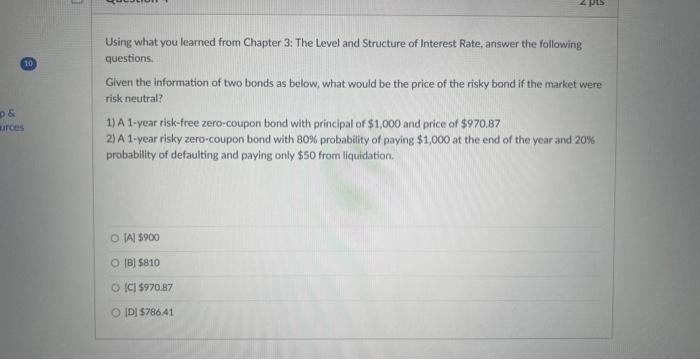

Question: Using what you learned from Chapter 3: The Level and Structure of Interest Rate, answer the following questions. Given the information of two bonds as

Using what you learned from Chapter 3: The Level and Structure of Interest Rate, answer the following questions. Given the information of two bonds as below, what would be the price of the risky bond if the market were risk neutral? 1) A 1-year risk-free zero-coupon bond with principal of $1,000 and price of $970.87 2) A 1-year risky zero-coupon bond with 80% probability of paying $1,000 at the end of the year and 20% probability of defaulting and paying only $50 from liquidation. [A] $900 (B) $810 (C) 5970.87 |DI 5786.41

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts