Question: Using These Journal Entries I need to: Post all journal entries to the appropriate ledger account and calculate account balances as of September 30th. Note

Using These Journal Entries I need to:

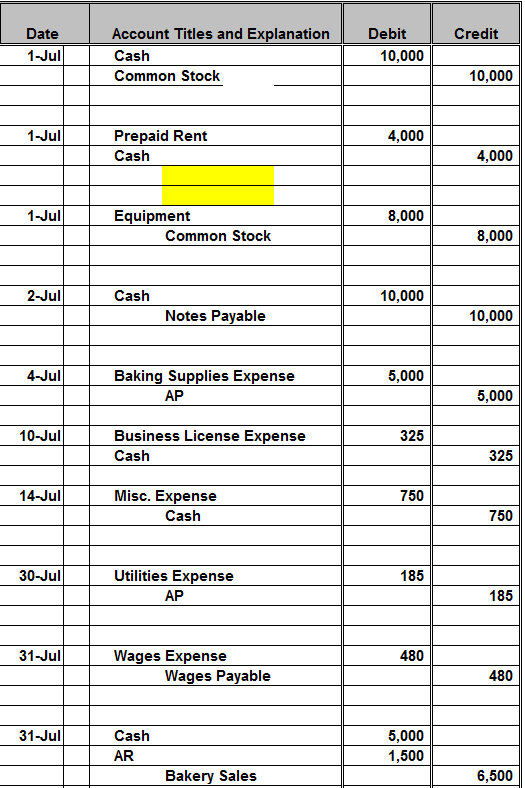

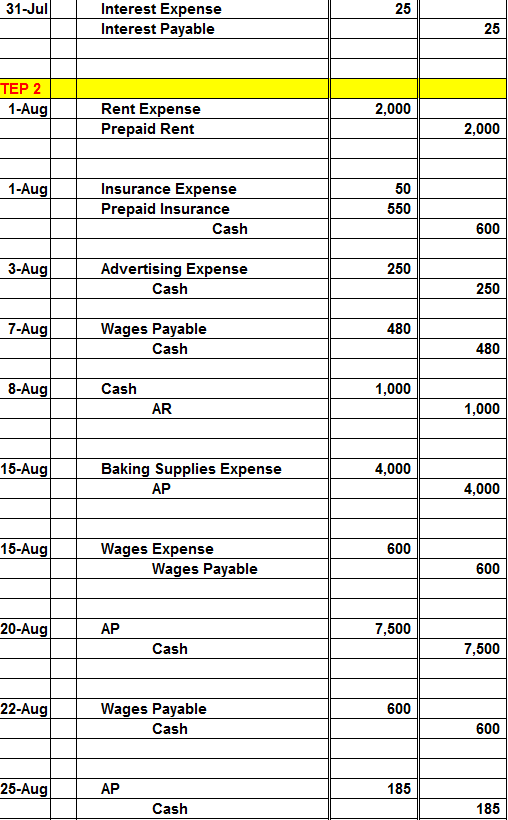

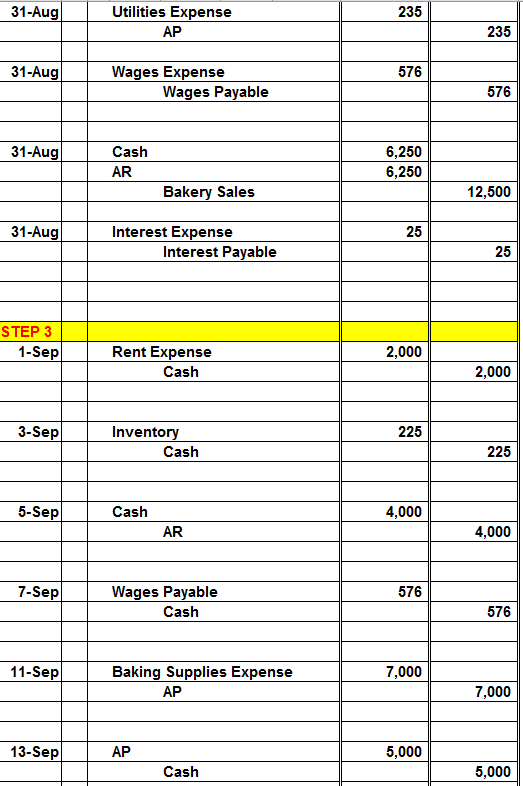

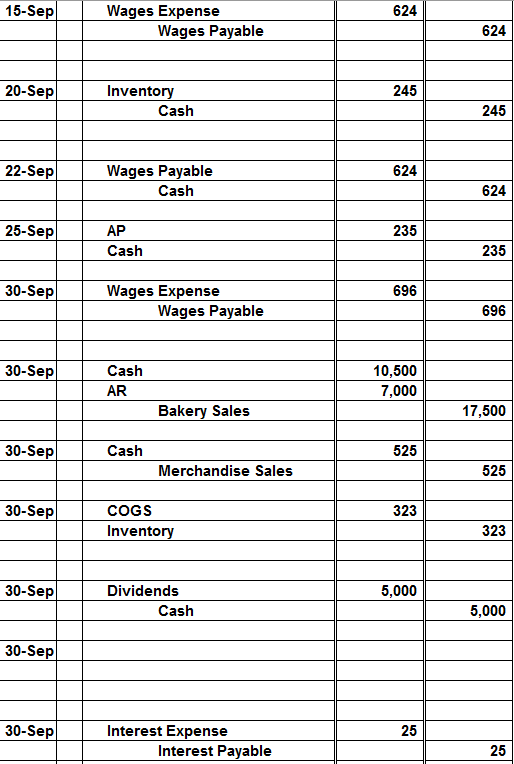

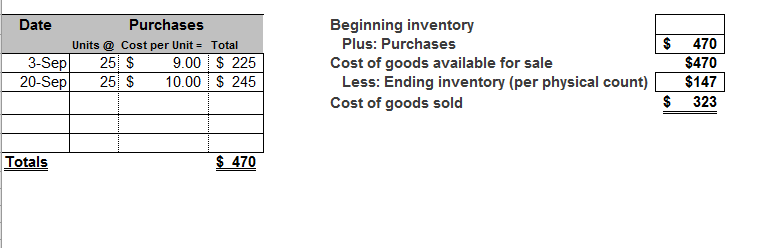

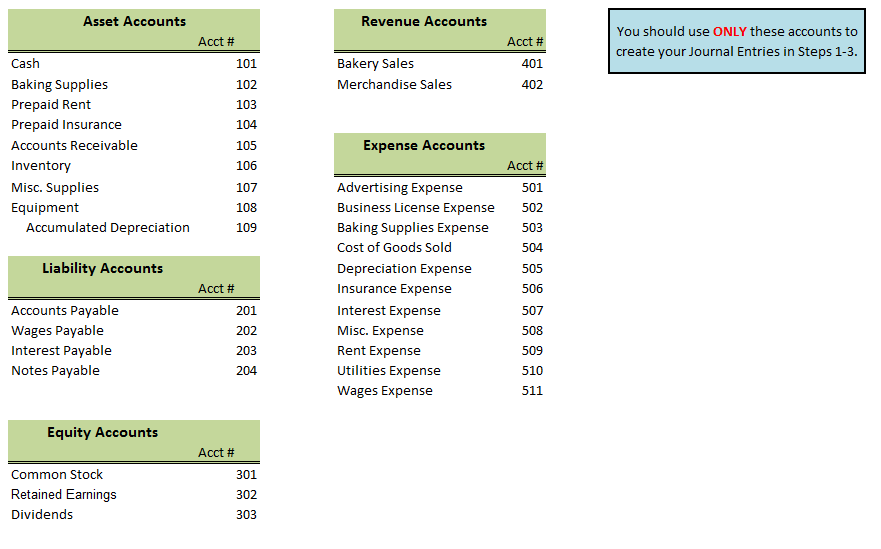

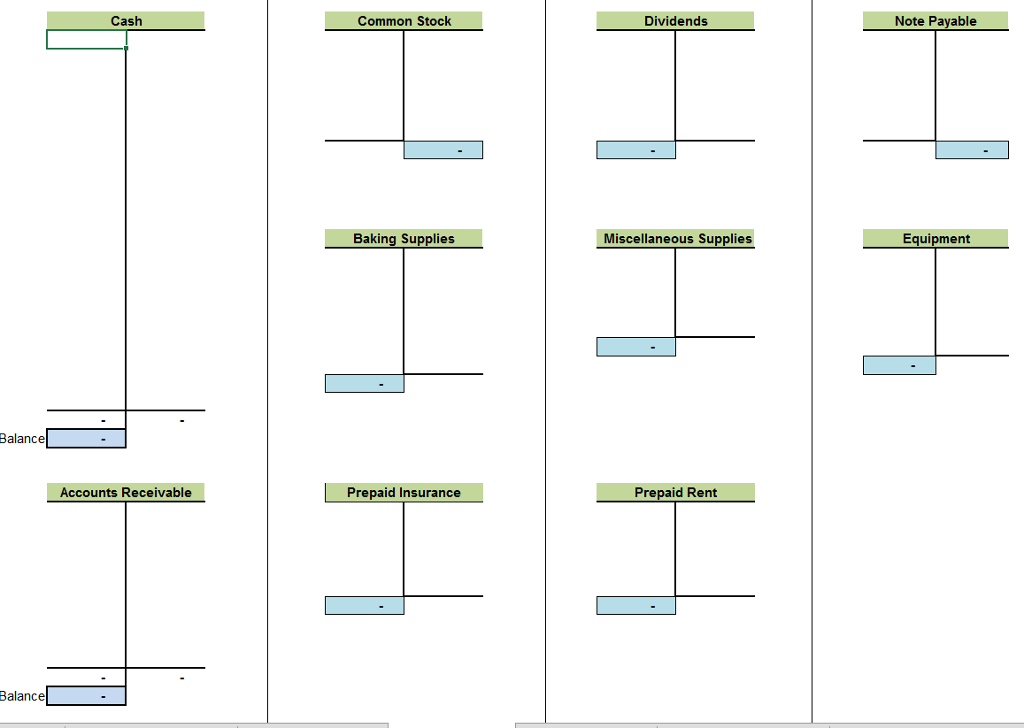

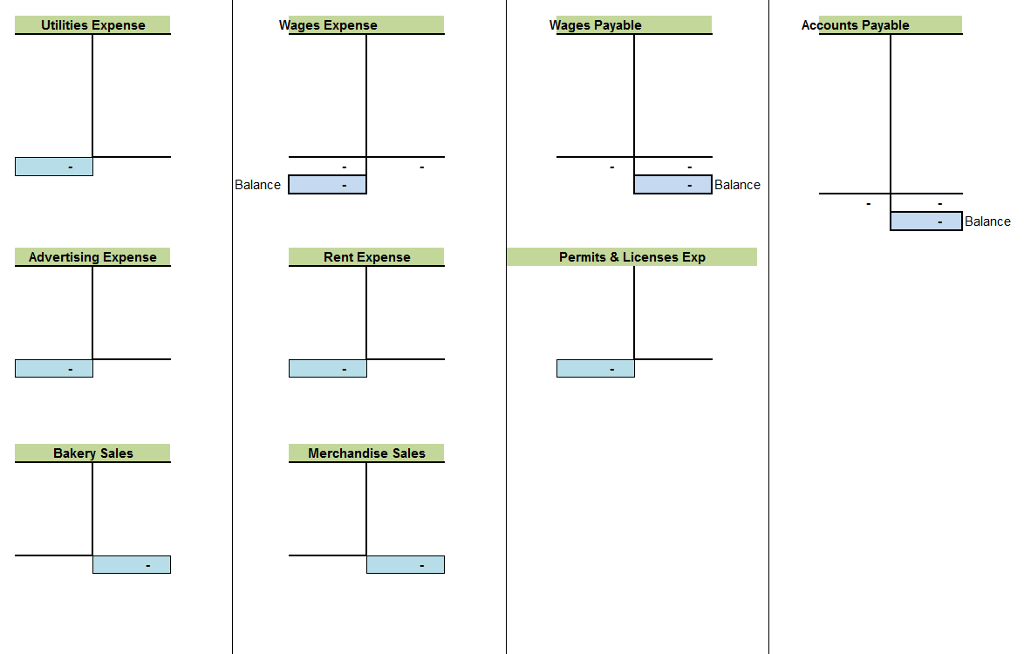

Post all journal entries to the appropriate ledger account and calculate account balances as of September 30th. Note that you do not have to post the Inventory and COGS transactions to the T-accounts.

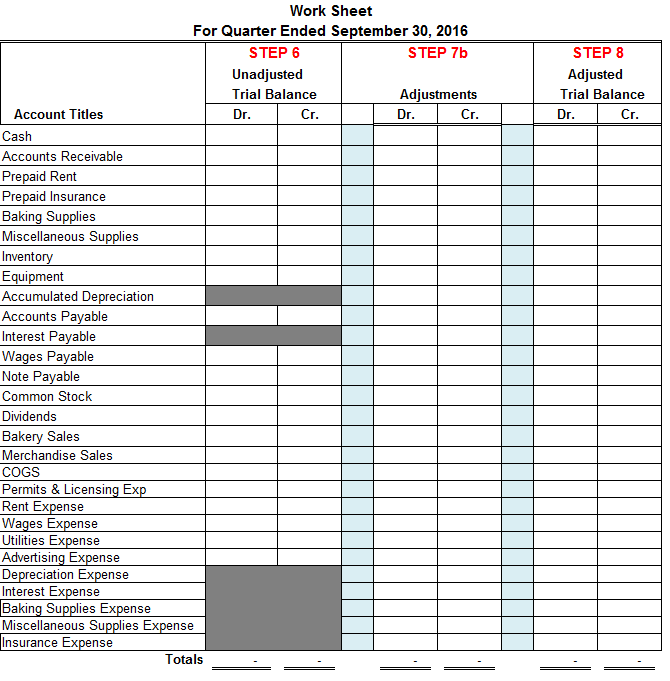

Use the T-account balances completed in the previous step to prepare the unadjusted trial balance

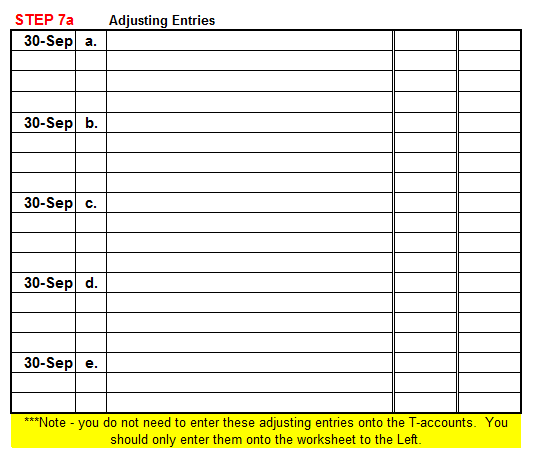

Make Adjusting Entries On September 30, the following adjustments must be made: a. Depreciation of baking equipment transferred to company on July 1st. Depreciation is computed using the straight-line method. The equipment has a 5-year useful life, and an original cost of $10,000. b. Accrue interest for note payable. The annual interest on $10,000 loan from parents is 3%. Interest is payable quarterly. c. Record insurance used for the year. Assume a full month for August. d. Actual baking supplies on-hand as of September 30th is $500. e. Misc. supplies on-hand as of September 30th is $100.

Transfer Adjusting Entries to the Worksheet (STEP 7B) Transfer your adjusting journal entries to the Adjustments columns of the Worksheet.

Step 8: Adjusted Trial Balance Apply adjusting entries to the trial balance to create the adjusted trial balance. Adjusting entries from Step 6 will apply to affected accounts in the unadjusted trial balance to arrive at the adjusted trial balance.

Thanks in Advance!

Date Account Titles and Explanation Cash 1-Jul Common Stock 1-Jul Prepaid Rent Cash Equipment Common Stock Cash 2-Jul Notes Payable Baking Supplies Expense 4-Jul 10-Jul Business License Expense 14-Jul Misc. Expense 30-Jul Utilities Expense 31-Jul Wages Expense Wages Payable Cash 31-Jul Bakery Sales Debit 10,000 4,000 8,000 10,000 5,000 325 750 185 480 5,000 1,500 Credit 10,000 4,000 8,000 10,000 5,000 325 750 185 480 6,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts