Question: using the top information answer the bottom information A real estate broker is offering a commercial property building for sale that has the following characteristics:

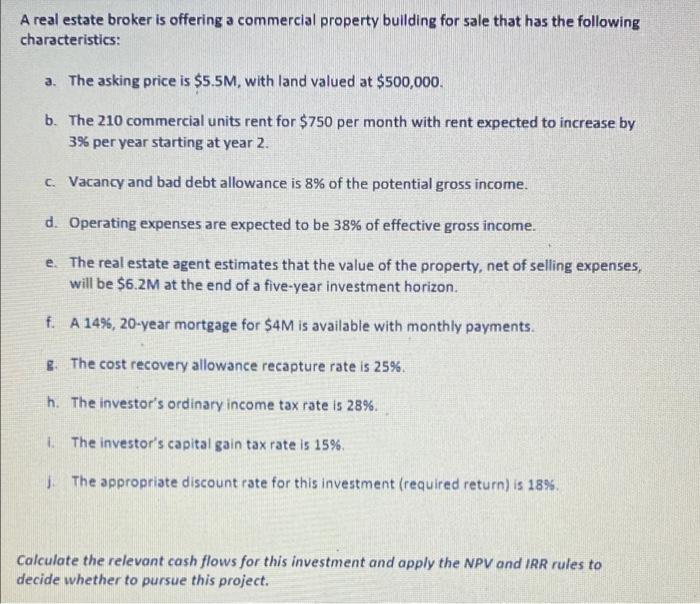

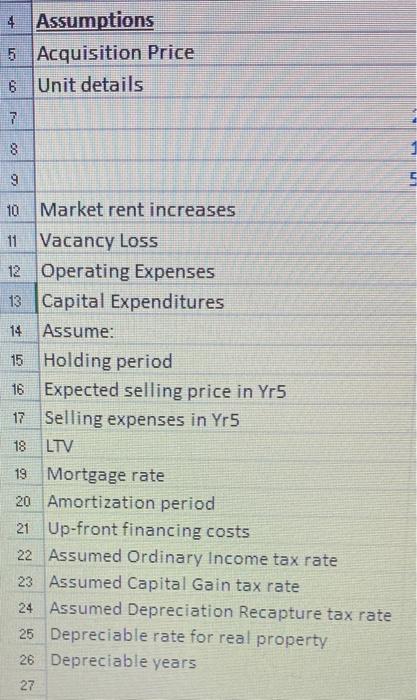

A real estate broker is offering a commercial property building for sale that has the following characteristics: a. The asking price is $5.5M, with land valued at $500,000. b. The 210 commercial units rent for $750 per month with rent expected to increase by 3% per year starting at year 2. C. Vacancy and bad debt allowance is 8% of the potential gross income. d. Operating expenses are expected to be 38% of effective gross income. e. The real estate agent estimates that the value of the property, net of selling expenses, will be $6.2M at the end of a five-year investment horizon f. A 14%, 20-year mortgage for $4M is available with monthly payments. . The cost recovery allowance recapture rate is 25% h. The investor's ordinary income tax rate is 28%. The investor's capital gain tax rate is 15% The appropriate discount rate for this investment (required return) is 18% Calculate the relevant cash flows for this investment and apply the NPV and IRR rules to decide whether to pursue this project. 4 Assumptions 5 Acquisition Price 6 Unit details 7 8 9 10 Market rent increases 11 Vacancy Loss 12 Operating Expenses Capital Expenditures 14 Assume: 15 Holding period 16 Expected selling price in Yr5 17 Selling expenses in Yr5 18 LTV 19 Mortgage rate 20 Amortization period 21 Up-front financing costs 22 Assumed Ordinary Income tax rate 23 Assumed Capital Gain tax rate 24 Assumed Depreciation Recapture tax rate 25 Depreciable rate for real property 26 Depreciable years 27 A real estate broker is offering a commercial property building for sale that has the following characteristics: a. The asking price is $5.5M, with land valued at $500,000. b. The 210 commercial units rent for $750 per month with rent expected to increase by 3% per year starting at year 2. C. Vacancy and bad debt allowance is 8% of the potential gross income. d. Operating expenses are expected to be 38% of effective gross income. e. The real estate agent estimates that the value of the property, net of selling expenses, will be $6.2M at the end of a five-year investment horizon f. A 14%, 20-year mortgage for $4M is available with monthly payments. . The cost recovery allowance recapture rate is 25% h. The investor's ordinary income tax rate is 28%. The investor's capital gain tax rate is 15% The appropriate discount rate for this investment (required return) is 18% Calculate the relevant cash flows for this investment and apply the NPV and IRR rules to decide whether to pursue this project. 4 Assumptions 5 Acquisition Price 6 Unit details 7 8 9 10 Market rent increases 11 Vacancy Loss 12 Operating Expenses Capital Expenditures 14 Assume: 15 Holding period 16 Expected selling price in Yr5 17 Selling expenses in Yr5 18 LTV 19 Mortgage rate 20 Amortization period 21 Up-front financing costs 22 Assumed Ordinary Income tax rate 23 Assumed Capital Gain tax rate 24 Assumed Depreciation Recapture tax rate 25 Depreciable rate for real property 26 Depreciable years 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts