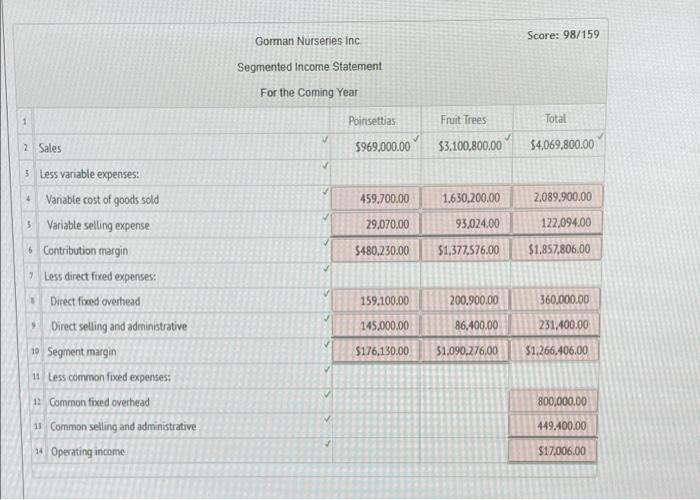

Question: USING VARIABLE COSTING Gorman Nurseries Inc Score: 98/159 Segmented Income Statement For the Coming Year 1 Poinsettias Fruit Trees Total 2 Sales $969.000.00 $3,100,800.00 $4,069,800.00

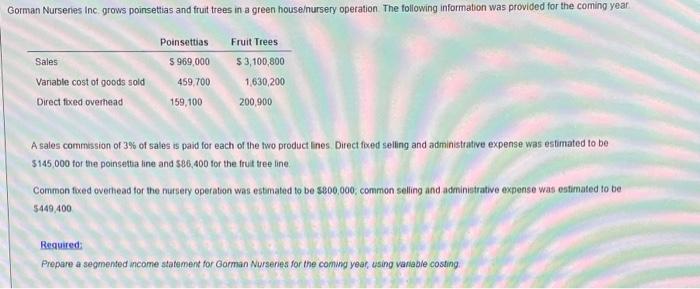

Gorman Nurseries Inc Score: 98/159 Segmented Income Statement For the Coming Year 1 Poinsettias Fruit Trees Total 2 Sales $969.000.00 $3,100,800.00 $4,069,800.00 3 Less variable expenses: 4 459.700.00 1,630,200.00 2.089,900.00 29.070.00 93.024.00 122.094.00 $480.230.00 $1,377.576.00 $1,857,806.00 159.100.00 200.900.00 360.000,00 Variable cost of goods sold 5 Variable selling expense 6 Contribution margin 7 Less direct fixed expenses: Direct foxed overhead Direct selling and administrative 10 Segment margin 11 less common fixed expenses: 1. Common fixed overhead 15 Common selling and administrative Operating income 145,000.00 86,400.00 231.400.00 $176,130.00 $1.090.276,00 $1,266,406.00 800,000.00 449,400.00 $17,006,00 Gorman Nurseries Inc grows poinsettias and fruit trees in a green houseursery operation The following information was provided for the coming year Fruit Trees Sales $ 3,100,800 Poinsettias 5 969,000 459,700 159,100 Variable cost of goods sold Direct fixed overhead 1,630,200 200,900 A sales commission of 3% of sales is paid for each of the two product lines Direct fixed selling and administrative expense was estimated to be $145,000 for the poinsettia line and 586,400 for the fruit tree line Common tored overhead for the nursery operation was estimated to be 5800,000, common selling and administrative expense wat estimated to be 5449 400 Required: Prepare a segmented income statement for Gorman Nurseries for the coming year, using variable costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts