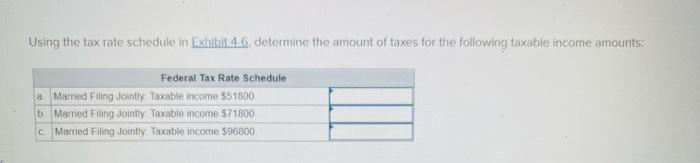

Question: Using the tax rate schedule in Exhibit 46, determine the amount of taxes for the following taxable income amounts: Federal Tax Rate Schedule a Married

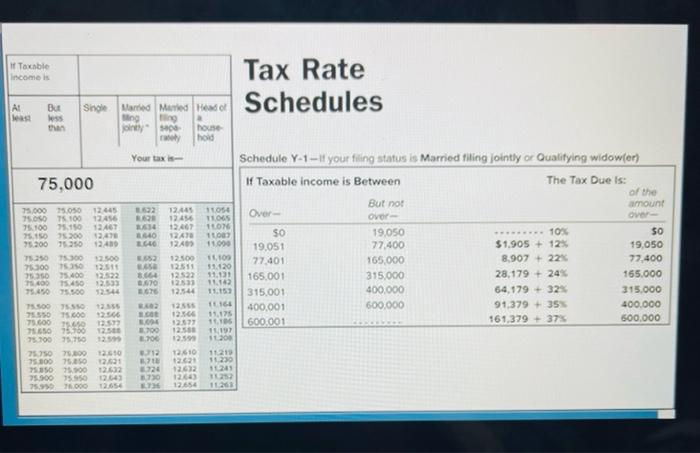

Using the tax rate schedule in Exhibit 46, determine the amount of taxes for the following taxable income amounts: Federal Tax Rate Schedule a Married Filing Jointly Taxable income $51800 Mamed Filing Jointly Taxable income $71800 Married Filing Jointly Taxable income $96800 Taxable Incomes Tax Rate Schedules But Single les than Maria Marie Head of ing y house hold Your taxi 75.000 52 10% 26 B640 1640 3653 12.45 12.454 12.27 12416 1240 2.500 12511 12522 3664 60 ET Schedule Y-1 -- 1 your firing status is Married filing jointly or Qualifying widower) If Taxable income is Between The Tax Due is: of the But not amount Over- ovo- SO 19.050 SO 19.051 77.400 $1.905 + 12% 19.050 77.401 165,000 8.907 + 22% 77.400 165.001 315.000 28,179 + 24% 165.000 315.000 400.000 64,179 +32 315.000 400.001 600.000 91379 +35 400.000 600.000 161.379 + 375 500,000 75.000 15.050 12445 750SO 75 100 1245 75.100 156150 12467 25.176200 95.200 75250 75.250 5.300 12.500 753300 12.11 75350 5.400 7.0 7.450 2533 75.450 75.500 78.500 550 7550 75.600 2572 SO 1800 12.50 75.700 75.00 125 75.750 2010 75.000 75.35 26 75.00 75.00 126 75.900 75.950 75. 71.000 12.654 2533 11054 1106 076 11003 11.09 11,100 51.420 11.131 11.12 15.151 16164 11.15 11 11:19 1200 11:21 11230 111245 12.544 25 12.30 75.600 . 1.094 100 3.700 12 12.5 12.610 126 12672 724 3.730 12.654 1123

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts