Question: Using this model, net income in 20X1 is computed as $5,500 * (1 45% 15%) * (1 22%) = $1,716.0. Net income in 20X2 is

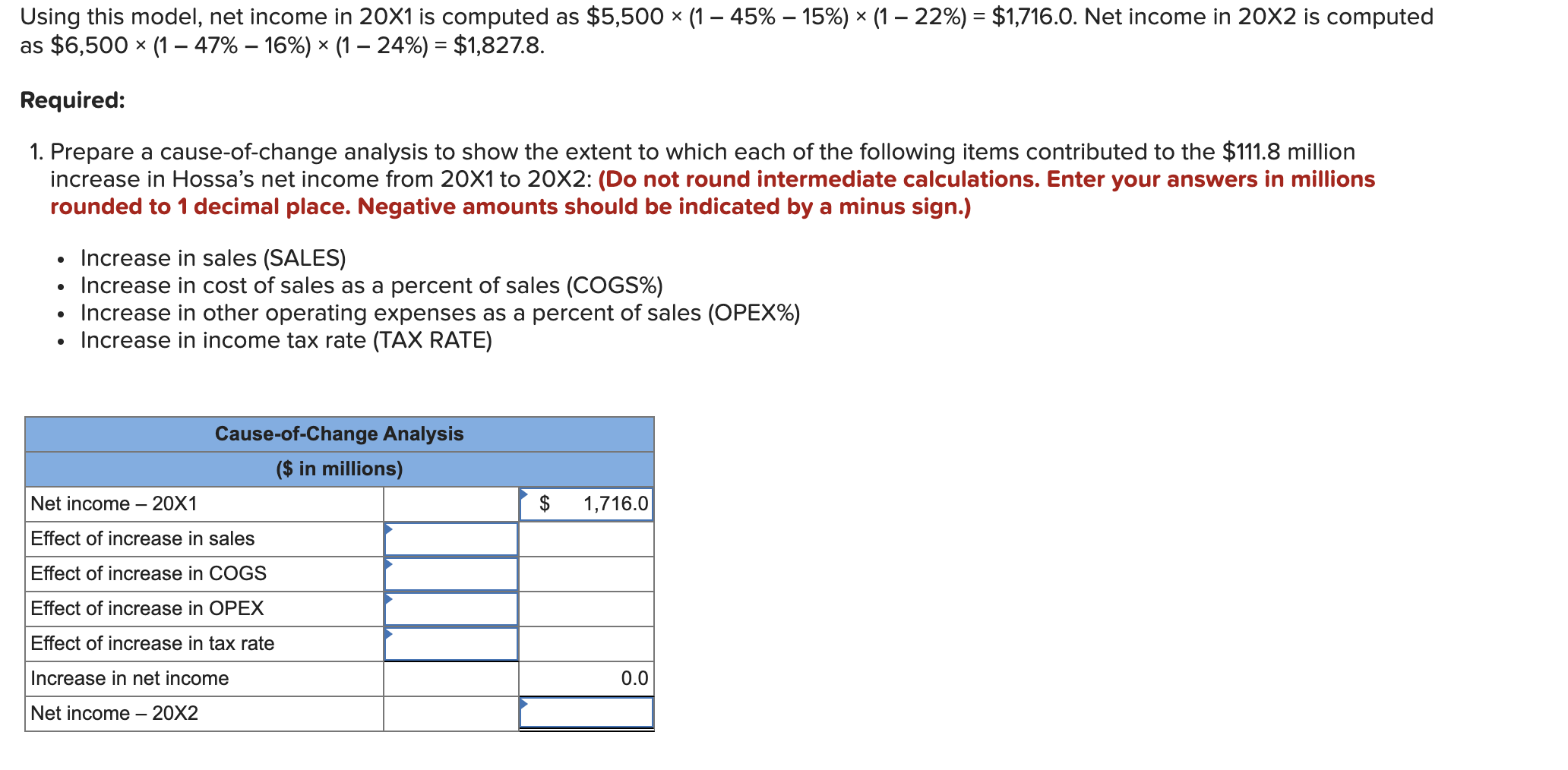

Using this model, net income in 20X1 is computed as $5,500 * (1 45% 15%) * (1 22%) = $1,716.0. Net income in 20X2 is computed as $6,500 x (1 47% 16%) * (1 24%) = $1,827.8. Required: 1. Prepare a cause-of-change analysis to show the extent to which each of the following items contributed to the $111.8 million increase in Hossa's net income from 20x1 to 20X2: (Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place. Negative amounts should be indicated by a minus sign.) Increase in sales (SALES) Increase in cost of sales as a percent of sales (COGS%) Increase in other operating expenses as a percent of sales (OPEX%) Increase in income tax rate (TAX RATE) Cause-of-Change Analysis ($ in millions) Net income - - 20X1 $ 1,716.0 Effect of increase in sales Effect of increase in COGS Effect of increase in OPEX Effect of increase in tax rate Increase in net income 0.0 Net income - 20X2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts