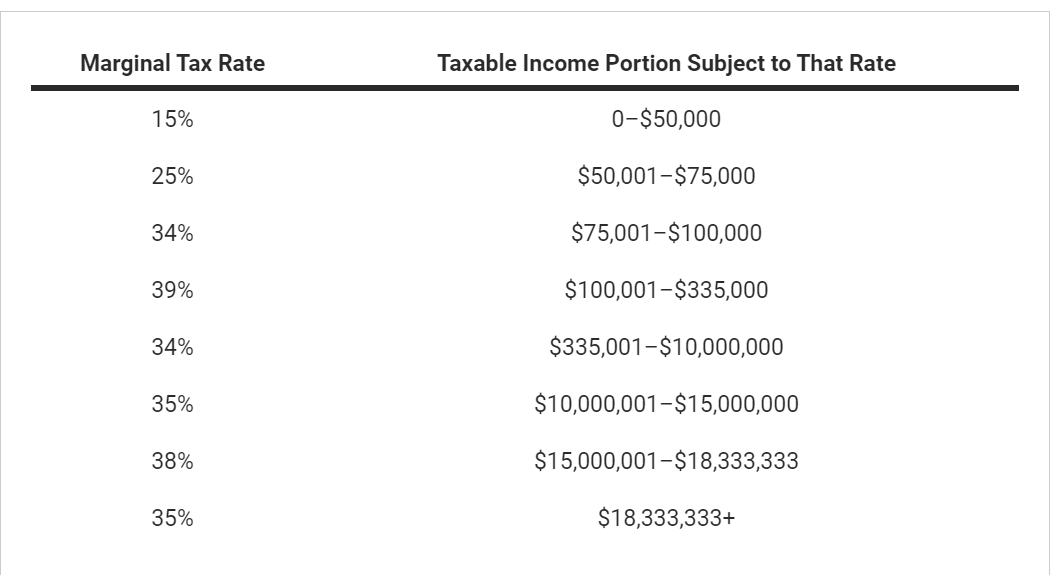

Question: Using the tax table provided in Figure below, determine the average and marginal tax rates for a company that earned $17.25 million in taxable income.

Using the tax table provided in Figure below, determine the average and marginal tax rates for a company that earned $17.25 million in taxable income.

A. Average rate = 34.25%; Marginal rate = 38.00%

B. Average rate = 34.81%; Marginal rate = 38.00%

C. Average rate = 35.00%; Marginal rate = 35.00%

D. Average rate = 38.00%; Marginal rate = 34.81%

Marginal Tax Rate Taxable Income Portion Subject to That Rate 15% 0-$50,000 25% $50,001-$75,000 34% $75,001-$100,000 39% $100,001-$335,000 34% $335,001-$10,000,000 35% $10,000,001-$15,000,000 38% $15,000,001-$18,333,333 35% $18,333,333+

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts