Question: Using Visual Basic, write the code for the picture underneath ( ensure that the input [textbox txtgrosspay] is valid [cannot be empty], is numeric [must

Using Visual Basic, write the code for the picture underneath ( ensure that the input [textbox txtgrosspay] is valid [cannot be empty], is numeric [must be numbers only], cannot be negative numbers. use listbox as answer, assume all other inputs have been validated. disreguard the net pay

![that the input [textbox txtgrosspay] is valid [cannot be empty], is numeric](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e84b0042582_58366e84affe2133.jpg)

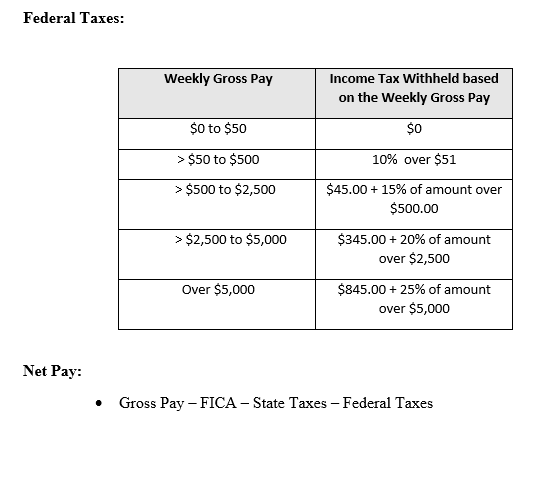

Federal Taxes: Weekly Gross Pay Income Tax Withheld based on the Weekly Gross Pay $0 to $50 $0 > $50 to $500 10% over $51 > $500 to $2,500 $45.00 + 15% of amount over $500.00 > $2,500 to $5,000 $345.00 + 20% of amount over $2,500 Over $5,000 $845.00 + 25% of amount over $5,000 Net Pay: Gross Pay FICA - State Taxes - Federal Taxes Net Pay: $XX,XXX.00 FICA: $XX,XXX.00 State Tax: $XX,XXX.00 Federal Tax: $XX,XXX.00 Gross Pay: $XX,XXX.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts