Question: using the template provided work out the journal entries using info given 1 Write your answer as a whole number in the space provided. Do

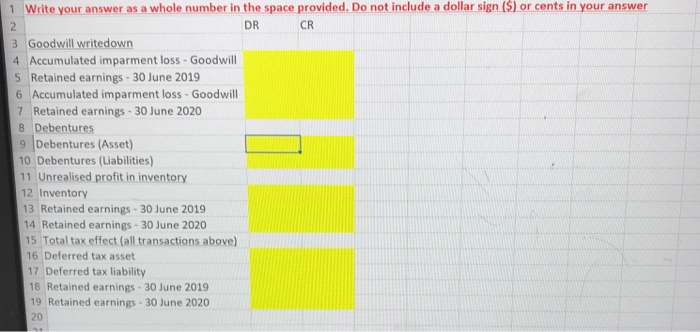

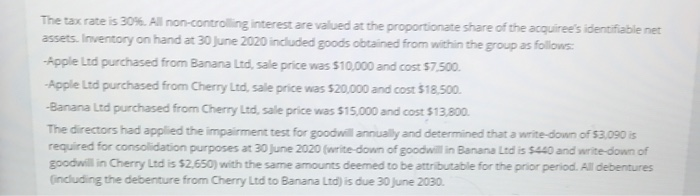

1 Write your answer as a whole number in the space provided. Do not include a dollar sign ($) or cents in your answer 2 DR CR 3 Goodwill writedown 4 Accumulated imparment loss - Goodwill 5 Retained earnings - 30 June 2019 6 Accumulated imparment loss - Goodwill 7 Retained earnings - 30 June 2020 8 Debentures 9 Debentures (Asset) 10 Debentures (Liabilities) 11 Unrealised profit in inventory 12 Inventory 13 Retained earnings - 30 June 2019 14 Retained earnings - 30 June 2020 15 Total tax effect (all transactions above) 16 Deferred tax asset 17 Deferred tax liability 18 Retained earnings - 30 June 2019 19 Retained earnings - 30 June 2020 20 The tax rate is 30%. All non-controlling interest are valued at the proportionate share of the acquiree's identifiable net assets. Inventory on hand at 30 June 2020 included goods obtained from within the group as follows: Apple Ltd purchased from Banana Ltd, sale price was $10,000 and cost $7.500. Apple Ltd purchased from Cherry Ltd, sale price was $20,000 and cost $18,500 -Banana Lid purchased from Cherry Ltd, sale price was $15,000 and cost $13,800. The directors had applied the impairment test for goodwill annually and determined that a write-down of 53,090 is required for consolidation purposes at 30 June 2020 (write down of goodwill in Banana Ltd is $440 and write down of goodwill in Cherry Ltd is $2,650) with the same amounts deemed to be attributable for the prior period. All debentures (including the debenture from Cherry Ltd to Banana Ltd) is due 30 June 2030. 1 Write your answer as a whole number in the space provided. Do not include a dollar sign ($) or cents in your answer 2 DR CR 3 Goodwill writedown 4 Accumulated imparment loss - Goodwill 5 Retained earnings - 30 June 2019 6 Accumulated imparment loss - Goodwill 7 Retained earnings - 30 June 2020 8 Debentures 9 Debentures (Asset) 10 Debentures (Liabilities) 11 Unrealised profit in inventory 12 Inventory 13 Retained earnings - 30 June 2019 14 Retained earnings - 30 June 2020 15 Total tax effect (all transactions above) 16 Deferred tax asset 17 Deferred tax liability 18 Retained earnings - 30 June 2019 19 Retained earnings - 30 June 2020 20 The tax rate is 30%. All non-controlling interest are valued at the proportionate share of the acquiree's identifiable net assets. Inventory on hand at 30 June 2020 included goods obtained from within the group as follows: Apple Ltd purchased from Banana Ltd, sale price was $10,000 and cost $7.500. Apple Ltd purchased from Cherry Ltd, sale price was $20,000 and cost $18,500 -Banana Lid purchased from Cherry Ltd, sale price was $15,000 and cost $13,800. The directors had applied the impairment test for goodwill annually and determined that a write-down of 53,090 is required for consolidation purposes at 30 June 2020 (write down of goodwill in Banana Ltd is $440 and write down of goodwill in Cherry Ltd is $2,650) with the same amounts deemed to be attributable for the prior period. All debentures (including the debenture from Cherry Ltd to Banana Ltd) is due 30 June 2030

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts