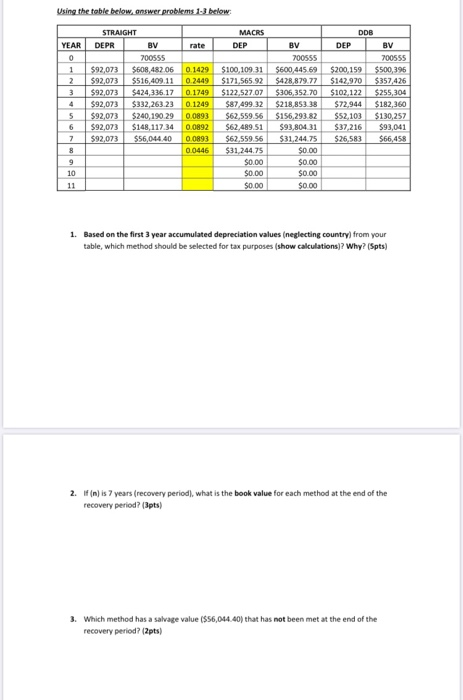

Question: Using the table below.answer problems 1-3 below YEAR 1 STRAIGHT DEPR BY rate 700555 $92,073 5608 482.06 0.1429 $92,073 $516.409 110 2449 $92 073 $424

Using the table below.answer problems 1-3 below YEAR 1 STRAIGHT DEPR BY rate 700555 $92,073 5608 482.06 0.1429 $92,073 $516.409 110 2449 $92 073 $424 336.17 0.1749 $92073 $332 263.23 0.1249 $92.073 $240,19029 0.0893 $92.073 $148, 117.34 0.0892 $9207355604440 0893 0.0446 MACRST DEP BY 200555 $100 10931 $600 445.69 $171.565 92 $428 879.77 $122 527.07 $306 352.70 $87,499.32 $218.853 38 562.559.56 $156,293.82 $62.489.51 $93.804 31 562.559 56 531 244.75 $31 244.75 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 DOS DEP BV 700555 $200, 159 $500 396 $142.970 $357 426 $102 122 $255, 304 $72.944 $182,360 5 52,103 $130.257 937 216 591 041 $26 583 $66.458 1. Based on the first 3 year accumulated depreciation values (neglecting country from your table, which method should be selected for tax purposes (show calculations? Why? (Spts) 2. ) is 7 years (recovery period. what is the book value for each method at the end of the recovery period? 3pts 3. Which method has a salvage value ($56,048.40) that has not been met at the end of the recovery period? (2pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts