Question: Using UNFI 2021 10-K Chapter 3: SCF - Question 4 Identify the primary cash outflows and inflows from investing activities. Description of Activity Cash outflow:

Using UNFI 2021 10-K

Using UNFI 2021 10-K

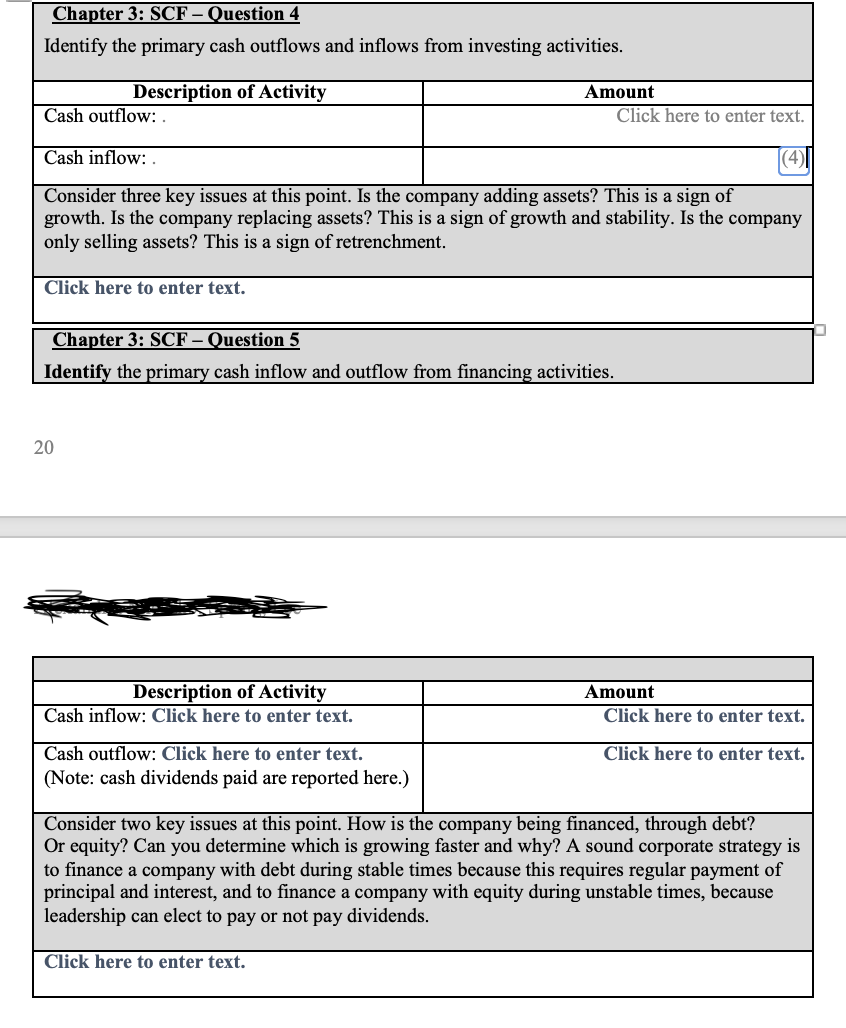

Chapter 3: SCF - Question 4 Identify the primary cash outflows and inflows from investing activities. Description of Activity Cash outflow: Amount Click here to enter text. Cash inflow: (4) Consider three key issues at this point. Is the company adding assets? This is a sign of growth. Is the company replacing assets? This is a sign of growth and stability. Is the company only selling assets? This is a sign of retrenchment. Click here to enter text. Chapter 3: SCF - Question 5 Identify the primary cash inflow and outflow from financing activities. 20 Description of Activity Cash inflow: Click here to enter text. Amount Click here to enter text. Click here to enter text. Cash outflow: Click here to enter text. (Note: cash dividends paid are reported here.) Consider two key issues at this point. How is the company being financed, through debt? Or equity? Can you determine which is growing faster and why? A sound corporate strategy is to finance a company with debt during stable times because this requires regular payment of principal and interest, and to finance a company with equity during unstable times, because leadership can elect to pay or not pay dividends. Click here to enter text

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts