Question: Using zero-profit method (cost recovery), compute the following: How much is the realized profit in 2015 and 2016? How much is the Revenue earned in

Using zero-profit method (cost recovery), compute the following:

Using zero-profit method (cost recovery), compute the following:

How much is the realized profit in 2015 and 2016?

How much is the Revenue earned in 2016?

How much is the CIP net in 2016?

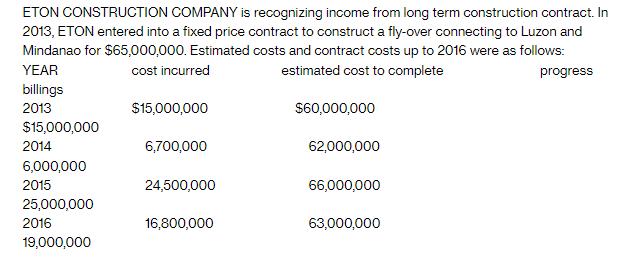

ETON CONSTRUCTION COMPANY is recognizing income from long term construction contract. In 2013, ETON entered into a fixed price contract to construct a fly-over connecting to Luzon and Mindanao for $65,000,000. Estimated costs and contract costs up to 2016 were as follows: YEAR cost incurred estimated cost to complete progress billings 2013 $15,000,000 2014 6,000,000 2015 25,000,000 2016 19,000,000 $15,000,000 6,700,000 24,500,000 16,800,000 $60,000,000 62,000,000 66,000,000 63,000,000

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Calculate the recognized revenue for each year 2013 Revenue Recognized Billings 15000000 2014 Cost Incurred in 2014 6700000 Total Cost Incurred up to ... View full answer

Get step-by-step solutions from verified subject matter experts