Question: Using The textbook problem please help me answer the following questions Obj. 1,2,3,4 Ken Jones, an architect, organized Jones Architects on April 1, 20Y2. During

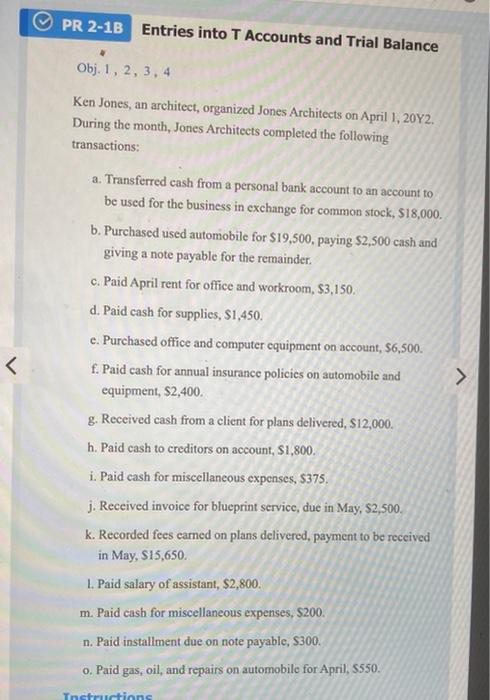

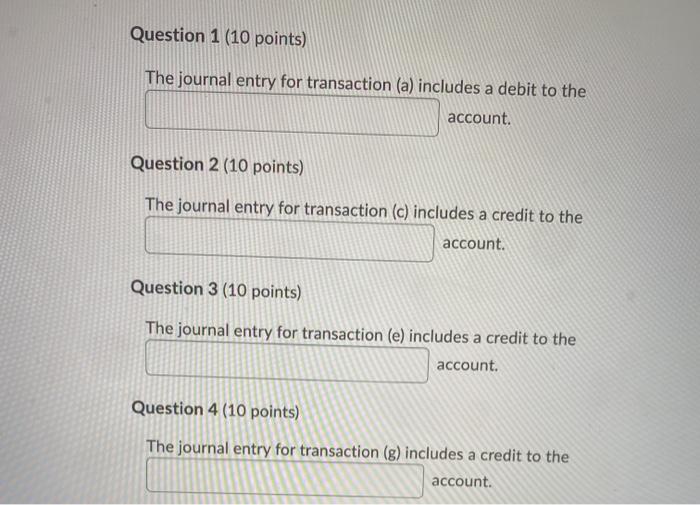

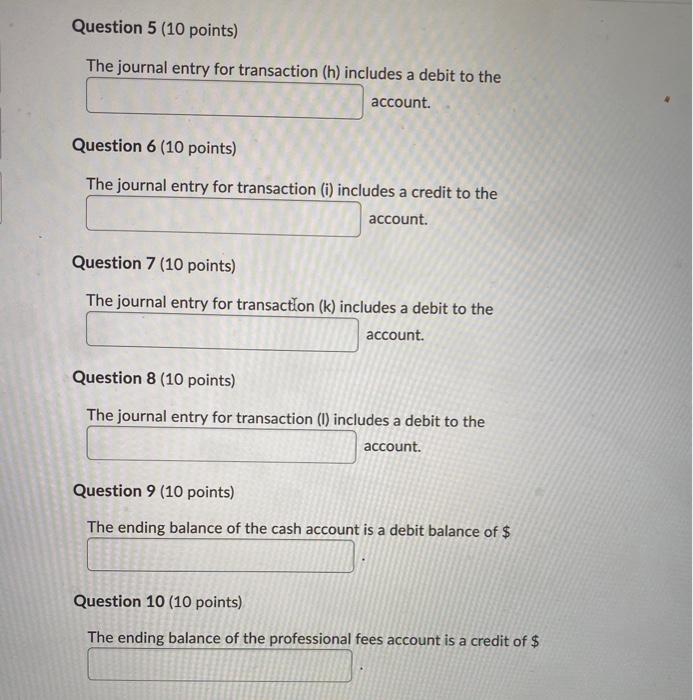

Obj. 1,2,3,4 Ken Jones, an architect, organized Jones Architects on April 1, 20Y2. During the month, Jones Architects completed the following transactions: a. Transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $18,000. b. Purchased used automobile for $19,500, paying $2,500 cash and giving a note payable for the remainder. c. Paid April rent for office and workroom, $3,150. d. Paid cash for supplies, $1,450. e. Purchased office and computer equipment on account, $6,500. f. Paid cash for annual insurance policies on automobile and equipment, $2,400. g. Received cash from a client for plans delivered, $12,000. h. Paid cash to creditors on account, $1,800. i. Paid cash for miscellancous expenses, $375. j. Received invoice for blueprint service, due in May, $2,500. k. Recorded fees carned on plans delivered, payment to be reccived in May, $15,650. 1. Paid salary of assistant, $2,800. m. Paid cash for miscellaneous expenses, \$200. n. Paid installment due on note payable, $300. o. Paid gas, oil, and repairs on automobile for April, $550. Question 1 (10 points) The journal entry for transaction (al includes a debit to the account. Question 2 (10 points) The journal entry for transaction (c) includes a credit to the account. Question 3 (10 points) The journal entry for transaction (el includes a credit to the account. Question 4 (10 points) The journal entry for transaction (g) includes a credit to the account. Question 6 (10 points) The journal entry for transaction (i) includes a credit to the account. Question 7 (10 points) The journal entry for transaction (k) includes a debit to the account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts