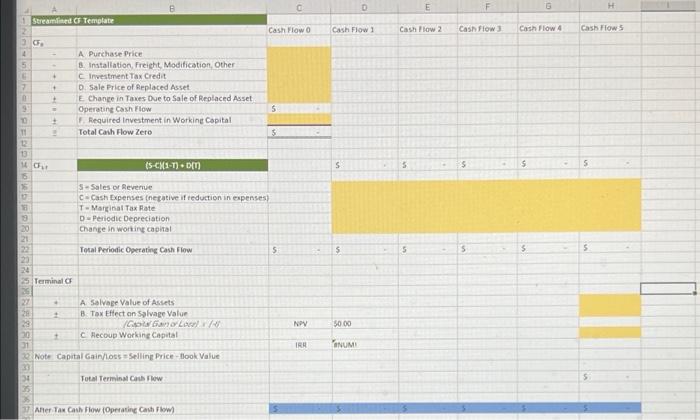

Question: using this template show how to solve #7 5. Dog Up! Franks is looking at a new sausage system with an installed cost of $460,000.

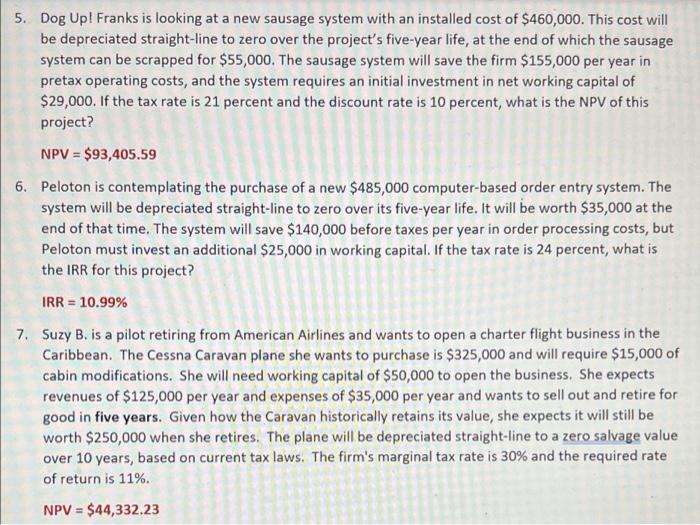

5. Dog Up! Franks is looking at a new sausage system with an installed cost of $460,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $55,000. The sausage system will save the firm $155,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $29,000. If the tax rate is 21 percent and the discount rate is 10 percent, what is the NPV of this project? NPV = $93,405.59 6. Peloton is contemplating the purchase of a new $485,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $35,000 at the end of that time. The system will save $140,000 before taxes per year in order processing costs, but Peloton must invest an additional $25,000 in working capital. If the tax rate is 24 percent, what is the IRR for this project? IRR = 10.99% 7. Suzy B. is a pilot retiring from American Airlines and wants to open a charter flight business in the Caribbean. The Cessna Caravan plane she wants to purchase is $325,000 and will require $15,000 of cabin modifications. She will need working capital of $50,000 to open the business. She expects revenues of $125,000 per year and expenses of $35,000 per year and wants to sell out and retire for good in five years. Given how the Caravan historically retains its value, she expects it will still be worth $250,000 when she retires. The plane will be depreciated straight-line to a zero salvage value over 10 years, based on current tax laws. The firm's marginal tax rate is 30% and the required rate of return is 11%. NPV = $44,332.23 E B H Streamlined Template Cash Flow o Cash Flow : Cash Flow 2 Cash Flow Cash Flow 4 Cash Flow 5 30 5 + A Purchase Price Installation Freight Modification Other Investment Tax Credit D. Sale Price of Replaced Asset E Chance in Taxes Due to Sale of Replaced Asset Operating Cash Flow Required Investment in Working Capital Total Cash Flow Zero + 3 5 5 13 HOM (5-CM1-T). 5 5 $ S 5 S. Sales or Reverie c-Cash Expenses (netative of reduction in expenses To Marginal Tax Rate Periodic Depreciation Change in worting capital 13 20 5 Total Periodic Operating Cash Flow 5 5 S $ 5 25 Terminal NP 5000 A Salvage Value of Assets 28 1 B. Tox Effect on Salvage Valur GAL 20 + Hecoup Working Capital 31 Note Capital Gain/Selling Price-look Value 2 34 Total Terminal Cach w 35 IR CANUMI 5 Aner Tax Cal Flow (Operating Cash Flow 5. Dog Up! Franks is looking at a new sausage system with an installed cost of $460,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $55,000. The sausage system will save the firm $155,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $29,000. If the tax rate is 21 percent and the discount rate is 10 percent, what is the NPV of this project? NPV = $93,405.59 6. Peloton is contemplating the purchase of a new $485,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $35,000 at the end of that time. The system will save $140,000 before taxes per year in order processing costs, but Peloton must invest an additional $25,000 in working capital. If the tax rate is 24 percent, what is the IRR for this project? IRR = 10.99% 7. Suzy B. is a pilot retiring from American Airlines and wants to open a charter flight business in the Caribbean. The Cessna Caravan plane she wants to purchase is $325,000 and will require $15,000 of cabin modifications. She will need working capital of $50,000 to open the business. She expects revenues of $125,000 per year and expenses of $35,000 per year and wants to sell out and retire for good in five years. Given how the Caravan historically retains its value, she expects it will still be worth $250,000 when she retires. The plane will be depreciated straight-line to a zero salvage value over 10 years, based on current tax laws. The firm's marginal tax rate is 30% and the required rate of return is 11%. NPV = $44,332.23 E B H Streamlined Template Cash Flow o Cash Flow : Cash Flow 2 Cash Flow Cash Flow 4 Cash Flow 5 30 5 + A Purchase Price Installation Freight Modification Other Investment Tax Credit D. Sale Price of Replaced Asset E Chance in Taxes Due to Sale of Replaced Asset Operating Cash Flow Required Investment in Working Capital Total Cash Flow Zero + 3 5 5 13 HOM (5-CM1-T). 5 5 $ S 5 S. Sales or Reverie c-Cash Expenses (netative of reduction in expenses To Marginal Tax Rate Periodic Depreciation Change in worting capital 13 20 5 Total Periodic Operating Cash Flow 5 5 S $ 5 25 Terminal NP 5000 A Salvage Value of Assets 28 1 B. Tox Effect on Salvage Valur GAL 20 + Hecoup Working Capital 31 Note Capital Gain/Selling Price-look Value 2 34 Total Terminal Cach w 35 IR CANUMI 5 Aner Tax Cal Flow (Operating Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts