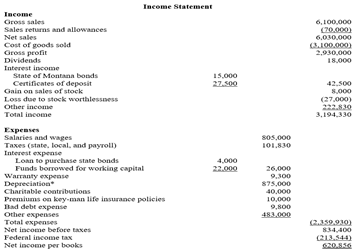

Question: Using this information I only need to complete the first page of a c corp 1120 and Schedule J Income Statement 6, 100 00 0

Using this information I only need to complete the first page of a c corp 1120 and Schedule J

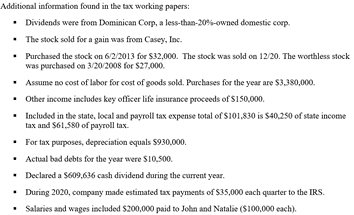

Income Statement 6, 100 00 0 Sales returns and Allowances Net sales 6.030 040 Coul of goods sold ( 100 00 0) Gross profit 2.040 060 Dividends 18 000 Interest Income Sinte of Montana bonds 15 000 Centificates of deposit 37.500 12.500 Gain on sales of stock Lou due to pock worthless (27.000) Other income Total income 3.194.350 Salaries and wages 8031000 Taxes (state. local, and payroll) 101.830 Interest expense Loan to purchase slate bands 4.000 Funds borrowed for working capital Warranty expense 9.300 Depreciation* 875.000 Charitable contributions 40.090 Premiums on key-man ilife insurance policies 10.000 I bad debt expense Other expenses Total express 12.359 9101 Net income before taxes Federal income Tax Net Income per booksAdditional information found in the tax working papers: Dividends were from Dominican Comp, a less-than-20 6-owned domestic corp. . The stock sold for a gain was from Casey, Inc. " Purchased the stock on 6/2/2013 for $32,000. The stock was sold on 12/20. The worthless stock was purchased on 3/20/2008 for $27,000. Assume no cost of labor for cost of goods sold. Purchases for the year are $3,380,000. . Other income includes key officer life insurance proceeds of $150.000. . Included in the state. local and payroll tax expense total of $101.830 is $40.250 of state income tax and $61,580 of payroll tax. . For tax parposes, depreciation equals $930.000. . Actual bad debts for the year were $10,500. " Declared a $609,636 cash dividend during the current year. . During 2020, company made estimated tax payments of $35,000 each quarter to the IRS. Salaries and wages included $200,000 paid to John and Natalie ($100,000 each)