Question: Using the Venture Capital valuation method we covered in class, what was CMUVs PRE -money valuation of DIY Chef? $4,000 $8,004,000 $12,000,000 $20,000,000 DIY Chef

Using the Venture Capital valuation method we covered in class, what was CMUVs PRE-money valuation of DIY Chef?

| | | $4,000 |

| | | $8,004,000 |

| | | $12,000,000 |

| | | $20,000,000 |

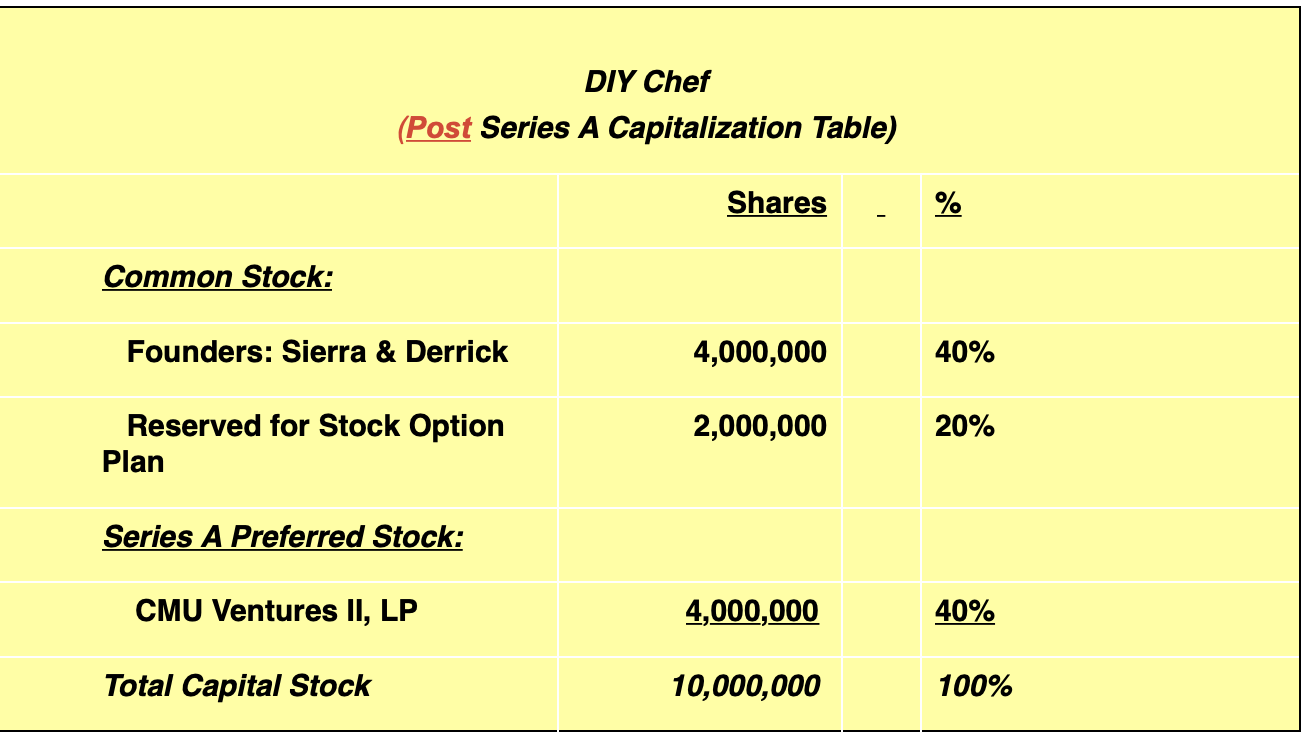

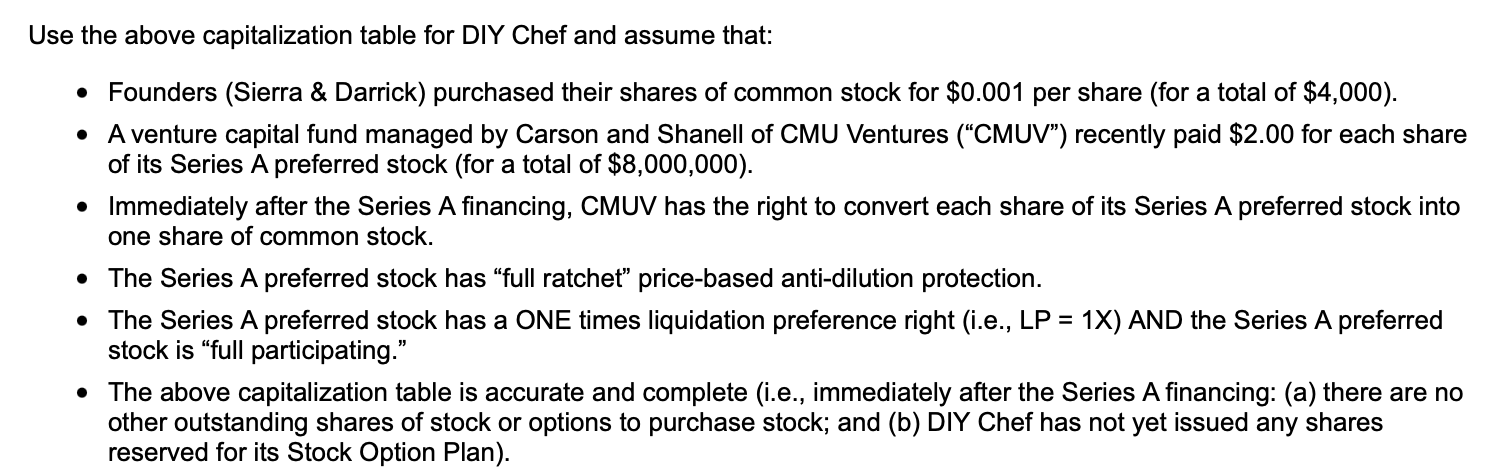

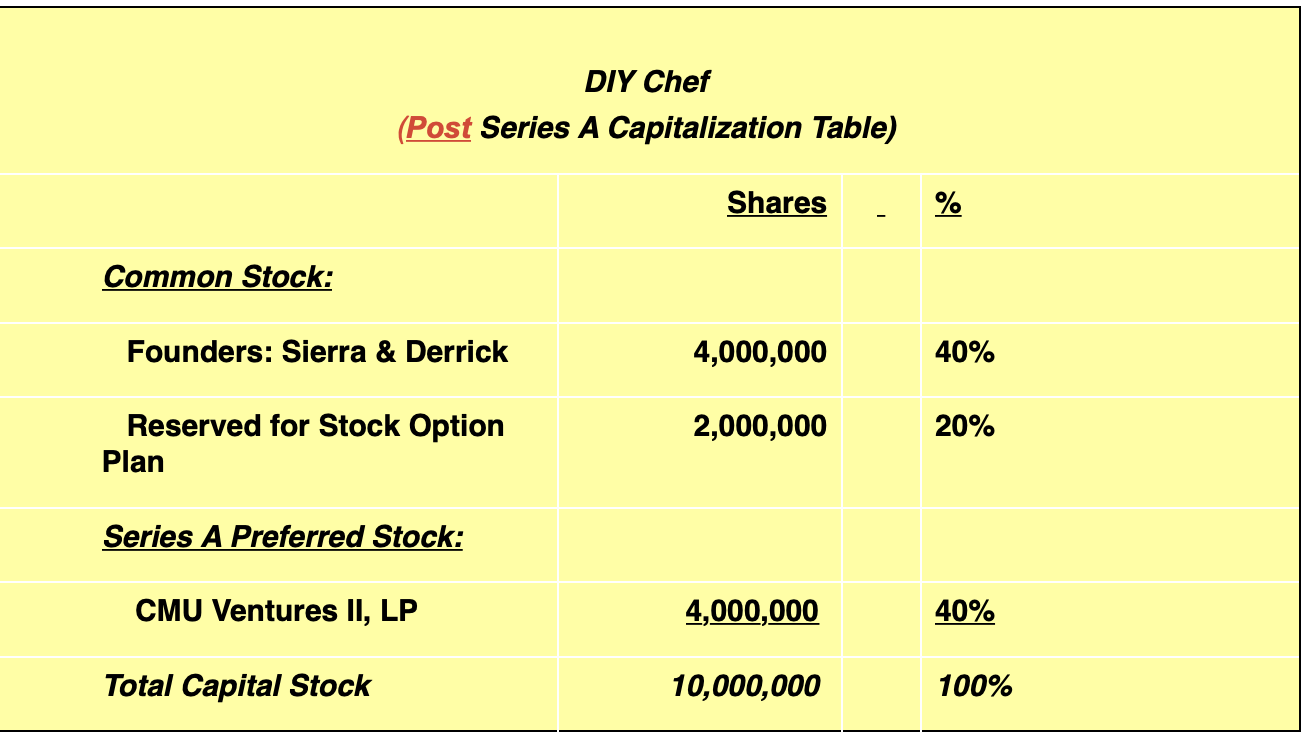

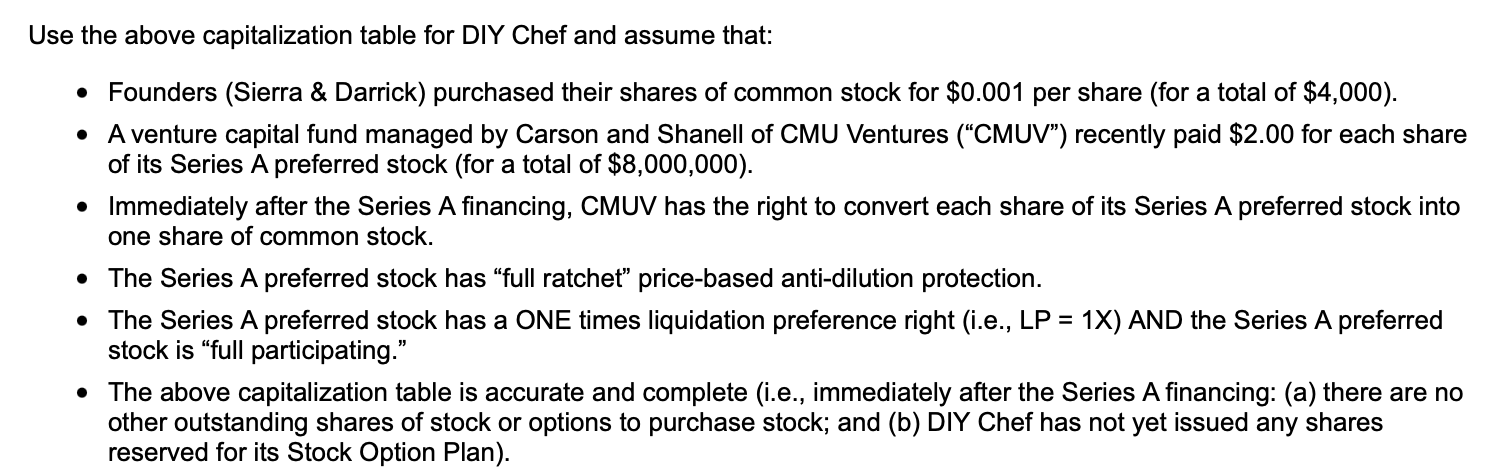

DIY Chef (Post Series A Capitalization Table) Shares % Common Stock: Founders: Sierra & Derrick 4,000,000 40% Reserved for Stock Option Plan 2,000,000 20% Series A Preferred Stock: CMU Ventures II, LP 4,000,000 40% Total Capital Stock 10,000,000 100% Use the above capitalization table for DIY Chef and assume that: Founders (Sierra & Darrick) purchased their shares of common stock for $0.001 per share (for a total of $4,000). A venture capital fund managed by Carson and Shanell of CMU Ventures ("CMUV") recently paid $2.00 for each share of its Series A preferred stock (for a total of $8,000,000). Immediately after the Series A financing, CMUV has the right to convert each share of its Series A preferred stock into one share of common stock. The Series A preferred stock has full ratchet" price-based anti-dilution protection. The Series A preferred stock has a ONE times liquidation preference right (i.e., LP = 1X) AND the Series A preferred stock is full participating. The above capitalization table is accurate and complete (i.e., immediately after the Series A financing: (a) there are no other outstanding shares of stock or options to purchase stock; and (b) DIY Chef has not yet issued any shares reserved for its Stock Option Plan)