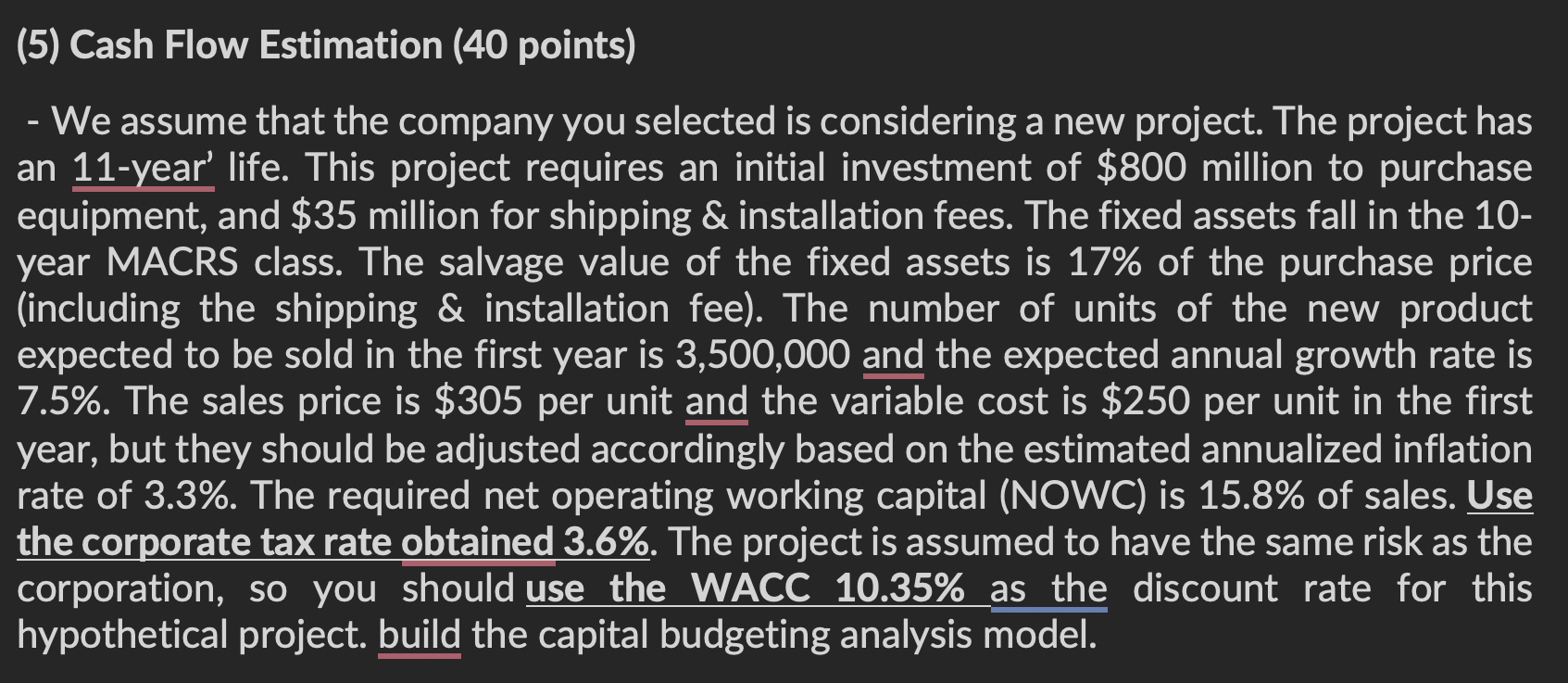

Question: - Using the WACC 1 0 . 3 5 % , apply capital budgeting analysis techniques for IRR, MIRR, PI , Payback, and Discounted Payback

Using the WACC apply capital budgeting analysis techniques for IRR, MIRR, PI Payback, and Discounted Payback to analyze the new project

Perform asensitivity analysis using a data table in Excelfor the effects of key variables eg sales growth rate, cost of capital, unit costs, sales price on the estimated NPV or IRR to demonstrate the model's sensitivity Thescenario analysisof several variables simultaneously is preferred but not required.

Discuss whether the project should be taken and summarize your report.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock