Question: Using the YIELD DATA below determine the following, for a plant designed to produce 150 million liters per year of biofuel: YIELD DATA: 2a) Assuming

Using the YIELD DATA below determine the following, for a plant designed to produce 150 million liters per year of biofuel:

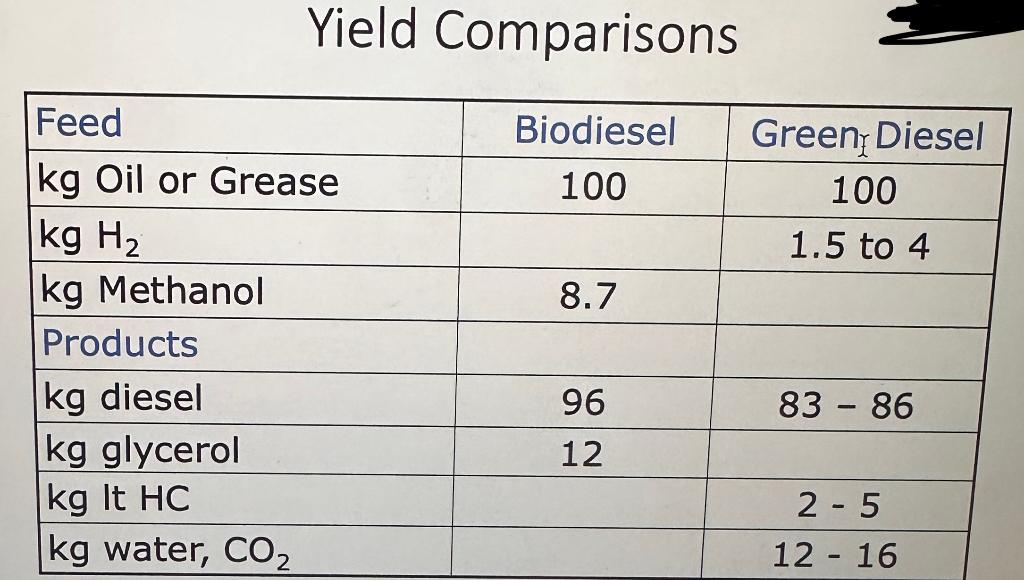

YIELD DATA:

2a) Assuming canola oil costs 90 cents (Cdn)/L, determine the feedstock cost per liter of biodiesel and green diesel.

2b)Determine total revenues and other expenses, on a Canadian dollar per liter of biofuel basis, assuming an exchange rate of $0.75 USD per CAD, and:

2b) a)Glycerol price is $0.065/lb

b) Light hydrocarbons are priced = propane

c) Wholesale price of Biodiesel and green diesel=1.945 CAD$/L

d) Hydrogen is priced per question (1), above

e) Methanol price = 1.73$/Gallon

f) Interest, maintenance, depreciation, SG&A, etc. total 8 cents (US)/L for biodiesel, and 12 cents (US)/L for green diesel.

2c) What is the net income/loss for production of biodiesel and green diesel, on a per litre basis.

2d) In the U.S., these fuels would be eligible to earn income on a RIN, currently valued at ~US$2 US gallon, and a Blenders Tax Incentive valued at US$1 per US gallon. What is the profit/loss once these incentives are applied? [Note that fuel sold in California would also receive LCFS credits based upon the carbon intensity of the fuel]

2e) What price of canola oil would generate a break-even situation, i.e., where the net income/loss = zero for parts (2f) and (2g)?

Note: Please assume any missing values, if any

Yield Comparisons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts