Question: Using Your Judgment Financial Reporting Problem Marks and Spencer plc (M&S) The financial statements of M&S (GBR) are presented in Appendix bellow. The complete annual

Using Your Judgment Financial Reporting Problem Marks and Spencer plc (M&S) The financial statements of M&S (GBR) are presented in Appendix bellow. The complete annual report, including the notes to the financial statements, is available online.

Instructions

Refer to M&Ss financial statements and the accompanying notes to answer the following questions.

a. Which method of computing net cash provided by operating activities does M&S use? What were the amounts of net cash provided by operating activities for the years 2018 and 2019? What were the two most significant items in the cash generated from operations in 2019?

b. What was the most significant item in the cash flows used for investing activities section in 2019? What was the most significant item in the cash flows used for financing activities section in 2019?

c. Where is deferred income taxes reported in M&Ss statement of cash flows? Why does it appear in that section of the statement of cash flows?

d. Where is depreciation reported in M&Ss statement of cash flows? Why is depreciation added to net income in the statement of cash flows?

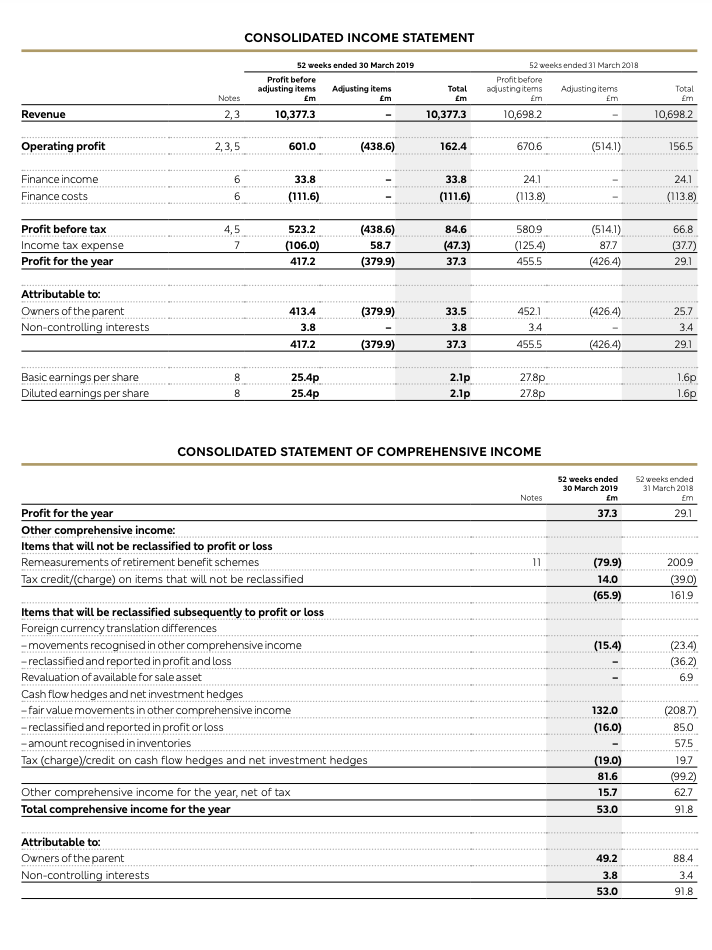

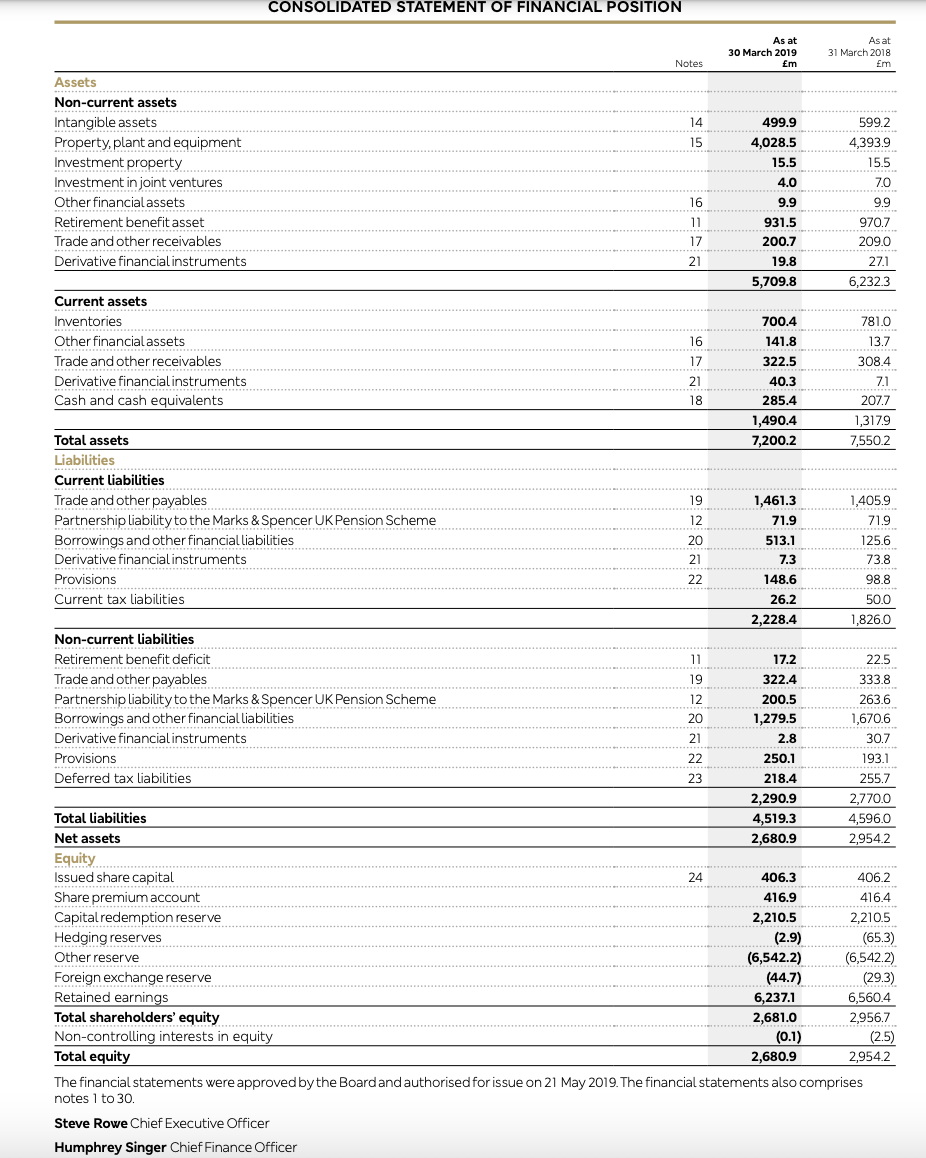

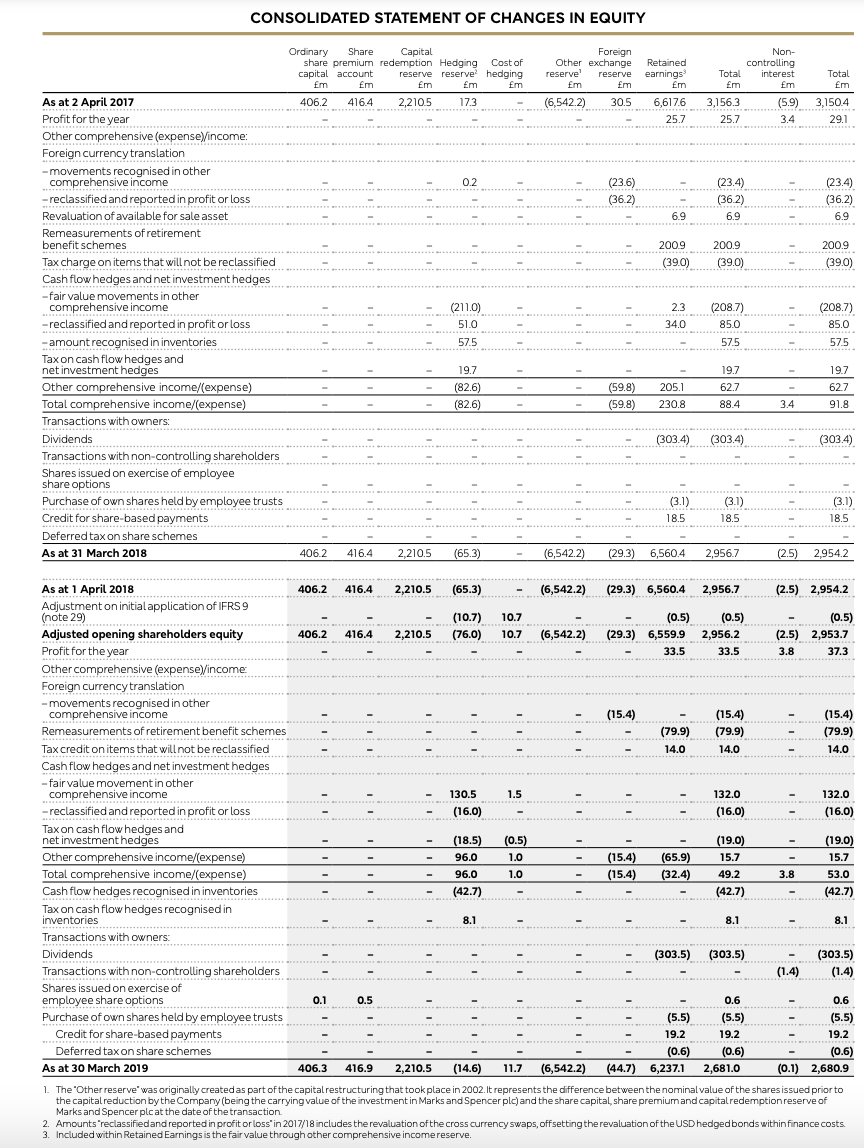

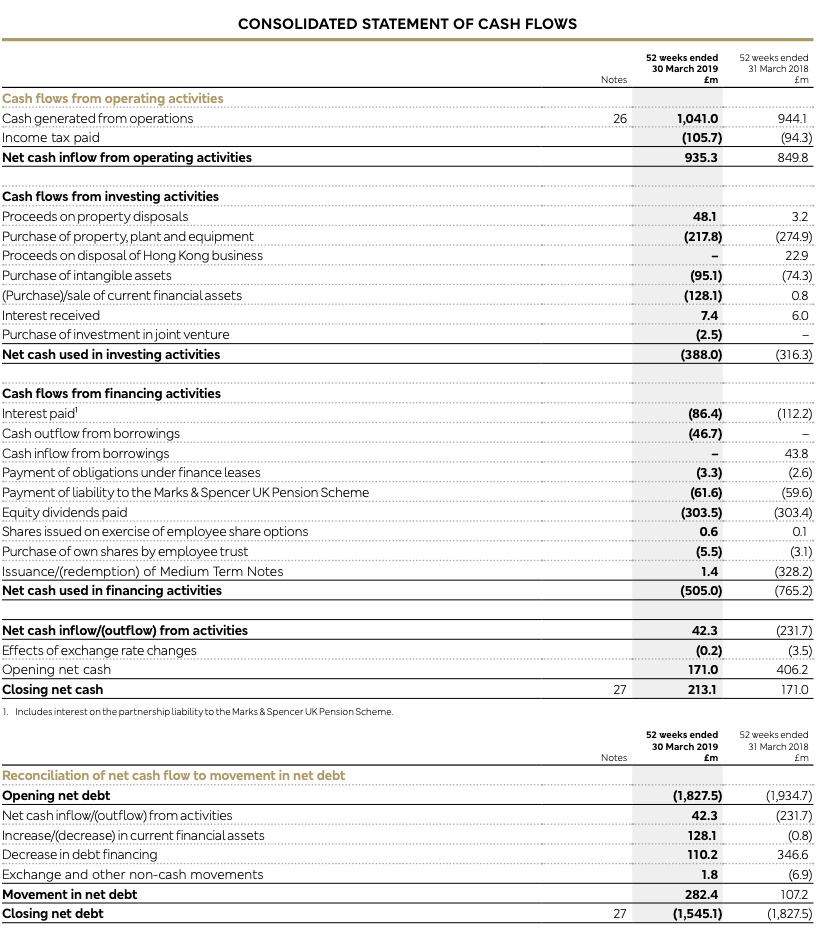

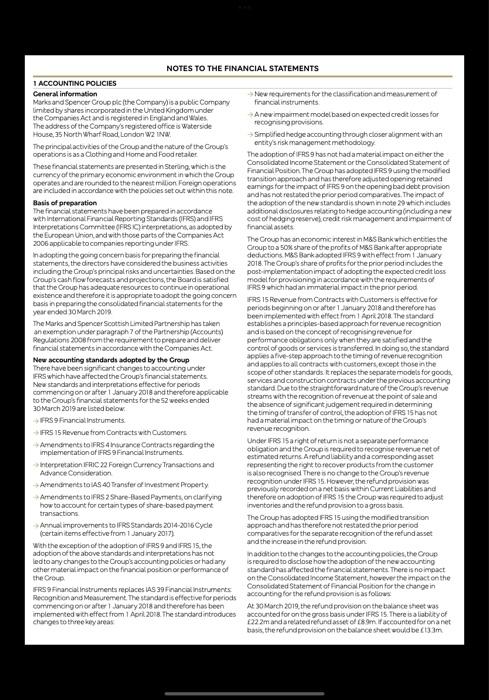

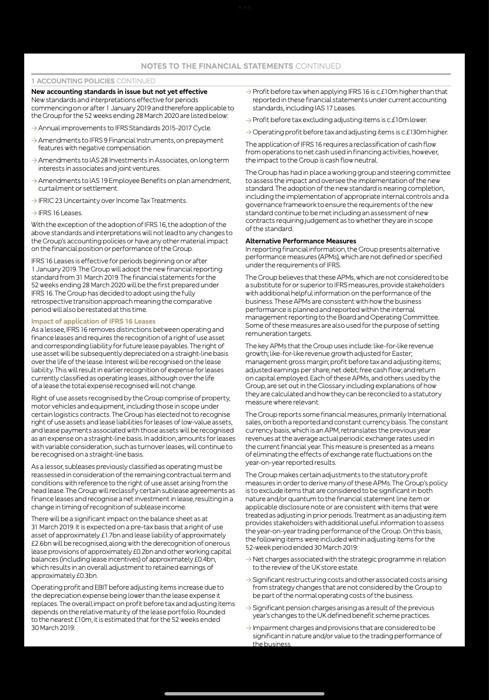

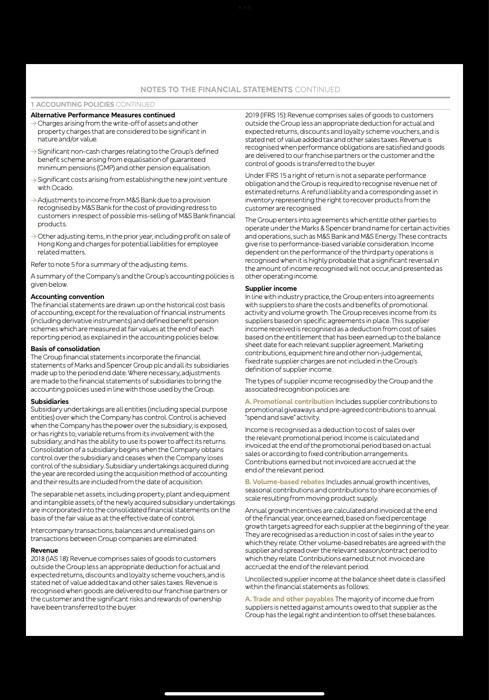

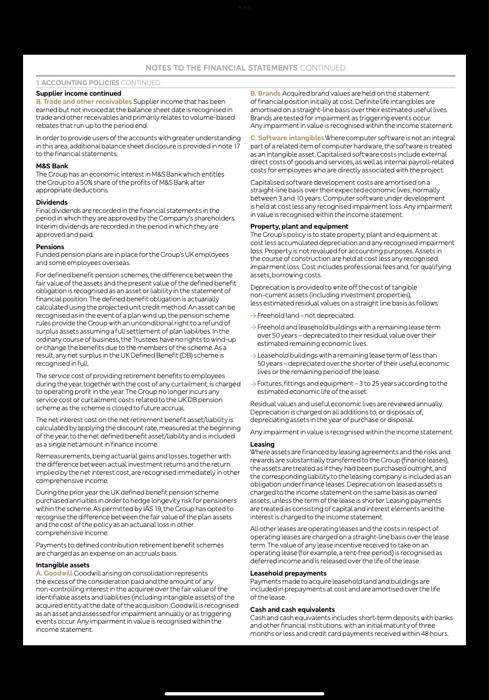

Revenue Operating profit Finance income Finance costs Profit before tax Income tax expense Profit for the year Attributable to: Owners of the parent Non-controlling interests Basic earnings per share Diluted earnings per share Notes 2,3 2,3,5 6 6 4,5 7 8 8 CONSOLIDATED INCOME STATEMENT Attributable to: Owners of the parent Non-controlling interests Profit before adjusting items m 52 weeks ended 30 March 2019 10,377.3 601.0 33.8 (111.6) 523.2 (106.0) 417.2 413.4 3.8 417.2 25.4p 25.4p Profit for the year Other comprehensive income: Items that will not be reclassified to profit or loss Remeasurements of retirement benefit schemes Tax credit/(charge) on items that will not be reclassified Items that will be reclassified subsequently to profit or loss Foreign currency translation differences -movements recognised in other comprehensive income -reclassified and reported in profit and loss Revaluation of available for sale asset Cash flow hedges and net investment hedges -fair value movements in other comprehensive income Other comprehensive income for the year, net of tax Total comprehensive income for the year Adjusting items m (438.6) (438.6) 58.7 (379.9) (379.9) (379.9) -reclassified and reported in profit or loss - amount recognised in inventories Tax (charge)/credit on cash flow hedges and net investment hedges Total m 10,377.3 162.4 33.8 (111.6) 84.6 (47.3) 37.3 33.5 3.8 37.3 2.1p 2.1p 52 weeks ended 31 March 2018 Profit before adjusting items m 10,698.2 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 670.6 24.1 (113.8) 580.9 (125.4) 455.5 452.1 3.4 455.5 27.8p 27.8p Notes 11 Adjusting items m (514.1) (514.1) 87.7 (426.4) (426.4) (426.4) 52 weeks ended 30 March 2019 m 37.3 (79.9) 14.0 (65.9) (15.4) 132.0 (16.0) (19.0) 81.6 15.7 53.0 49.2 3.8 53.0 Total m 10,698.2 156.5 24.1 (113.8) 66.8 (37.7) 29.1 25.7 3.4 29.1 1.6p 1.6p 52 weeks ended 31 March 2018 Em 29.1 200.9 (39.0) 161.9 (23.4) (36.2) 6.9 (208.7) 85.0 57.5 19.7 (99.2) 62.7 91.8 88.4 3.4 91.8 Assets Non-current assets Intangible assets Property, plant and equipment Investment property Investment in joint ventures Other financial assets Retirement benefit asset Trade and other receivables Derivative financial instruments Current assets Inventories Other financial assets Trade and other receivables Derivative financial instruments Cash and cash equivalents Total assets Liabilities Current liabilities Trade and other payables Partnership liability to the Marks & Spencer UK Pension Scheme Borrowings and other financial liabilities Derivative financial instruments Provisions Current tax liabilities Non-current liabilities Retirement benefit deficit Trade and other payables Partnership liability to the Marks & Spencer UK Pension Scheme Borrowings and other financial liabilities Derivative financial instruments Provisions Deferred tax liabilities Total liabilities Net assets CONSOLIDATED STATEMENT OF FINANCIAL POSITION Equity Issued share capital Share premium account Capital redemption reserve Hedging reserves Other reserve Foreign exchange reserve Retained earnings Total shareholders' equity Non-controlling interests in equity Total equity Notes 14 15 16 11 17 21 16 17 21 18 92222 19 12 20 21 11 19 12 20 21 22 23 24 As at 30 March 2019 m 499.9 4,028.5 15.5 4.0 9.9 931.5 200.7 19.8 5,709.8 700.4 141.8 322.5 40.3 285.4 1,490.4 7,200.2 1,461.3 71.9 513.1 7.3 148.6 26.2 2,228.4 17.2 322.4 200.5 1,279.5 2.8 250.1 218.4 2,290.9 4,519.3 2,680.9 406.3 416.9 2,210.5 (2.9) (6,542.2) (44.7) 6,237.1 2,681.0 (0.1) 2,680.9 As at 31 March 2018 m 599.2 4,393.9 15.5 7.0 9.9 970.7 209.0 27.1 6,232.3 781.0 13.7 308.4 7.1 207.7 1,3179 7,550.2 1,405.9 71.9 125.6 73.8 98.8 50.0 1,826.0 22.5 333.8 263.6 1,670.6 30.7 193.1 255.7 2,770.0 4,596.0 2,954.2 406.2 416.4 2,210.5 (65.3) (6,542.2) (29.3) 6,560.4 2,956.7 (2.5) 2,954.2 The financial statements were approved by the Board and authorised for issue on 21 May 2019. The financial statements also comprises notes 1 to 30. Steve Rowe Chief Executive Officer Humphrey Singer Chief Finance Officer As at 2 April 2017 Profit for the year Other comprehensive (expense)/income: Foreign currency translation -movements recognised in other comprehensive income -reclassified and reported in profit or loss Revaluation of available for sale asset Remeasurements of retirement benefit schemes Tax charge on items that will not be reclassified Cash flow hedges and net investment hedges -fair value movements in other comprehensive income -reclassified and reported in profit or loss - amount recognised in inventories Tax on cash flow hedges and net investment hedges Other comprehensive income/(expense) Total comprehensive income/(expense) Transactions with owners: Dividends Transactions with non-controlling shareholders Shares issued on exercise of employee share options Purchase of own shares held by employee trusts Credit for share-based payments Deferred tax on share schemes As at 31 March 2018 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY As at 1 April 2018 Adjustment on initial application of IFRS 9 (note 29) Adjusted opening shareholders equity Profit for the year Other comprehensive (expense)/income: Foreign currency translation -movements recognised in other comprehensive income Remeasurements of retirement benefit schemes Tax credit on items that will not be reclassified Cash flow hedges and net investment hedges -fair value movement in other comprehensive income -reclassified and reported in profit or loss Tax on cash flow hedges and net investment hedges Other comprehensive income/(expense) Total comprehensive income/(expense) Cash flow hedges recognised in inventories Tax on cash flow hedges recognised in inventories Transactions with owners: Dividends Transactions with non-controlling shareholders Shares issued on exercise of employee share options Purchase of own shares held by employee trusts Credit for share-based payments Deferred tax on share schemes As at 30 March 2019 Ordinary Share Capital share premium redemption Hedging Cost of capital account reserve reserve hedging m m m m m 406.2 416.4 2,210.5 17.3 406.2 416.4 406.2 416.4 0.1 0.2 406.2 416.4 2,210.5 (65.3) 0.5 (211.0) 51.0 57.5 19.7 (82.6) (82.6) 2,210.5 (65.3) - (10.7) 10.7 2,210.5 (76.0) 10.7 130.5 (16.0) 1.5 (18.5) (0.5) 96.0 1.0 96.0 1.0 (42.7) 8.1 - Foreign Other exchange Retained reserve reserve earnings m m (6,542.2) 30.5 (6,542.2) (23.6) (36.2) (6,542.2) m 6,617.6 25.7 6.9 (15.4) 200.9 (39.0) 2.3 34.0 (59.8) 205.1 (59.8) 230.8 (303.4) (3.1) 18.5 (29.3) 6,560.4 (79.9) 14.0 (15.4) (65.9) (15.4) (32.4) Total m 3,156.3 25.7 (23.4) (36.2) 6.9 200.9 (39.0) (208.7) 85.0 57.5 19.7 62.7 88.4 (6,542.2) (29.3) 6,560.4 2,956.7 (0.5) (0.5) (29.3) 6,559.9 2,956.2 33.5 33.5 (303.4) (3.1) 18.5 2,956.7 (15.4) (79.9) 14.0 132.0 (16.0) (19.0) 15.7 49.2 (42.7) 8.1 (303.5) (303.5) Non- controlling interest m Total m (5.9) 3,150.4 ********* 3.4 29.1 - 3.4 (23.4) (36.2) 6.9 - 200.9 3.8 (39.0) (1.4) (208.7) 85.0 57.5 19.7 62.7 91.8 (2.5) 2,954.2 (303.4) (2.5) 2,954.2 (3.1) 18.5 (0.5) (2.5) 2,953.7 3.8 37.3 (15.4) (79.9) 14.0 132.0 (16.0) 0.6 (5.5) (5.5) 19.2 19.2 19.2 (0.6) (0.6) (0.6) 406.3 416.9 2,210.5 (14.6) 11.7 (6,542.2) (44.7) 6,237.1 2,681.0 (0.1) 2,680.9 1. The *Other reserve" was originally created as part of the capital restructuring that took place in 2002. It represents the difference between the nominal value of the shares issued prior to the capital reduction by the Company (being the carrying value of the investment in Marks and Spencer plc) and the share capital, share premium and capital redemption reserve of Marks and Spencer plc at the date of the transaction. 2. Amounts "reclassified and reported in profit or loss" in 2017/18 includes the revaluation of the cross currency swaps, offsetting the revaluation of the USD hedged bonds within finance costs. 3. Included within Retained Earnings is the fair value through other comprehensive income reserve. (19.0) 15.7 53.0 (42.7) 8.1 (303.5) (1.4) 0.6 (5.5) CONSOLIDATED STATEMENT OF CASH FLOWS Cash flows from operating activities Cash generated from operations Income tax paid Net cash inflow from operating activities Cash flows from investing activities Proceeds on property disposals Purchase of property, plant and equipment Proceeds on disposal of Hong Kong business Purchase of intangible assets (Purchase)/sale of current financial assets Interest received Purchase of investment in joint venture Net cash used in investing activities Cash flows from financing activities Interest paid Cash outflow from borrowings Cash inflow from borrowings Payment of obligations under finance leases Payment of liability to the Marks & Spencer UK Pension Scheme Equity dividends paid Shares issued on exercise of employee share options Purchase of own shares by employee trust Issuance/(redemption) of Medium Term Notes Net cash used in financing activities Net cash inflow/(outflow) from activities Effects of exchange rate changes Opening net cash Closing net cash 1. Includes interest on the partnership liability to the Marks & Spencer UK Pension Scheme. Reconciliation of net cash flow to movement in net debt Opening net debt Net cash inflow/(outflow) from activities Increase/(decrease) in current financial assets Decrease in debt financing Exchange and other non-cash movements Movement in net debt Closing net debt Notes 26 27 Notes 27 52 weeks ended 30 March 2019 m 1,041.0 (105.7) 935.3 48.1 (217.8) (95.1) (128.1) 7.4 (2.5) (388.0) (86.4) (46.7) (3.3) (61.6) (303.5) 0.6 (5.5) 1.4 (505.0) 42.3 (0.2) 171.0 213.1 52 weeks ended 30 March 2019 m (1,827.5) 42.3 128.1 110.2 1.8 282.4 (1,545.1) 52 weeks ended 31 March 2018 m 944.1 (94.3) 849.8 3.2 (274.9) 22.9 (74.3) ******* 0.8 6.0 (316.3) (1122) 43.8 (2.6) (59.6) (303.4) 0.1 (3.1) (328.2) (765.2) (231.7) (3.5) 406.2 171.0 52 weeks ended 31 March 2018 m (1,934.7) (231.7) (0.8) 346.6 (6.9) 107.2 (1,827.5) NOTES TO THE FINANCIAL STATEMENTS 1 ACCOUNTING POLICIES Ceneral information Marks and Spencer Group pic (the Company) is a public Company limited by shares incorporated in the United Kingdom under the Companies Act and is registered in England and Wales The address of the Company's registered office is Waterside House, 35 North Wharf Road, London W2 INW The principal activities of the Croup and the nature of the Group's operations is as a Clothing and Home and Food retaler These financial statements are presented in Stering, which is the currency of the primary economic environment in which the Croup operates and are rounded to the nearest million Foreign operations are included in accordance with the policies set out within this note Basis of preparation The financial statements have been prepared in accordance with international Financial Reporting Standards (IFRS) and IFRS Interpretations Committee (FRS C) interpretations as adopted by the European Union, and with those parts of the Companies Act 2006 applicable to companies reporting under IFRS In adopting the going concem basis for preparing the financial statements, the directors have considered the business activities including the Group's principal risks and uncertainties Based on the Croup's cash flow forecasts and projections, the Boardis satisfied that the Croup has adequate resources to continue in operational existence and therefore it is appropriate to adopt the going concern basis in preparing the consolidated financial statements for the year ended 30 March 2009 The Marks and Spencer Scottish Limited Partnership has taken an exemption under paragraph 7 of the Partnership (Accounts) Regulations 2008 from the requirement to prepare and deliver financial statements in accordance with the Companies Act New accounting standards adopted by the Group There have been significant changes to accounting under IFRS which have affected the Group's financial statements New standards and interpretations effective for periods commencing on or after 1 January 2018 and therefore applicable to the Croup's financial statements for the 52 weeks ended 30 March 2019 are listed below FRS 9 Financial Instruments +IFRS 15 Revenue from Contracts with Customers Amendments to FRS 4 Insurance Contracts regarding the implementation of IFRS 9 Financial Instruments Interpretation FRIC 22 Foreign Currency Transactions and Advance Consideration Amendments to AS 40 Transfer of investment Property Amendments to FRS 2 Share-Based Payments, on clarifying how to account for certain types of share-based payment transactions Annual improvements to IFRS Standards 2014-2016 Cycle (certain items effective from 1 January 2017) With the exception of the adoption of IFRS 9 and IFRS 15, the adoption of the above standards and interpretations has not led to any changes to the Croup's accounting policies or had any other material impact on the financial position or performance of the Croup FRS 9 Financial Instruments replaces IAS 39 Financial Instruments Recognition and Measurement. The standard is effective for periods commencing on or after 1 January 2018 and therefore has been implemented with effect from 1 April 2018. The standard introduces changes to three key areas New requirements for the classification and measurement of financial instruments A new impairment model based on expected credit losses for recognising provisions Simplified hedge accounting through closer alignment with an entity's risk management methodology The adoption of IFRS 9 has not had a material impact on either the Consolidated Income Statement of the Consolidated Statement of Financial Position The Group has adopted IFRS 9 using the modified transition approach and has therefore adjusted opening retained Tevision parem the adoption of the new standardis shown in note 29 which includes additional disclosures relating to hedge accounting (including a new cost of hedgingreserve), credit risk management and impairment of financial assets The Croup has an economic interest in M&S Bankwhich entities the Group to a 50% share of the profits of M&S Bank after appropriate deductions M&S Bank adopted IFRS 9 with effect from 1 January 2018. The Croup's share of profits for the prior period includes the post-implementation impact of adopting the expected credit loss model for provisioning in accordance with the requirements of IFRS 9 which had an immaterial impact in the prior period www and the control of goods or services is transferred in doing so, the standard woods arive-the timing of revenue recognition FRS 15 Revenue from Contracts with Customers is effective for periods beginning on or after 1 January 2018 and therefore has been implemented with effect from 1 April 2018 The standard establishes a principles-based approach for revenue recognition and applies to all contracts with customers, except those in the and co scope of other standards. It replaces the separate models for goods standard the absence of significant judgement required in determining the timing of transfer of control the adoption of FRS 15 has not had a material impact on the timing or nature of the Croup's revenue recognition Under IFRS 15 a right of return is not a separate performance obligation and the Group is required to recognise revenue net of estimated returns Arefund liability and a corresponding asset representing the right to recover products from the customer There is no recognition under IFRS 15. However, the refund provision was previously recorded on a net basis within Current Liabilities and therefore on adoption of IFRS 15 the Croup was required to adjust inventories and the refund provision to a gross basis The Croup has adopted FRS 15 using the modified transition approach and has therefore not restated the prior period comparatives for the separate recognition of the refund asset and the increase in the refund provision in addition to the changes to the accounting policies, the Croup is required to disclose how the adoption of the new accounting standard has affected the financial statements. There is no impact on the Consolidated income Statement, however the impact on the Consolidated Statement of Financial Position for the change in accounting for the refund provision is as follows: At 30 March 2019, the refund provision on the balance sheet was accounted for on the gross basis under IFRS 15. There is a liability of 22 2m and a related refund asset of 89m if accounted foron anet basis, the refund provision on the balance sheet would be 13.3m NOTES TO THE FINANCIAL STATEMENTS CONTINUED 1 ACCOUNTING POLICIES CONTINUED New accounting standards in issue but not yet effective New standards and interpretations effective for periods commencing on or after 1 January 2019 and therefore applicable to the Group for the 52 weeks ending 28 March 2020 are listed below Annual improvements to IFRS Standards 2015-2017 Cycle Amendments to FRS 9 Financial instruments, on prepayment features with negative compensation +Amendments to AS 28 Investments in Associates, on long term interests in associates and joint ventures Amendments to IAS 19 Employee Benefits on plan amendment curtailment or settlement FRIC 23 Uncertainty over Income Tax Treatments FRS 16 Leases with the exception of the adoption of FRS 16, the adoption of the above standards and interpretations will not lead to any changes to the Group's accounting policies or have any other material impact on the financial position or performance of the Group FRS 16 Leases is effective for periods beginning on or after 1 January 2019 The Croup will adopt the new financial reporting standard from 31 March 2019 The financial statements for the 52 weeks ending 28 March 2020 will be the first prepared under FRS 16. The Croup has decided to adopt using the fully retrospective transition approach meaning the comparative period will also be restated at this time impact of application of IFRS 16 Leases As a lessee, IFRS 16 removes distinctions between operating and finance leases and requires the recognition of a right of use asset and corresponding liabuty for future lease payables. The right of use asset will be subsequently depreciated on a straight line basis over the life of the lease Interest will be recognised on the lease lability. This will result in earlier recognition of expense for leases currently classified as operating leases, although over the life of a lease the total expense recognised will not change Right of use assets recognised by the Croup comprise of property motor vehicles and equipment, including those in scope under certain logistics contracts. The Croup has elected not to recognise right of use assets and lease liabilities for leases of low-value assets and lease payments associated with those assets will be recognised as an expense on a straight line basis. In addition, amounts for leases with variable consideration, such as turnover leases, will continue to be recognised on a straight line basis As a lessor subleases previously classified as operating must be reassessed in consideration of the remaining contractual term and conditions with reference to the right of use asset arising from the head lease. The Croup will reclassify certain sublease agreements as finance leases and recognise a net investment in lease, resultingina change in timing of recognition of sublease income There will be a significant impact on the balance sheet as at 31 March 2019 it is expected on a pre-tax basis that right of use asset of approximately 17bn and lease liability of approximately 2.6bn will be recognised, along with the derecognition of onerous lease provisions of approximately 0 2bn and other working capital balances (including lease incentives) of approximately 0.4bn which results in an overall adjustment to retained earnings of approximately 0.3bn Operating profit and EBIT before adjusting items increase due to the depreciation expense being lower than the lease expenseit replaces. The overall impact on profit before tax and adjusting items depends on the relative maturity of the lease portfolio Rounded to the nearest E10m, it is estimated that for the 52 weeks ended 30 March 2019 Profit before tax when applying FRS 16 is CE10m higher than that reported in these financial statements under current accounting standards, including IAS 17 Leases Profit before tax excluding adjusting items is cf10mlower Operating profit before tax and adjusting tems is c130m higher The application of IFRS 16 requires a reclassification of cash flow from operations to net cash used in financing activities, however the impact to the Croup is cash flow neutral The Croup has had in place a working group and steering committee to assess the impact and oversee the implementation of the new standard The adoption of the new standard is nearing completion including the implementation of appropriate internal controls and a governance framework to ensure the requirements of the new standard continue to be met including an assessment of new contracts requiring judgement as to whether they are in scope of the standard Alternative Performance Measures In reporting financial information, the Group presents alternative performance measures (APM) which are not defined or specified under the requirements of IFRS The Croup believes that these APMs, which are not considered to be a substitute for or superior to IFRS measures provide stakeholders with additional helpful information on the performance of the business. These APMs are consistent with how the business performance is planned and reported within the internal management reporting to the Board and Operating Committee Some of these measures are also used for the purpose of setting remuneration targets. The key APMs that the Group uses include like-for-like revenue growth like-for-like revenue growth adjusted for Easter, management gross margin profit before tax and adjusting items; adjusted earings per share, net debt free cash flow, and return on capital employed Each of these APMs, and others used by the Group, are set out in the Glossary including explanations of how they are calculated and how they can be reconciled to a statutory measure where relevant The Croup reports some financial measures, primarily international sales, on both a reported and constant currency basis. The constant currency basis, which is an APM, retranslates the previous year revenues at the average actual periodic exchange rates used in the current financial year. This measure is presented as a means of eliminating the effects of exchange rate fluctuations on the year-on-year reported results. The Croup makes certain adjustments to the statutory profe measures in order to derive many of these APMs The Croup's policy is to exclude items that are considered to be significant in both nature and/or quantum to the financial statement line bemor applicable disclosure note or are consistent with items that were treated as adjusting in prior periods. Treatment as an adjusting item provides stakeholders with additional useful information to assess the year-on-year trading performance of the Croup. On this basis, the following items were included within adjusting items for the 52-week period ended 30 March 2019 Net charges associated with the strategic programme in relation to the review of the UK store estate Significant restructuring costs and other associated costs arising from strategy changes that are not considered by the Group to be part of the normal operating costs of the business. Significant pension charges arising as a result of the previous year's changes to the UK defined benefit scheme practices Impairment charges and provisions that are considered to be significant in nature and/or value to the trading performance of the business NOTES TO THE FINANCIAL STATEMENTS CONTINUED 1 ACCOUNTING POLICIES CONTINUED Alternative Performance Measures continued *Charges arising from the write-off of assets and other property charges that are considered to be significant in nature and/or value Significant non-cash charges relating to the Group's defined benefit scheme arising from equalisation of guaranteed minimum pensions (CMP) and other pension equalisation +Significant costs arising from establishing the new joint venture with Ocado Adjustments to income from M&S Bank due to a provision recognised by M&S Bank for the cost of providing redress to customers in respect of possible mis-selling of M&S Bank financial products *Other adjusting items in the prior year, including profit on sale of Hong Kong and charges for potential liabilities for employee related matters. Accounting convention The financial statements are drawn up on the historical cost basis of accounting, except for the revaluation of financial instruments (including derivative instruments) and defined benefit pension schemes which are measured at fair values at the end of each reporting period, as explained in the accounting policies below Basis of consolidation The Croup financial statements incorporate the financial statements of Marks and Spencer Croup plc and all its subsidiaries made up to the period end date Where necessary adjustments are made to the financial statements of subsidiaries to bring the accounting policies used in line with those used by the Group Subsidiaries Subsidiary undertakings are all entities (including special purpose entities over which the Company has control Control is achieved when the Company has the power over the subsidiary, is exposed, or has rights to variable returns from its involvement with the subsidiary, and has the ability to use its power to affect its returns Consolidation of a subsidiary begins when the Company obtains nebyg the year are recorded using the acquisition method of accounting and their results are included from the date of acquisition The separable net assets, including property plant and equipment and intangible assets, of the newly acquired subsidiary undertakings are incorporated into the consolidated financial statements on the basis of the fair value as at the effective date of control Intercompany transactions, balances and unrealised gains on transactions between Croup companies are eliminated 2019 (FRS 15) Revenue comprises sales of goods to customers outside the Croup less an appropriate deduction for actual and expected returns, discounts and loyalty scheme vouchers, and is stated net of value added tax and other sales taxes Revenue is recognised when performance obligations are satisfied and goods are delivered to our franchise partners or the customer and the control of goods is transferred to the buyer Refer to notes for a summary of the adjusting items. A summary of the Company's and the Group's accounting policies is other operating income given below Revenue 2018 (AS 18) Revenue comprises sales of goods to customers outside the Group less an appropriate deduction for actual and expected returns, discounts and loyalty scheme vouchers, and is stated net of value added tax and other sales taxes Revenue s recognised when goods are delivered to our franchise partners or the customer and the significant risks and rewards of ownership have been transferred to the buyer Under FRS 15 a right of return is not a separate performance obligation and the Group is required to recognise revenue net of estimated returns Arefund liability and a corresponding asset in inventory representing the right to recover products from the customer are recognised The Group enters into agreements which entitle other parties to operate under the Marks & Spencer brand name for certain activities and operations, such as M&S Bank and M&S Energy. These contracts give rise to performance-based variable consideration Income dependent on the performance of the third party operations is recognised when it is highly probable that a significant reversal in the amount of income recognised will not occur and presented as Supplier income in line with industry practice, the Croup enters into agreements with suppliers to share the costs and benefits of promotional ARE THE SUB income received is recognised as a deduction from cost of sales based on the entitlement that has been earned up to the balance sheet date for each relevant supplier agreement Marketing contributions, equipment hire and other non-judgemental fixed rate supplier charges are not included in the Group's definition of supplier income The types of supplier income recognised by the Croup and the associated recognition policies are A Promotional contribution includes supplier contributions to promotional giveaways and pre-agreed contributions to annual "spend and save activity. Income is recognised as a deduction to cost of sales over the relevant promotional period income is calculated and invoiced at the end of the promotional period based on actual sales or according to foxed contribution arrangements Contributions earned but not invoiced are accrued at the end of the relevant period B. Volume-based rebates includes annual growth incentives, seasonal contributions and contributions to share economies of scale resulting from moving product supply Annual growth incentives are calculated and invoiced at the end of the financial year, once earned, based on fixed percentage growth targets agreed for each supplier at the beginning of the year They are recognised as a reduction in cost of sales in the year to which they relate Other volume-based rebates are agreed with the supplier and spread over the relevant season contract period to which they relate Contributions earned but not invoiced are accrued at the end of the relevant period Uncollected supplier income at the balance sheet date is classified within the financial statements as follows: A Trade and other payables The majority of income due from suppliers is netted against amounts owed to that supplier as the Croup has the legal right and intention to offset these balances NOTES TO THE FINANCIAL STATEMENTS CONTINUED 1 ACCOUNTING POLICIES CONTINUED Supplier income continued Trade and other receivables Supplier income that has been earned but not invoiced at the balance sheet date is recognised in trade and other receivables and primarily relates to volume-based rebates that run up to the periodend in order to provide users of the accounts with greater understanding in this area, additional balance sheet disclosure is provided in note 17 to the financial statements M&S Bank The Croup has an economic interest in M&S Bank which entities the Croup to a 50% share of the profits of M&S Bank after appropriate deductions Dividends Final dividends are recorded in the financial statements in the period in which they are approved by the Company's shareholders Interim dividends are recorded in the period in which they are approved and paid Pensions Funded pension plans are in place for the Croup's UK employees and some employees overseas For defined benefit pension schemes, the difference between the fair value of the assets and the present value of the defined benefit obogation is recognised as an asset or liability in the statement of financial position The defined benefit obligation is actuarialy calculated using the projected unit credit method An asset can be event of a rules provide the Croup with an unconditional right to a refund of surplus assets assuming a full settlement of plan liabilities in the ordinary course of business, the Trustees have no rights to wind-up or change the benefits due to the members of the scheme. As a result, any net surplus in the UK Defined Benefit (DB) scheme is recognised in full The service cost of providing retirement benefits to employees during the year together with the cost of any curtaiment is charged to operating profit in the year. The Croup no longer incurs any service cost or curtailment costs related to the UKDB pension scheme as the scheme is closed to future accrual The net interest cost on the net retirement benefit asset/liabutyis calculated by applying the discount rate, measured at the beginning of the year, to the net defined benefit asset/liability and is included as a single net amount in finance income Remeasurements, being actuarial gains and losses, together with the difference between actual investment returns and the return implied by the net interest cost, are recognised immediately in other comprehensive income During the prior year the UK defined benefit pension scheme purchased annuities in order to hedge longevity risk for pensioners within the scheme As permitted by IAS 19 the Croup has opted to recognise the difference between the fair value of the plan assets and the cost of the policy as an actuarial loss in other comprehensive income Payments to defined contribution retirement benefit schemes are charged as an expense on an accruals basis Intangible assets A Goodwill Goodwill arising on consolidation represents the excess of the consideration paid and the amount of any non-controlling interest in the acquiree over the fair value of the identifiable assets and abilities (including intangible assets) of the acquired entity at the date of the acquisition Goodwill is recognised as an asset and assessed for impairment annually or as triggering events occur. Any impairment in value is recognised within the income statement. B. Brands Acquired brand values are held on the statement of financial position initially at cost. Definite life intangibles are amortised on a straight-line basis over their estimated useful lives Brands are tested for impairment as triggering events occur Any impairment in value is recognised within the income statement C Software intangibles Where computer software is not an integral part of a related item of computer hardware, the software is treated as an intangible asset Capitalised software costs include external direct costs of goods and services, as well as internal payroll-related costs for employees who are directly associated with the project Capitalised software development costs are amortised on a straight-line basis over their expected economic lives, normally between 3 and 10 years. Computer software under development is held at cost less any recognised impairment loss Any impairment in value is recognised within the income statement Property, plant and equipment The Croup's policy is to state property, plant and equipment at cost less accumulated depreciation and any recognised impairment loss Property is not revalued for accounting purposes. Assets in the course of construction are held at cost less any recognised impairment loss Cost includes professional fees and for qualifying assets, borrowing costs Depreciation is provided to write off the cost of tangible non-current assets (including investment propertie less estimated residual values on a straight line basis as follows Freehold land-not depreciated +Freehold and leasehold buildings with a remaining lease term over 50 years-depreciated to their residual value over their estimated remaining economic lives. Leasehold buildings with a remaining lease term of less than 50 years-depreciated over the shorter of their useful economic lives or the remaining period of the lease Fixtures, fittings and equipment-3 to 25 years according to the estimated economic life of the asset Residual values and useful economic lives are reviewed annually Depreciation is charged on all additions to or disposals of depreciating assets in the year of purchase or disposal Anyimpairment in value is recognised within the income statement Leasing Where assets are financed by leasing agreements and the risks and rewards are substantially transferred to the Croup (finance leases) the assets are treated as if they had been purchased outright, and the corresponding liability to the leasing company is included as an obligation under finance leases. Deprecation on leased assets is charged to the income statement on the same basis as owned assets, unless the term of the lease is shorter Leasing payments are treated as consisting of capital and interest elements and the interest is charged to the income statement All other leases are operating leases and the costs in respect of operating leases are charged on a straight-line basis over the lease term The value of any lease incentive received to take on an operating lease (for example, a rent free period) is recognised as deferred income and is released over the life of the lease Leasehold prepayments Payments made to acquire leasehold land and buildings are included in prepayments at cost and are amortised over the life of the lease Cash and cash equivalents Cash and cash equivalents includes short-term deposits with banks and other financial institutions, with an initial maturity of three months or less and credit card payments received within 48 hours NOTES TO THE FINANCIAL STATEMENTS CONTINUED 1 ACCOUNTING POLICIES CONTINUED Inventories Inventories are valued on a weighted average cost basis and carried at the lower of cost and net realisable value Cost includes all direct expenditure and other attributable costs incurred in bringing inventories to their present location and condition. All inventories are finished goods. Certain purchases of inventories may be subject to cash flow hedges for foreign exchange risk. The Croup applies a basis adjustment for those purchases in a way that the cost is initially established by reference to the hedged exchange rate and not the spot rate at the day of purchase Provisions Provisions are recognised when the Croup has a present obligation as a result of a past event, and it is probable that the Croup will be required to settle that obligation Provisions are measured at the best estimate of the expenditure required to settle the obligation at the end of the reporting period and are discounted to present value where the effect is material, Share-based payments The Croupissuesequity-settled share-based payments to certain employees Afair value for the equity-settled share awards is measured at the date of grant. The Croup measures the fair value of each award using the Black-Scholes model where appropriate The fair value of each award is recognised as an expense over the vesting period on a straight line basis, after allowing for an estimate of the share awards that will eventually vest. The level of vesting is reviewed at each reporting period and the charge is adjusted to reflect actual and estimated levels of vesting Foreign currencies The results of overseas subsidiaries are translated at the weighted average of monthly exchange rates for revenue and profits The statements of financial position of overseas subsidiaries are translated at year end exchange rates. The resulting exchange differences are booked into reserves and reported in the consolidated statement of comprehensive income cash flow hedges and qualifying net investment hedges. Taxation Tax expense comprises current and deferred tax Taxis recognised in the income statement, except to the extent it relates totes recognised in other comprehensive income or directly in equity.in which case the related tax is recognised in other comprehensive income or directly in equity Provision is made for uncertain tax positions when it is considered probable that there will be a future outflow of funds to a tax authority The provision is calculated using the single best estimate where that outcome is more likely than not and a weighted average probability in other circumstances. The position is reviewed on an ongoing basis, to ensure appropriate provision is made for each known taxrisk Deferred taxabilities are generally recognised for all taxable temporary differences. Deferred tax liabilities are recognised for taxable temporary differences arising on investments in subsidiaries, associates and joint ventures, except where the Deferred taxis accounted for using a temporary difference approach, and is the tax expected to be payable or recoverable on temporary differences between the carrying amount of assets and liabilities in the statement of financial position and the corresponding tax bases used in the computation of taxable profit Deferred tax is calculated based on the expected manner of realisation or settlement of the carrying amount of assets and labilities, applying tax rates and laws enacted or substantively enacted at the end of the reporting period reversal of the temporary difference can be controlled by the Croup and it is probable that the difference will not reverse in the foreseeable future Deferred tax liabilities are not recognised on temporary differences that arise from goodwill which is not deductible for taxpurposes. Deferred tax assets are recognised to the extent it is probable that taxable profits will be available against which the deductible temporary differences can be utilised The carrying amount of deferred tax assets is reviewed at the end of each reporting period and reduced to the extent that it is no longer probable that sufficient taxable profits will be available to allow all or part of the asset to be recovered Deferred tax assets and abilities are not recognised in respect of temporary differences that arise on initial recognition of assets and liabilities acquired other than in a business combination Financial instruments Financial assets and liabilities are recognised in the Croup's statement of financial position when the Croup becomes a party to the contractual provisions of the instrument Transactions denominated in foreign currencies are translated at the exchange rate at the date of the transaction Foreign currency monetary assets and liabilities held at the end of the reporting period are translated at the closing balance sheet rate. The resulting exchange gain or loss is recognised within the income statement except when deferred in other comprehensive income as qualifying other c A Trade and other receivables Trade receivables are recorded initially at fair value and subsequently measured at amortised cost. This results in their recognition at nominal value less an allowance for any doubtful debts The allowance for doubtful debts was recognised under an incurred loss model until 1 April 2018 and therefore it was dependent upon the existence of an impairment event. From 1 April 2018, the allowance for doubtfuldebts is recognised based on management's expectation of losses without regard to whether an impairment trigger happened or not an expected credit loss model) B. Other financial assets Other financial assets consist of investments in debt and equity securities and short-term investments with a maturity date of over 90 days and are classified the fair value through other comprehensive income Cavailable for sale for periods before 1 April 2018) or "fair value before 1 April 2018 are initially measured at fair value, including transaction costs directly attributable to the acquisition of the financial asset. Financial assets held at fair value through profit and loss are initially recognised at fair value and transaction costs are expensed Where securities are designated as "fair value through profit and loss gains and losses arising from changes in fair value are included in the income statement for the period. For equity investments at "fair value through comprehensive income gains or losses arising from changes in fair value are recognised in other comprehensive income, until the security is disposed of at which time the cumulative gain or loss previously recognised in other comprehensive income is included directly in retained earnings and is not recycled to the income statement For the periods before 1 April 2018, the gans or losses accumulated at the time of sale or impairment are recycled to the income statement NOTES TO THE FINANCIAL STATEMENTS CONTINUED 1 ACCOUNTING POLICIES CONTINUED Financial instruments continued For debt instruments at "fair value through comprehensive income or "available for sale in the periods before I April 2018, gains and losses arising from changes in fair value are recognised in other comprehensive unor the secured for s determined to be impaired, at which time the cumulative gain or loss previously recognised in other comprehensive income is included inthe securities w 2018 impairments in debt securities are recognised based on management's expectation of losses in each investment Cexpected credit loss' model) Until 1 April 2018 equity investments that do not have a quoted market price in an active market and whose fair value cannot be reliably measured by other means are held at cost. From 1 April 2018 all equity investments must be measured at fair value under FRS9 C. Classification of financial liabilities and equity Financial liabilities and equity instruments are classified according to the substance of the contractual arrangements entered into. An equity instrument is any contract that evidences a residual interest in the assets of the Croup after deducting all of its abilities D. Bank borrowings Interest-bearing bank loans and overdrafts are initially recorded at fair value, which equals the proceeds received, net of direct issue costs. They are subsequently held at amortised cost Finance charges, including premiums payable on settlement or redemption and direct issue costs, are accounted for using an effective interest rate method and are added to the carrying amount of the instrument to the extent that they are not settled in the period in which they arise E. Loan notes Long-term loans are initially measured at fair value net of direct issue costs and are subsequently held at amortised cost unless the loan is designated in a hedge relationship, in which case hedge accounting treatment will apply Trade payables Trade payables are recorded initially at fair value and subsequently measured at amortised cost Generally, this results in their recognition at their nominal value C. Equity instruments Equity instruments issued by the Company are recorded at the consideration received, net of direct issue costs. Derivative financial instruments and hedging activities The Croup primarily uses interest rate swaps, cross-currency swaps and forward foreign currency contracts to manage its exposures to fluctuations in interest rates and foreign exchange rates. These instruments are initially recognised at fair value on the trade date and are subsequently remeasured at their fair value at the end of the reporting period. The method of recognising the resulting gain or loss is dependent on whether the derivative is designated as a hedging instrument and the nature of the item being hedged. The Croup designates certain hedging derivatives as either Ahedge of a highly probable forecast transaction or change in the cash flows of a recognised asset or liability (a cash flow hedge) Ahedge of the exposure to change in the fair value of a recognised asset or liability (a fair value hedge) Ahedge of the exposure on the translation of net investments in foreign entities (a net investment hedge) At the inception of a hedging relationship, the hedging instrument and the hedged item are documented, along with the risk management objectives and strategy for undertaking various hedge transactions and prospective effectiveness testing is performed During the life of the hedging relationship.prospective effectiveness testing is performed (before 1 April 2018, both prospective and retrospective tests were required) to ensure the instrument remains an effective hedge of the transaction Changes in the fair value of derivative financial instruments that do not qualify for hedge accounting are recognised in the income statement as they arise A. Cash flow hedges Changes in the fair value of derivative financial instruments that are designated and effective as hedges of future cash flows are recognised in other comprehensive income From 1 April 2018, the element of the change in fair value which relates to value was recognised in the hedging reserve) and any ineffective portion is recognised immediately in the income statement the ment of onthatecto liability, then at the time the asset or liability is recognised the associated gains or losses on the derivative that had previously been recognised in other comprehensive income are included in the initial measurement of the asset or liability For hedges that do not result in the recognition of an asset or a liability, amounts deferred in other comprehensive income are recognised in the income statement in the same period in which the hedged items affect net profit or loss 11. Fair value hedges Changes in the fair value of a derivative instrument designated in a fair value hedge, or for non-derivatives the foreign currency component of carrying value are recognised in the income statement. The hedged item is adjusted for changes in fair value attributable to the risk being hedged with the corresponding entry in the income statement C. Net investment hedges Changes in the fair value of derivative or non-derivative financial instruments that are designated and effective as hedges of net investments are recognised in other comprehensive income in the hedging reserve and any ineffective portion is recognised immediately in the income statement Changes in the fair value of derivative financial instruments that do not qualify for hedge accounting are recognised in the income statement as they arise D. Discontinuance of hedge accounting Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated, or exercised, the hedge relationship no longer qualifies for hedge accounting the forecast transaction is no longer expected to occur. From 1 April 2018 the Croup cannot voluntarily de-designate a hedging relationship When a cash flow hedge is discontinued, any cumulative gain or loss on the hedging instrument recognised in other comprehensive income is retained in equity until the forecast transaction occurs Subsequent changes in the fair value of the hedging instruments are recognised in the income statement if a hedged transaction is no longer expected to occur, the net cumulative gain or loss recognised in comprehensive income is transferred to the income statement for the period When a fair value hedge is discontinued, the fair value adjustment to the carrying amount of the hedged item arising from the hedged riskis amortised to the income statement from that date NOTES TO THE FINANCIAL STATEMENTS CONTINUED 1 ACCOUNTING POLICIES CONTINUED Critical accounting judgements and key sources of estimation uncertainty When a net investment hedge is discontinued, the subsequent changes infair value of a derivative (or foreign exchange gains/ losses on recognised financial abilities) are recognised in the income statement. The gain or loss on the hedging instrument recognised in other comprehensive income is reclassified to the income statement only on disposal of the net investment. The Group does not use derivatives to hedge income statement translation exposures The preparation of consolidated financial statements requires the Group to make estimates and judgements that affect the application of policies and reported amounts Critical judgements represent key decisions made by management in the application of the Group accounting policies. Where a significant risk of matenally different outcomes exists due to management assumptions or sources of estimation uncertainty this will represent a key source of estimation uncertainty Estimates and judgements are continually evaluated and are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances Actual results may differ from these estimates The estimates which have a significant risk of causing a material adjustment to the carrying amount of assets and liabilities within the next 12 months are discussed below Critical accounting judgements Adjusting items The directors believe that the adjusted profit and earnings per share measures provide additional useful information to shareholders on the performance of the business. These od Operatin tentater considering therand es and the Clossary. These definitions have been applied consistently year onyear Note 5 provides further details on current year adjusting items and their adherence to Croup policy The giant UK Defined Benefit pension surplus Where a surplus on a defined benefit scheme arises, the rights of the Trustees t is to prevent the Group obtaining a refund of that surplus in the future are considered in determining whether it is necessary to restrict the amount of the surplus that is recognised. The UK Defined Benefit scheme is in surplus at 30 March 2019 The directors have made the judgement that these amounts meet the requirements of recoverability and a surplus of 931.5m has been recognised Key sources of estimation uncertainty UK store estate The Croup is undertaking a significant strategic programme to review its UK store estate resulting in a net charge of 2221m (ast year E321.1m) in the year A significant level of estimation has been used to determine the charges to be recognised in the year The most significant judgement that impacts the charge is that the stores identified as part of the programme are more likely than not to close. Further significant closure costs and impairment charges may be recorded in future years depending on decisions made about further store closures and the successful delivery of the transformation programme Where a store closure has been announced there is a reduced level of estimation uncertainty as the programme actions are to be taken over a shorter and more immediate timeframe. Further significant estimation uncertainty arises in respect of determining the recoverable amount of assets and the costs to be incurred as part of the programme Significant assumptions have been made including Reassessment of the usefullives of store fixed assets and closure dates Estimation in respect of the expected shorter term trading value in use, including assumptions with regard to the period of trading as well as changes to future sales, gross margin and operating costs. Estimation of the sale proceeds for freehold stores which is dependent upon location specific factors, timing of likely ext and future changes to the UK retail property market valuations Estimation of the value of dilapidation payments required for leasehold store exits, which is dependent on a number of factors including the extent of modifications of the store, the terms of the lease agreement, and the condition of the property Estimation of future contractual lease costs to be incurred including uncertainty with regards to the cost of termination, potential sub-let (including estimation of nature, timing and value including any potential void periods and based on assessment of location specific retail property market factors) See notes 5 and 15 for further detal Property provision The Croup has a number of property provisions totalling 345 8mat 30 March 2019 (ast year: 2333m), which include amounts in respect of onerous leases and subiet shortfalls The net present value of the future onerous leases and sublet shortfails has been provided for based on the contracted future cash flows, assumptions related to sublet income (including for credit risk where it is not included in the underlying cash flow Included within these provisions is a sublet shortfall of 892mfor surplus office space in the Merchant Square building in London, which is sublet for the remaining duration of the lease. The valuation of the provision is sensitive to movements in the discount rate, or to an event of default by the subtenant it an event of default had occurred at 30 March 2019 and no alternative sublet income was assumed the provision would have increased by 65.2m in this event, the Croup would seek alternative subtenants for the property Across all property provisions, an increase in the discount rate of 25bps would decrease the provision by 56m Useful lives and residual values of property, plant and equipment and intangibles Depreciation and amortisation are provided to write down the cost of property, plant and equipment and certain intangibles to their estimated residual values over their estimated useful lives, as set out above. The selection of the residual values and useful lives gives rise to estimation uncertanty especially in the context of changing economic and market techfactors the researc rammes The usefullives of propantandement and intangibles are reviewed by management annually See notes 14 and 15 for further details Refer to the UK store estate section above for specific sources of estimation uncertainty in relation to the useful lives and residual values of property, plant and equipment for stores identified as part of the UK store estate programme NOTES TO THE FINANCIAL STATEMENTS CONTINUED 1 ACCOUNTING POLICIES CONTINUED Key sources of estimation uncertainty continued Impairment of property, plant and equipment and intangibles Property plant and equipment and computer software intangibles are reviewed for impairment if events or changes in circumstances risk adjusted pre-tax discount rate used to discount the assumed cash flows to present value. In calculating the discount rate the Group has taken into account volatility in the inputs to the calculation that are reflective of the market uncertainty for Brexit The assumption that cash flows continue into perpetuity (with the exception of stores identified as part of the UK store estate programme) is a source of significant estimation certainty. A future change to the assumption of trading into perpetuity for any Cash Generating Unit (CCU) would result in a reassessment of useful economic lives and residual value and could give rise to a significant particularly where the store carrying value exceeds fair valueless cost to sell See notes 14 and 15 for further details on the Group's assumptions and associated sensitivities. Post-retirement benefits The determination of pension net interest income and the defined benefit obligation of the Croup's defined benefitpension schemes depends on the selection of certain assumptions which include the discount rate, inflation rate e salary growth, mortality and expected return on pensionables scheme assets. Differences arising from actual experiences or future changes in assumptions will be reflected in subsequent periods. The fair value of unquoted investments within total plan assets is estimated with consideration of fair value estimates provided by the manager of the investment or fund See note 11 for further details on the impact of changes in the key assumptions and estimates

Step by Step Solution

There are 3 Steps involved in it

To address your question about Marks and Spencer plc MS financial statements data lets go through th... View full answer

Get step-by-step solutions from verified subject matter experts