Question: Using ti-84 calc or formula You just bought one share of Smith Inc. for $40, and you plan to sell it after holding it for

Using ti-84 calc or formula

You just bought one share of Smith Inc. for $40, and you plan to sell it after holding it for one year. Smith Co. pays $0.55 in dividends every quarter, and financial analysts' 1-year target estimate on Smith Inc.'s stock is $47 per share. What do you expect will be your total return on Smith Inc.'s stock?

Apple is releasing a great new deal for getting IPhones. You can now buy the phone from the Apple store for $1,000 with an expected lifespan of 6 years.The second option is to lease the Phone with a cost of, $20 a month for 72 months. If the cost of capital is 5%, what is the NPV of the better deal and which one should you choose, lease or buy?

Jack plans to take a 30-year fixed rate, 0 point mortgage at 4.625% to finance 80% of his new house with a monthly payment of $1,200. For simplicity, assume that there are no other fees or costs. Jack would like to take a 20-year second mortgage loan (Home Equity Line of Credit (HELOC)), with an annual rate of 5.615%. If Jack can only make $200 monthly payments for the HELOC, how much does he still need right now for the down payment?

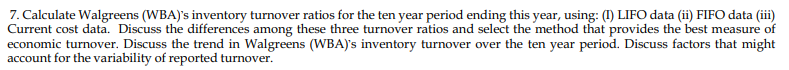

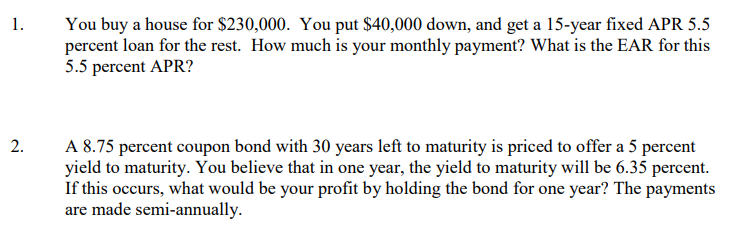

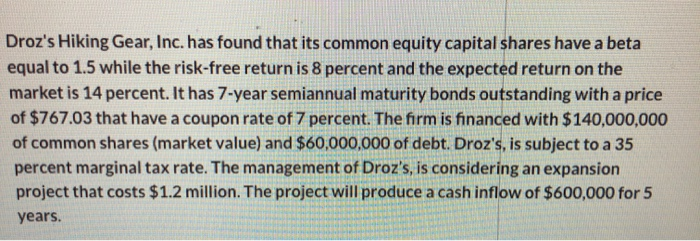

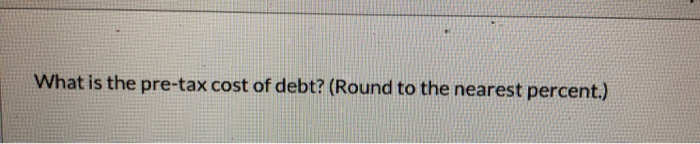

7. Calculate Walgreens (WBA)'s inventory turnover ratios for the ten year period ending this year, using: (I) LIFO data (ii) FIFO data (iii) Current cost data. Discuss the differences among these three turnover ratios and select the method that provides the best measure of economic turnover. Discuss the trend in Walgreens (WBA)'s inventory turnover over the ten year period. Discuss factors that might account for the variability of reported turnover.1 You buy a house for $230,000. You put $40,000 down, and get a 15-year fixed APR 5.5 percent loan for the rest. How much is your monthly payment? What is the EAR for this 5.5 percent APR? 2. A 8.75 percent coupon bond with 30 years left to maturity is priced to offer a 5 percent yield to maturity. You believe that in one year, the yield to maturity will be 6.35 percent. If this occurs, what would be your profit by holding the bond for one year? The payments are made semi-annually.Droz's Hiking Gear, Inc. has found that its common equity capital shares have a beta equal to 1.5 while the risk-free return is 8 percent and the expected return on the market is 14 percent. It has 7-year semiannual maturity bonds outstanding with a price of $767.03 that have a coupon rate of 7 percent. The firm is financed with $140,000,000 of common shares (market value) and $60,000,000 of debt. Droz's, is subject to a 35 percent marginal tax rate. The management of Droz's, is considering an expansion project that costs $1.2 million. The project will produce a cash inflow of $600,000 for 5 years.What is the pre-tax cost of debt? (Round to the nearest percent.)