Question: Using this template, show how to get NPV in Excel. 1. Classic Drums is in the business of purchasing older drumsets and refurbishing them for

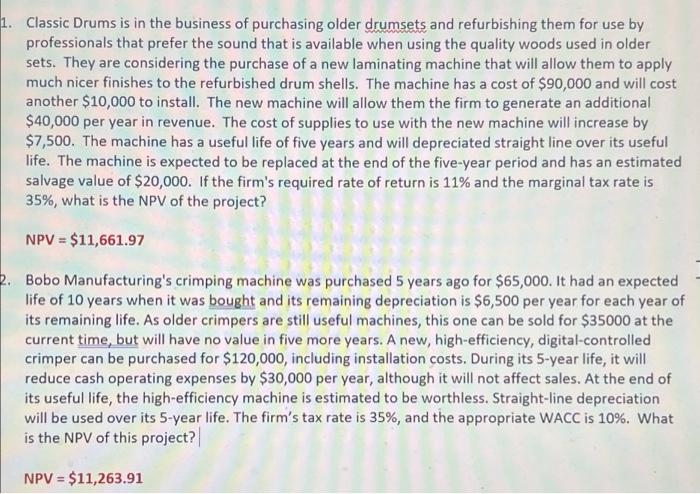

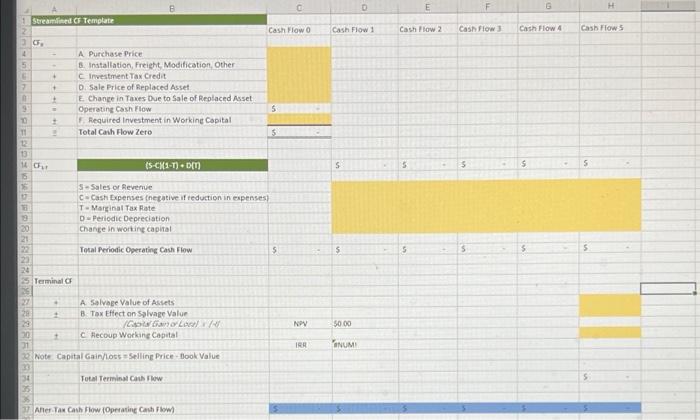

1. Classic Drums is in the business of purchasing older drumsets and refurbishing them for use by professionals that prefer the sound that is available when using the quality woods used in older sets. They are considering the purchase of a new laminating machine that will allow them to apply much nicer finishes to the refurbished drum shells. The machine has a cost of $90,000 and will cost another $10,000 to install. The new machine will allow them the firm to generate an additional $40,000 per year in revenue. The cost of supplies to use with the new machine will increase by $7,500. The machine has a useful life of five years and will depreciated straight line over its useful life. The machine is expected to be replaced at the end of the five-year period and has an estimated salvage value of $20,000. If the firm's required rate of return is 11% and the marginal tax rate is 35%, what is the NPV of the project? NPV = $11,661.97 2. Bobo Manufacturing's crimping machine was purchased 5 years ago for $65,000. It had an expected life of 10 years when it was bought and its remaining depreciation is $6,500 per year for each year of its remaining life. As older crimpers are still useful machines, this one can be sold for $35000 at the current time, but will have no value in five more years. A new, high-efficiency, digital-controlled crimper can be purchased for $120,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $30,000 per year, although it will not affect sales. At the end of its useful life, the high-efficiency machine is estimated to be worthless. Straight-line depreciation will be used over its 5-year life. The firm's tax rate is 35%, and the appropriate WACC is 10%. What is the NPV of this project? NPV = $11,263.91 E G H Streamlined Template Cash Flow Cash Flow 1 Cash Flow 2 Cash Flow Cash Flow 4 Cash Flow 5 9. 1 5 + + A Purchase Price Installation, Freight Modification Other Investment Tax Credit D. Sale Price of Replaced Asset E Chance in Taxes Due to Sale of Replaced Asset Operating Cash Flow F. Required Investment in Working Capital Total Cash Flow Zero 3 5 11 5 13 14 CM (5-CH1-T). 5 5 $ S 5 1 5-Sales or Revenue c-Cash Expenses (netative reduction in expenses T. Martinal Tax Rate D-Periodic Depreciation Change in working capital 20 S $ Total Periodic Operating Cash Flow 5 $ 5 5 24 5 Terminal NPV 5000 A Salvage Value of Assets 28 1 B Tox Effect on Salvage Value OL 20 + C Recoup Working Capital 1 Note Capital Gairlos Selling Price Book Value IRR INUMI Total Terminat Cat Flow 5 35 Aller.Tax Cash Flow (Operating Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts