Question: ? Using your general knowledge about credit, identify what factors would likely affect credit risk for consumer loans (i.e. car, personal, credit cards, etc.).? What

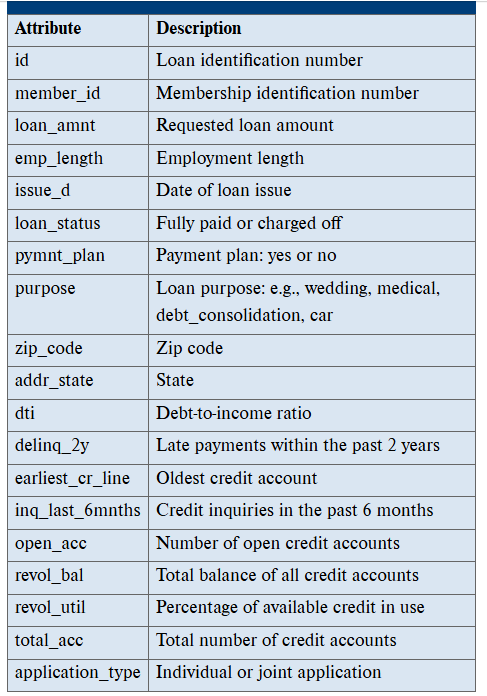

? Using your general knowledge about credit, identify what factors would likely affect credit risk for consumer loans (i.e. car, personal, credit cards, etc.).? What hypotheses would you develop using those factors, and what is the logic supporting your hypotheses?? Examine the data fields given in Part 2 of the Lab. o Which of these fields would serve as the factors to be used for testing your hypotheses?o Are any fields missing that you would need to obtain? If so, how would you obtain them?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts