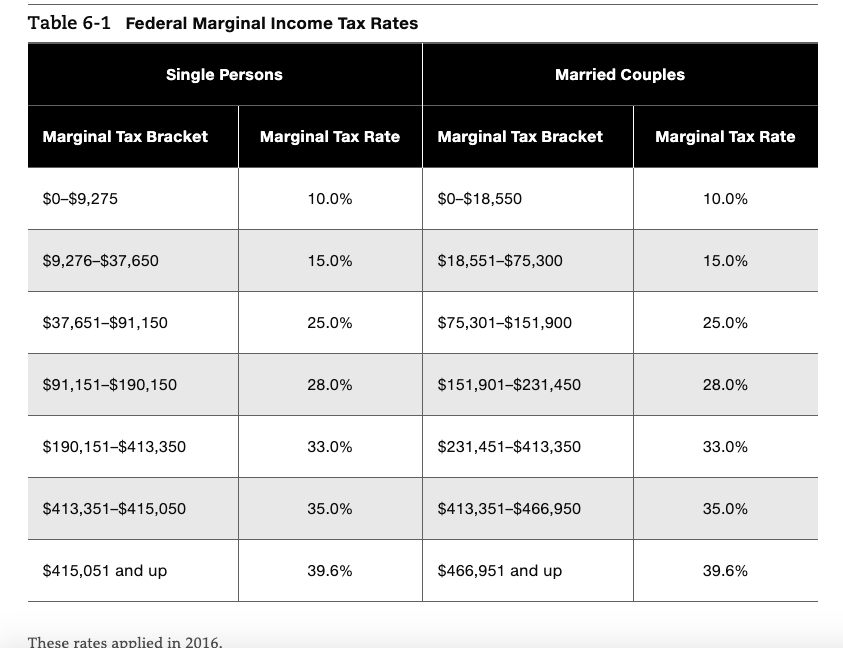

Question: Using the tax brackets in your textbook (table 6-1) calculate the average tax rate of a single person earning $100,000 per year. Show calculations If

- Using the tax brackets in your textbook (table 6-1) calculate the average tax rate of a single person earning $100,000 per year. Show calculations

- If that person making $100,000 receives a raise of $20,000,

- how much money in taxes will they have to pay on that extra $20,000?

- What is the marginal tax rate on the additional $20,000?

- At income $120,000 how large is the total tax paid on that income?

- Show calculations

- Calculate the average tax rate of a single person earning $200,000. Show your calculations

- If that person making $200,000 receives a raise of $50,000,

- how much money will they be paying in taxes on that additional $50,000? Show calculations.

- What is their marginal tax rate? Show calculation

Table 6-1 Federal Marginal Income Tax Rates Single Persons Married couples Marginal Tax Bracket Marginal Tax Rate Marginal Tax Bracket Marginal Tax Rate $0-$9,275 10.0% $0-$18,550 10.0% $9,276-$37,650 15.0% $18,551-$75,300 15.0% $37,651-$91,150 25.0% $75,301-$151,900 25.0% $91,151-$190,150 28.0% $151,901-$231,450 28.0% $190,151-$413,350 33.0% $231,451-$413,350 33.0% $413,351-$415,050 35.0% $413,351-$466,950 35.0% $415,051 and up 39.6% $466,951 and up 39.6% These rates applied in 2016, Table 6-1 Federal Marginal Income Tax Rates Single Persons Married couples Marginal Tax Bracket Marginal Tax Rate Marginal Tax Bracket Marginal Tax Rate $0-$9,275 10.0% $0-$18,550 10.0% $9,276-$37,650 15.0% $18,551-$75,300 15.0% $37,651-$91,150 25.0% $75,301-$151,900 25.0% $91,151-$190,150 28.0% $151,901-$231,450 28.0% $190,151-$413,350 33.0% $231,451-$413,350 33.0% $413,351-$415,050 35.0% $413,351-$466,950 35.0% $415,051 and up 39.6% $466,951 and up 39.6% These rates applied in 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts