Question: Using the tax rate schedule given here perform the following: a. Find the marginal tax rate for the following levels of sole proprietorship earnings

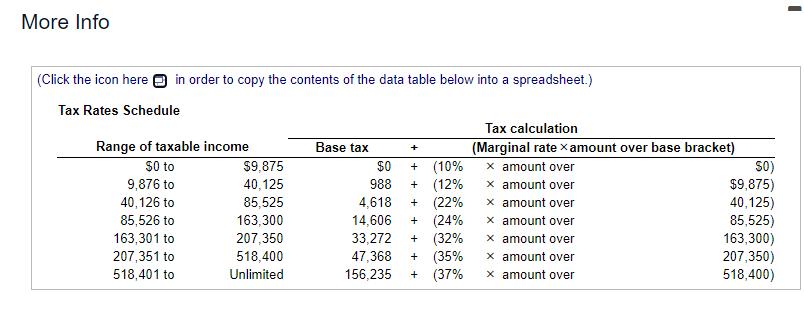

Using the tax rate schedule given here perform the following: a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $15,000; $60,000; $90,000; $150,000; $250,000; $450,000; and $1 million. b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis). More Info (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) Tax Rates Schedule Range of taxable income $0 to 9,876 to 40,126 to 85,526 to 163,301 to 207,351 to 518,401 to $9,875 40,125 85,525 163,300 207,350 518,400 Unlimited Base tax + + (10% $0 988 4,618 + (12% + (22% 14,606 + (24% 33,272 + (32% 47,368 + (35% 156,235 + (37% Tax calculation (Marginal rate x amount over base bracket) x amount over x amount over x amount over x amount over x amount over x amount over x amount over SO) $9,875) 40,125) 85,525) 163,300) 207,350) 518,400)

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts