Question: Using vertical analysis (show your calculations), present the following values for this year and last year: gross profit margin net profit margin (use the last

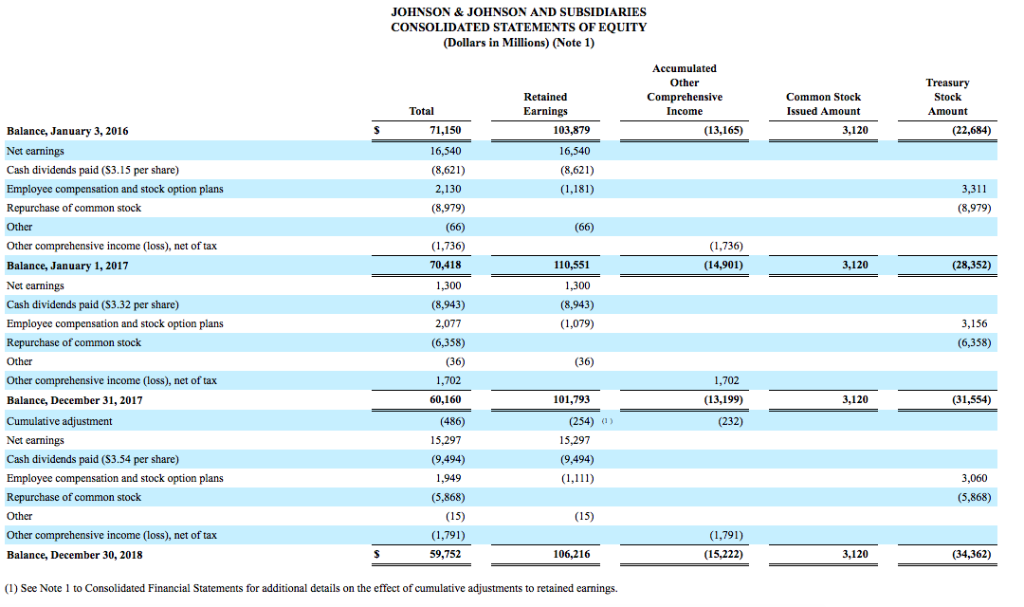

Using vertical analysis (show your calculations), present the following values for this year and last year: gross profit margin net profit margin (use the last "net income" line on the statement) Comment on changes: Are sales increasingly profitable? How are gross profit and net income changing, as dollar values? O JOHNSON & JOHNSON AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EQUITY (Dollars in Millions) (Note 1) Accumulated Other Treasury Com Retained ensive Common Stock p Income Total Earnings Issued Amount Amount (13,165) 71,150 103,879 3.120 (22,684) Balance, January 3, 2016 Net earnings 16,540 16,540 Cash dividends paid (S3.15 per share) (8,621) (8,621) Employee compensation and stock option plans (1,181) 2,130 3,31 Repurchase of common stock (8,979) (8,979) (66) Other (66) tax (1,736) Other comprehensive income (loss), net (1,736) Balance, January 1, 2017 (14,901) (28,352) 70,418 110,551 3,120 Net carnings 1.300 1,300 Cash dividends paid (S3.32 per share) (8,943) (8,943) Employee compensation and stock option plans 2,077 (1,079) 3.156 Repurchase common stock (6,358) (6,358) Other (36) (36) Other comprehensive income (loss), net of tax 1,702 1,702 60.160 101.793 (13,199) 3.120 (31,554) Balance, December 31, 2017 Cumulative adjustment (232) (486) (254) 15,297 Net earnings 15,297 (9,494) Cash dividends paid (S3.54 per share) (9,494) Employee compensation and stock option plans 3,060 1,949 (1,11 common stock (5,868) Repurchase (5,868) (15) Other (15) Other comprehensive income (loss), net f tax (1,791) (1,791) 106.216 59,752 (15.222) 3.120 (34,362) Balance, December 30, 2018 (1) See Note 1 to Consolidated Financial Statements for additional details on the effect of cumulative adjustments to retained eanings. Using vertical analysis (show your calculations), present the following values for this year and last year: gross profit margin net profit margin (use the last "net income" line on the statement) Comment on changes: Are sales increasingly profitable? How are gross profit and net income changing, as dollar values? O JOHNSON & JOHNSON AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EQUITY (Dollars in Millions) (Note 1) Accumulated Other Treasury Com Retained ensive Common Stock p Income Total Earnings Issued Amount Amount (13,165) 71,150 103,879 3.120 (22,684) Balance, January 3, 2016 Net earnings 16,540 16,540 Cash dividends paid (S3.15 per share) (8,621) (8,621) Employee compensation and stock option plans (1,181) 2,130 3,31 Repurchase of common stock (8,979) (8,979) (66) Other (66) tax (1,736) Other comprehensive income (loss), net (1,736) Balance, January 1, 2017 (14,901) (28,352) 70,418 110,551 3,120 Net carnings 1.300 1,300 Cash dividends paid (S3.32 per share) (8,943) (8,943) Employee compensation and stock option plans 2,077 (1,079) 3.156 Repurchase common stock (6,358) (6,358) Other (36) (36) Other comprehensive income (loss), net of tax 1,702 1,702 60.160 101.793 (13,199) 3.120 (31,554) Balance, December 31, 2017 Cumulative adjustment (232) (486) (254) 15,297 Net earnings 15,297 (9,494) Cash dividends paid (S3.54 per share) (9,494) Employee compensation and stock option plans 3,060 1,949 (1,11 common stock (5,868) Repurchase (5,868) (15) Other (15) Other comprehensive income (loss), net f tax (1,791) (1,791) 106.216 59,752 (15.222) 3.120 (34,362) Balance, December 30, 2018 (1) See Note 1 to Consolidated Financial Statements for additional details on the effect of cumulative adjustments to retained eanings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts