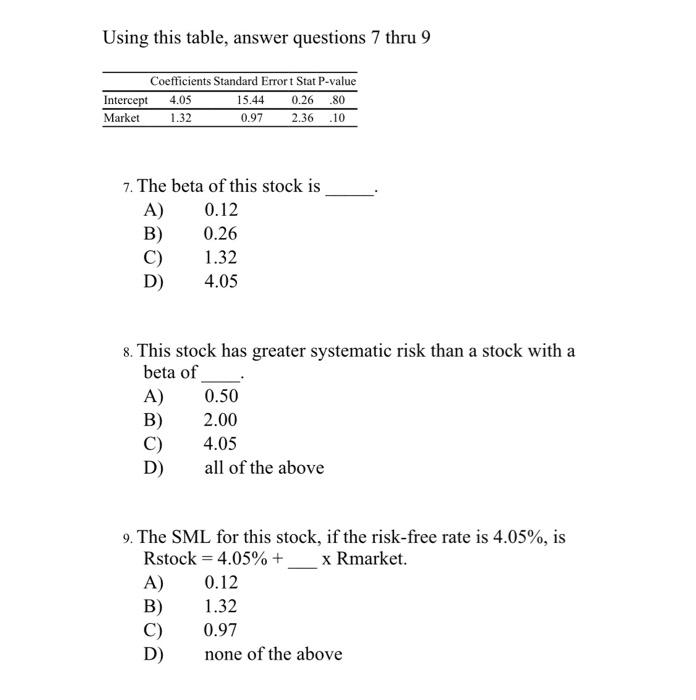

Question: Using this table, answer questions 7 thru 9 Intercept 4.05 Market Coefficients Standard Error t Stat P-value 15.44 0.97 0.26 80 2.36 10 1.32 7.

Using this table, answer questions 7 thru 9 Intercept 4.05 Market Coefficients Standard Error t Stat P-value 15.44 0.97 0.26 80 2.36 10 1.32 7. The beta of this stock is A) 0.12 B) 0.26 C) .312 D) 4.05 8, This stock has greater systematic risk than a stock with a beta of A) 0.50 B) 2.00 C) 4.05 all of the above 9. The SML for this stock, if the risk-free rate is 4.05%, is Rstock 4.05% + x Rmarket A) 0.12 B) .32 C) 0.97 D)none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts