.00 $87,460.00 $62,480.00 $44,620.00 $26,780.00 $8,920.00 $0.00 $28,580.00 $48,980.00 $34,980.00 $24,980.00 $17,860.00 $17,840.00 $17,860.00 $8,920.00 4 DDB DEP BV 200000 $57,143 $142,857 $40,816 $102,041 $29,155 $72,886 $20,825 $52,062 $14,875 $37,187 $10,625 $26,562 $7,589 $18,973 5 6 7 8 9 10 11 1. Based on the first 3 year accumulated depreciation values (neglecting country) from your table, which method should be selected for tax purposes (show calculations)? Why? (5pts) 2. If (n) is 7 years (recovery period), what is the book value for each method at the end of its recovery period? (3pts) 3. Which method has a salvage value ($16,000) that has not been met at the end of the recovery period? (2pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts