Question: Using these information below. These are the only info. that are provided for this assignment. U sing forms: 1040, Schedule 1, Schedule 3. Schedule A.

Using these information below. These are the only info. that are provided for this assignment. Using forms: 1040, Schedule 1, Schedule 3. Schedule A. schedule D, Schedule E, Form 8949, Form 2441... and I think those are the form needed for this assignment?

Thank you.

Other information:Javier wants to make the maximum allowable contribution to his traditional IRA account. He needs you to determine the amount and include it on his return. He is not a participant in any other retirement plans.

Javier did not have a foreign account.

Javier did not use any virtual currency

.Javier did not dispose of any investments in a qualified opportunity fund.

Javier and his entire household had health insurance coverage for the full year.

If theres an overpayment, Javier would like it refunded.

Javier did not receive any of the Economic Impact Payments. Additional notes and hints:

1.Any excess Social Security withholdings are refundable and reported on line 11 of Schedule 3.

2.If Javier has a passive loss, you are not required to prepare and attach Form 8582 (even if it would ordinarily be required).

However, you will need to determine if he is allowed to take any passive losses he may have incurred.

3.Javier has no passive loss carryforwards from the previous year.

4.Assume that Javier does not have any Qualified Business Income and does not qualify for the QBI deduction.

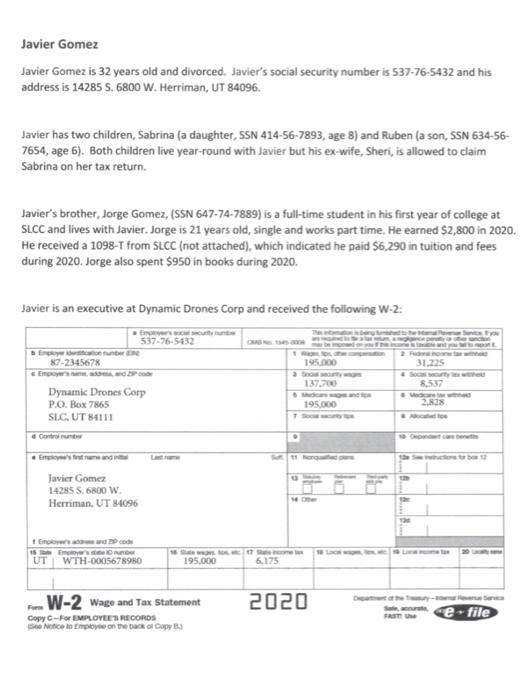

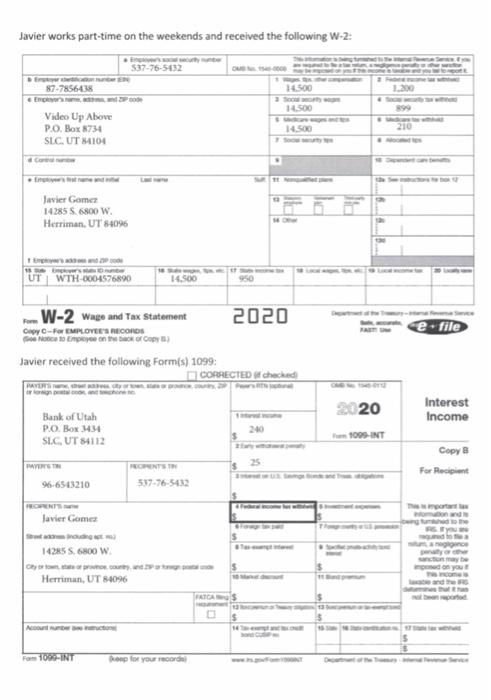

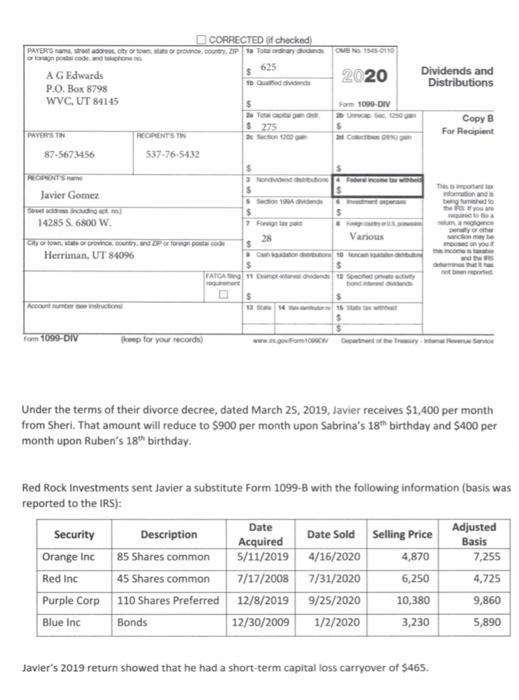

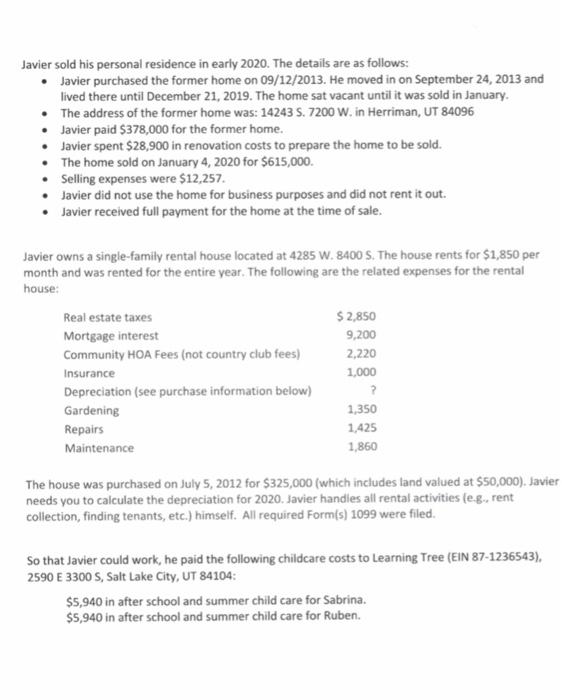

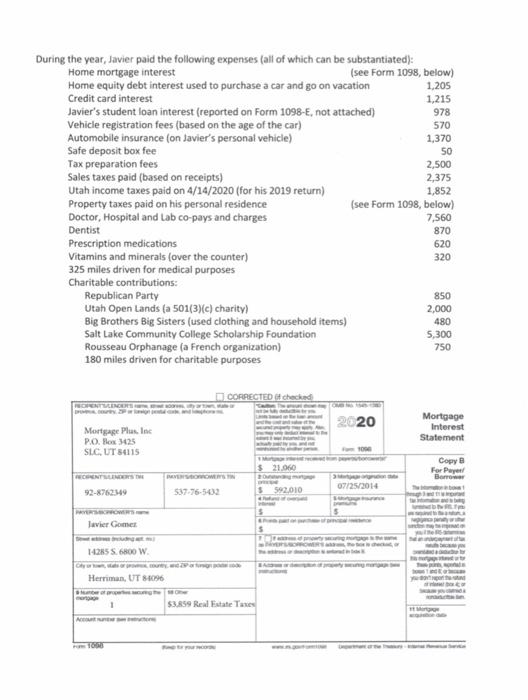

Javier Gomez Javier Gomez is 32 years old and divorced. Javier's social security number is 537-76-5432 and his address is 14285 S. 6800 W. Herriman, UT 84096. Javier has two children, Sabrina (a daughter, SSN 414-56-7893, age 8) and Ruben (a son, SSN 634-56- 7654, age 6). Both children live year-round with Javier but his ex-wife, Sheri, is allowed to claim Sabrina on her tax return Javier's brother, Jorge Gomez, (SSN 647-74-7889) is a full-time student in his first year of college at SLCC and lives with Javier. Jorge is 21 years old, single and works part time. He earned $2,800 in 2020. He received a 1098-T from SLCC (not attached), which indicated he paid $6.290 in tuition and fees during 2020. Jorge also spent $950 in books during 2020. Javier is an executive at Dynamic Drones Corp and received the following W-2: 537-76-5432 Etme 87-2345678 195.000 31.225 137.700 8.537 . Dynamic Drones Corp P.O.Box 7865 SIC, UT 84111 195.000 2.838 Javier Gomez 14285 S. 6800 W Herriman, UT 84096 mode IS Encore UT WTH-0005678980 195.000 6.175 W-2 Wage and Tax Statement 2020 e-file Copy C-For EMPLOYEES RECORDS So Notice to Employee on the back of Copy) Javier works part-time on the weekends and received the following W-2: 537-76-5432 ER 87-7856438 1.500 1500 Video Up Above P.O. Box 8734 SLC, UT 8104 14.500 210 Javier Gomes 14285 S 600 W Herriman, UT 84096 UT WTH-0004576890 14.500 e.file W-2 wage and Tax Statement 2020 Cupy-For EMPLOYEES RECORDS Notice to Empo) Javier received the following Form(s) 1099: CORRECTED chached 220 Interest Income Bank of Utah PO, Box 34 SIC, UT 84112 1009 INT Copy IMAYERS For Recipient 96-6543210 517-76-5432 Javier Gomes Ry 14285 S. 600 W Herriman, UT 84096 on your comes that FATCAS 5 Form 10-INT Ron for your 2020 Dividends and Distributions CORRECTED checked PAYERS roadmoor, sorrow, DP 1 Tear UE NO 155 A G Edwards 625 $ P.O. Box 8798 To Ouled WVC, UT 84145 $ Form 1090-DIV , $ 275 PWYERS IN REOPENES TW 87-5673456 537-76-5432 $ Copy a For Recipient S Javier Gomez tung $ 5 14285 S. 6800 W 28 Various $ Herriman, UT 840% $ $ PAIGAS 11 de ocio $ 5 ACS $ Form 1099-DIV Keep for your records) Under the terms of their divorce decree, dated March 25, 2019, Javier receives $1,400 per month from Sheri. That amount will reduce to $900 per month upon Sabrina's 18th birthday and $400 per month upon Ruben's 18th birthday. Red Rock Investments sent Javier a substitute Form 1099-8 with the following information (basis was reported to the IRS): Security Description Date Acquired Date Sold Selling Price Adjusted Basis Orange Inc 85 Shares common 5/11/2019 4/16/2020 4,870 7,255 Red Inc 45 Shares common 7/17/2008 7/31/2020 6,250 4,725 Purple Corp 110 Shares Preferred 12/8/2019 9/25/2020 10,380 9,860 Bonds 12/30/2009 1/2/2020 3,230 5,890 Blue Inc Javier's 2019 return showed that he had a short-term capital loss carryover of $465. Javier sold his personal residence in early 2020. The details are as follows: Javier purchased the former home on 09/12/2013. He moved in on September 24, 2013 and lived there until December 21, 2019. The home sat vacant until it was sold in January. The address of the former home was: 14243 S. 7200 W. in Herriman, UT 84096 Javier paid $378,000 for the former home. Javier spent $28,900 in renovation costs to prepare the home to be sold. The home sold on January 4, 2020 for $615,000 Selling expenses were $12,257. Javier did not use the home for business purposes and did not rent it out. Javier received full payment for the home at the time of sale. Javier owns a single-family rental house located at 4285 W.8400 S. The house rents for $1,850 per month and was rented for the entire year. The following are the related expenses for the rental house: Real estate taxes $ 2,850 Mortgage interest 9,200 Community HOA Fees (not country club fees) 2,220 Insurance 1,000 Depreciation (see purchase information below) ? Gardening 1,350 Repairs 1,425 Maintenance 1,860 The house was purchased on July 5, 2012 for $325,000 (which includes land valued at $50,000). Javier needs you to calculate the depreciation for 2020. Javier handles all rental activities (eg, rent collection, finding tenants, etc.) himself. All required Form(s) 1099 were filed. So that Javier could work, he paid the following childcare costs to Learning Tree (EIN 87-1236543), 2590 E 3300 S, Salt Lake City, UT 84104: $5,940 in after school and summer child care for Sabrina. $5,940 in after school and summer child care for Ruben. During the year, Javier paid the following expenses (all of which can be substantiated): Home mortgage interest (see Form 1098, below) Home equity debt interest used to purchase a car and go on vacation 1,205 Credit card interest 1,215 Javier's student loan interest (reported on Form 1098-E, not attached) 978 Vehicle registration fees (based on the age of the car) 570 Automobile insurance (on Javier's personal vehicle) 1,370 Safe deposit box fee 50 Tax preparation fees 2,500 Sales taxes paid (based on receipts) 2,375 Utah income taxes paid on 4/14/2020 (for his 2019 return) 1,852 Property taxes paid on his personal residence (see Form 1098, below) Doctor, Hospital and Lab co-pays and charges 7,560 Dentist 870 Prescription medications 620 Vitamins and minerals (over the counter) 320 325 miles driven for medical purposes Charitable contributions: Republican Party 850 Utah Open Lands (a 501(3)(c) charity) 2,000 Big Brothers Big Sisters (used clothing and household items) 480 Salt Lake Community College Scholarship Foundation 5,300 Rousseau Orphanage (a French organization) 750 180 miles driven for charitable purposes CORRECTED checked GREVENGE 2020 Mortgage Plus Ine PO Box 3425 SIC, UT 84115 Mortgage Interest Statement Copy 21.060 For Payel Borror 92-8762549 537.76-5433 07/25/2014 5592010 $ Javier Gomes 1425 5.6800 W Herriman, UT 84096 Piemonte 53.859 Real Estate Taxe Javier Gomez Javier Gomez is 32 years old and divorced. Javier's social security number is 537-76-5432 and his address is 14285 S. 6800 W. Herriman, UT 84096. Javier has two children, Sabrina (a daughter, SSN 414-56-7893, age 8) and Ruben (a son, SSN 634-56- 7654, age 6). Both children live year-round with Javier but his ex-wife, Sheri, is allowed to claim Sabrina on her tax return Javier's brother, Jorge Gomez, (SSN 647-74-7889) is a full-time student in his first year of college at SLCC and lives with Javier. Jorge is 21 years old, single and works part time. He earned $2,800 in 2020. He received a 1098-T from SLCC (not attached), which indicated he paid $6.290 in tuition and fees during 2020. Jorge also spent $950 in books during 2020. Javier is an executive at Dynamic Drones Corp and received the following W-2: 537-76-5432 Etme 87-2345678 195.000 31.225 137.700 8.537 . Dynamic Drones Corp P.O.Box 7865 SIC, UT 84111 195.000 2.838 Javier Gomez 14285 S. 6800 W Herriman, UT 84096 mode IS Encore UT WTH-0005678980 195.000 6.175 W-2 Wage and Tax Statement 2020 e-file Copy C-For EMPLOYEES RECORDS So Notice to Employee on the back of Copy) Javier works part-time on the weekends and received the following W-2: 537-76-5432 ER 87-7856438 1.500 1500 Video Up Above P.O. Box 8734 SLC, UT 8104 14.500 210 Javier Gomes 14285 S 600 W Herriman, UT 84096 UT WTH-0004576890 14.500 e.file W-2 wage and Tax Statement 2020 Cupy-For EMPLOYEES RECORDS Notice to Empo) Javier received the following Form(s) 1099: CORRECTED chached 220 Interest Income Bank of Utah PO, Box 34 SIC, UT 84112 1009 INT Copy IMAYERS For Recipient 96-6543210 517-76-5432 Javier Gomes Ry 14285 S. 600 W Herriman, UT 84096 on your comes that FATCAS 5 Form 10-INT Ron for your 2020 Dividends and Distributions CORRECTED checked PAYERS roadmoor, sorrow, DP 1 Tear UE NO 155 A G Edwards 625 $ P.O. Box 8798 To Ouled WVC, UT 84145 $ Form 1090-DIV , $ 275 PWYERS IN REOPENES TW 87-5673456 537-76-5432 $ Copy a For Recipient S Javier Gomez tung $ 5 14285 S. 6800 W 28 Various $ Herriman, UT 840% $ $ PAIGAS 11 de ocio $ 5 ACS $ Form 1099-DIV Keep for your records) Under the terms of their divorce decree, dated March 25, 2019, Javier receives $1,400 per month from Sheri. That amount will reduce to $900 per month upon Sabrina's 18th birthday and $400 per month upon Ruben's 18th birthday. Red Rock Investments sent Javier a substitute Form 1099-8 with the following information (basis was reported to the IRS): Security Description Date Acquired Date Sold Selling Price Adjusted Basis Orange Inc 85 Shares common 5/11/2019 4/16/2020 4,870 7,255 Red Inc 45 Shares common 7/17/2008 7/31/2020 6,250 4,725 Purple Corp 110 Shares Preferred 12/8/2019 9/25/2020 10,380 9,860 Bonds 12/30/2009 1/2/2020 3,230 5,890 Blue Inc Javier's 2019 return showed that he had a short-term capital loss carryover of $465. Javier sold his personal residence in early 2020. The details are as follows: Javier purchased the former home on 09/12/2013. He moved in on September 24, 2013 and lived there until December 21, 2019. The home sat vacant until it was sold in January. The address of the former home was: 14243 S. 7200 W. in Herriman, UT 84096 Javier paid $378,000 for the former home. Javier spent $28,900 in renovation costs to prepare the home to be sold. The home sold on January 4, 2020 for $615,000 Selling expenses were $12,257. Javier did not use the home for business purposes and did not rent it out. Javier received full payment for the home at the time of sale. Javier owns a single-family rental house located at 4285 W.8400 S. The house rents for $1,850 per month and was rented for the entire year. The following are the related expenses for the rental house: Real estate taxes $ 2,850 Mortgage interest 9,200 Community HOA Fees (not country club fees) 2,220 Insurance 1,000 Depreciation (see purchase information below) ? Gardening 1,350 Repairs 1,425 Maintenance 1,860 The house was purchased on July 5, 2012 for $325,000 (which includes land valued at $50,000). Javier needs you to calculate the depreciation for 2020. Javier handles all rental activities (eg, rent collection, finding tenants, etc.) himself. All required Form(s) 1099 were filed. So that Javier could work, he paid the following childcare costs to Learning Tree (EIN 87-1236543), 2590 E 3300 S, Salt Lake City, UT 84104: $5,940 in after school and summer child care for Sabrina. $5,940 in after school and summer child care for Ruben. During the year, Javier paid the following expenses (all of which can be substantiated): Home mortgage interest (see Form 1098, below) Home equity debt interest used to purchase a car and go on vacation 1,205 Credit card interest 1,215 Javier's student loan interest (reported on Form 1098-E, not attached) 978 Vehicle registration fees (based on the age of the car) 570 Automobile insurance (on Javier's personal vehicle) 1,370 Safe deposit box fee 50 Tax preparation fees 2,500 Sales taxes paid (based on receipts) 2,375 Utah income taxes paid on 4/14/2020 (for his 2019 return) 1,852 Property taxes paid on his personal residence (see Form 1098, below) Doctor, Hospital and Lab co-pays and charges 7,560 Dentist 870 Prescription medications 620 Vitamins and minerals (over the counter) 320 325 miles driven for medical purposes Charitable contributions: Republican Party 850 Utah Open Lands (a 501(3)(c) charity) 2,000 Big Brothers Big Sisters (used clothing and household items) 480 Salt Lake Community College Scholarship Foundation 5,300 Rousseau Orphanage (a French organization) 750 180 miles driven for charitable purposes CORRECTED checked GREVENGE 2020 Mortgage Plus Ine PO Box 3425 SIC, UT 84115 Mortgage Interest Statement Copy 21.060 For Payel Borror 92-8762549 537.76-5433 07/25/2014 5592010 $ Javier Gomes 1425 5.6800 W Herriman, UT 84096 Piemonte 53.859 Real Estate Taxe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts