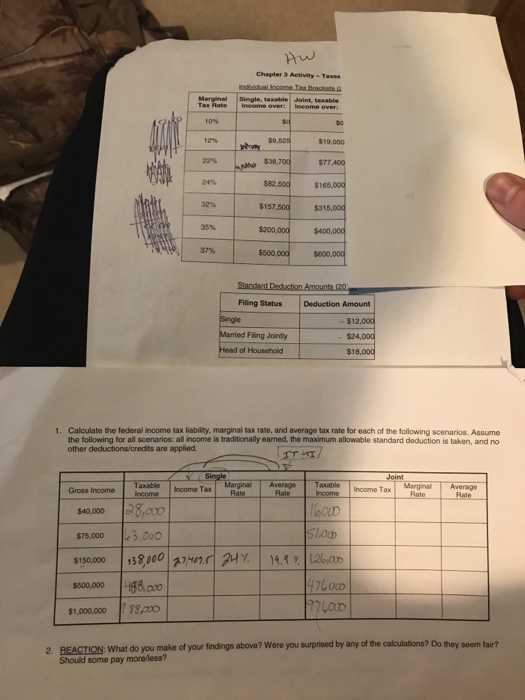

Question: Using the top worksheet, fill out the boxes in the bottom worksheet. Chapter 3 Activity-Taxes Marginal Single, taxable Tax Rate Joint, taxable over: ineome the

Chapter 3 Activity-Taxes Marginal Single, taxable Tax Rate Joint, taxable over: ineome the $38,700 ST7 $82,500 22% $77 .400 $165,000 $315,000 24% | $157,500+ 32% 35% $200 37% 8800 Filing Status Deduction Amount $12,000 Fling Jointy Head of Househoild $18,000 1. Calculate the federal income tax liability, marginal tax rate, and average tax rate for each of the following scenarios. Assume the following for all scenarios: all ncome is traditionally earned, the maximum allowable standard deduction is taken, and no other deductions/credits are applied Single Taxabioincome Tax Income Tax Marginal Average Taxabile Gross Income 540000 op $75,000 143,00 $150.000 138000 24 4.160 s00000 48,00 1,000,0008puo 2. REACTION What do you make of your findings above? Were you surprised by any of the calculations? Do they seem fair? Should some pay moreless

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts