Question: Using the Units-of-Production Method of depreciation, how much depreciation expense should be recorded in Year 1? And what is the book value at the end

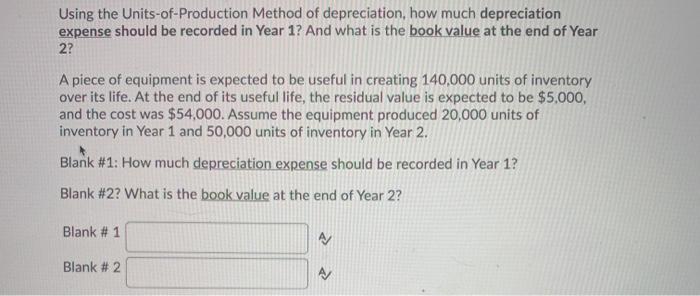

Using the Units-of-Production Method of depreciation, how much depreciation expense should be recorded in Year 1? And what is the book value at the end of Year 2? A piece of equipment is expected to be useful in creating 140,000 units of inventory over its life. At the end of its useful life, the residual value is expected to be $5,000, and the cost was $54,000. Assume the equipment produced 20,000 units of inventory in Year 1 and 50,000 units of inventory in Year 2. Blank #1: How much depreciation expense should be recorded in Year 1? Blank #2? What is the book value at the end of Year 2? Blank # 1 Blank # 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts