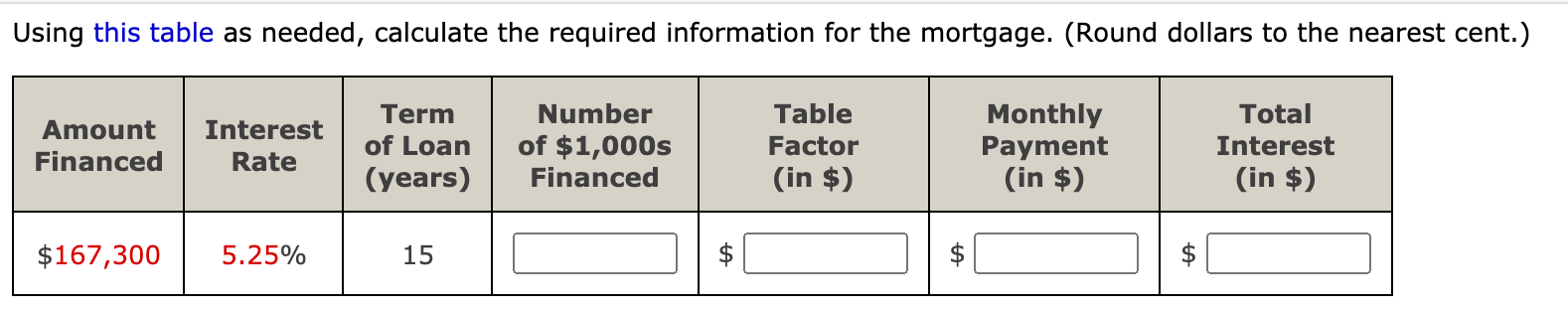

Question: Using this table as needed, calculate the required information for the mortgage. (Round dollars to the nearest cent.) Amount Financed Interest Rate Term of Loan

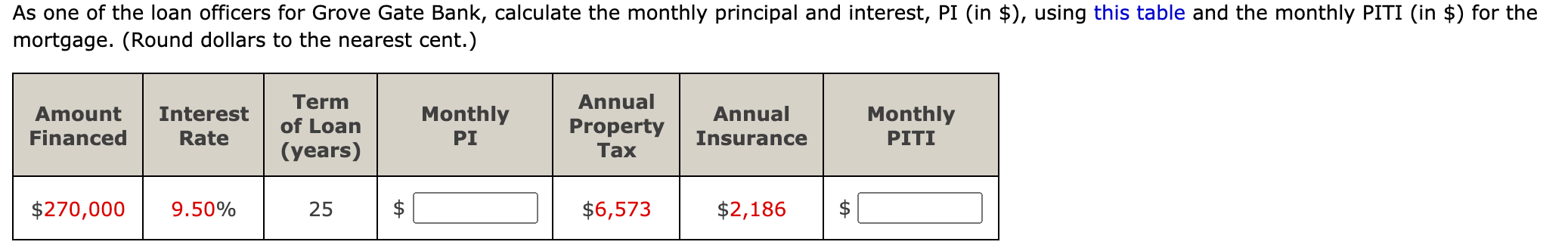

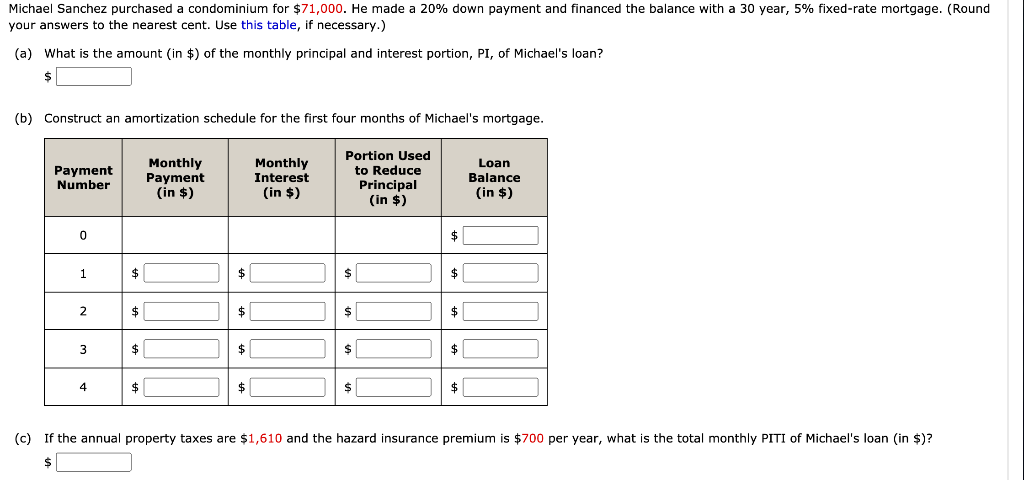

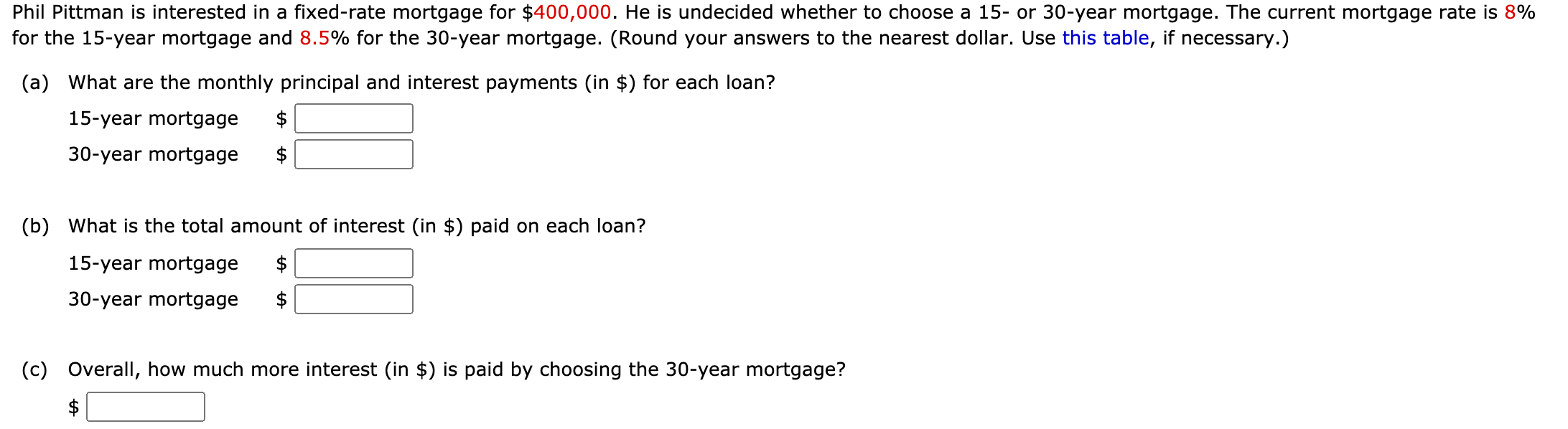

Using this table as needed, calculate the required information for the mortgage. (Round dollars to the nearest cent.) Amount Financed Interest Rate Term of Loan (years) Number of $1,000s Financed Table Factor (in $) Monthly Payment (in $) Total Interest (in $) $167,300 5.25% 15 As one of the loan officers for Grove Gate Bank, calculate the monthly principal and interest, PI (in $), using this table and the monthly PITI (in $) for the mortgage. (Round dollars to the nearest cent.) Amount Financed Interest Rate Term of Loan (years) Monthly PI Annual Property Annual Insurance Monthly PITI Tax $270,000 9.50% 25 $6,573 $2,186 $ Michael Sanchez purchased a condominium for $71,000. He made a 20% down payment and financed the balance with a 30 year, 5% fixed-rate mortgage. (Round your answers to the nearest cent. Use this table, if necessary.) (a) What is the amount (in $) of the monthly principal and interest portion, PI, of Michael's loan? $ (b) Construct an amortization schedule for the first four months of Michael's mortgage. Payment Number Monthly Payment (in $) Monthly Interest (in $) Portion Used to Reduce Principal (in $) Loan Balance (in $) 0 1 $ $ $ 2 $ $ $ 3 $ $ $ 4 $ $ $ $ (c) If the annual property taxes are $1,610 and the hazard insurance premium is $700 per year, what is the total monthly PITI of Michael's loan (in $)? Phil Pittman is interested in a fixed-rate mortgage for $400,000. He is undecided whether to choose a 15- or 30-year mortgage. The current mortgage rate is 8% for the 15-year mortgage and 8.5% for the 30-year mortgage. (Round your answers to the nearest dollar. Use this table, if necessary.) (a) What are the monthly principal and interest payments (in $) for each loan? 15-year mortgage $ 30-year mortgage (b) What is the total amount of interest (in $) paid on each loan? 15-year mortgage 30-year mortgage (c) Overall, how much more interest (in $) is paid by choosing the 30-year mortgage? $ Using this table as needed, calculate the required information for the mortgage. (Round dollars to the nearest cent.) Amount Financed Interest Rate Term of Loan (years) Number of $1,000s Financed Table Factor (in $) Monthly Payment (in $) Total Interest (in $) $167,300 5.25% 15 As one of the loan officers for Grove Gate Bank, calculate the monthly principal and interest, PI (in $), using this table and the monthly PITI (in $) for the mortgage. (Round dollars to the nearest cent.) Amount Financed Interest Rate Term of Loan (years) Monthly PI Annual Property Annual Insurance Monthly PITI Tax $270,000 9.50% 25 $6,573 $2,186 $ Michael Sanchez purchased a condominium for $71,000. He made a 20% down payment and financed the balance with a 30 year, 5% fixed-rate mortgage. (Round your answers to the nearest cent. Use this table, if necessary.) (a) What is the amount (in $) of the monthly principal and interest portion, PI, of Michael's loan? $ (b) Construct an amortization schedule for the first four months of Michael's mortgage. Payment Number Monthly Payment (in $) Monthly Interest (in $) Portion Used to Reduce Principal (in $) Loan Balance (in $) 0 1 $ $ $ 2 $ $ $ 3 $ $ $ 4 $ $ $ $ (c) If the annual property taxes are $1,610 and the hazard insurance premium is $700 per year, what is the total monthly PITI of Michael's loan (in $)? Phil Pittman is interested in a fixed-rate mortgage for $400,000. He is undecided whether to choose a 15- or 30-year mortgage. The current mortgage rate is 8% for the 15-year mortgage and 8.5% for the 30-year mortgage. (Round your answers to the nearest dollar. Use this table, if necessary.) (a) What are the monthly principal and interest payments (in $) for each loan? 15-year mortgage $ 30-year mortgage (b) What is the total amount of interest (in $) paid on each loan? 15-year mortgage 30-year mortgage (c) Overall, how much more interest (in $) is paid by choosing the 30-year mortgage? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts