Question: UST 425 - Economic Development Finance Extra Credit Assignment You are the economic development director for the city of Newstown. You are approached by a

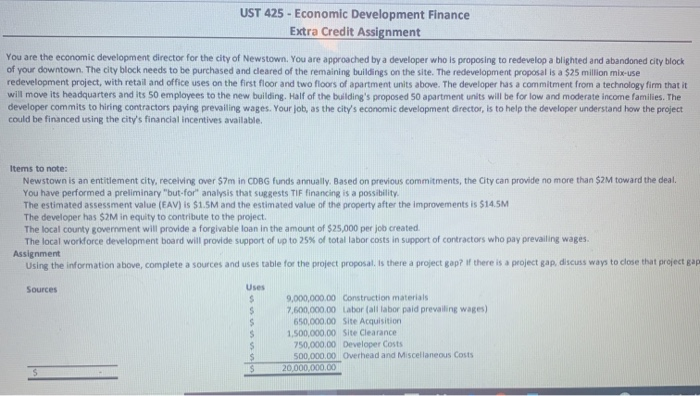

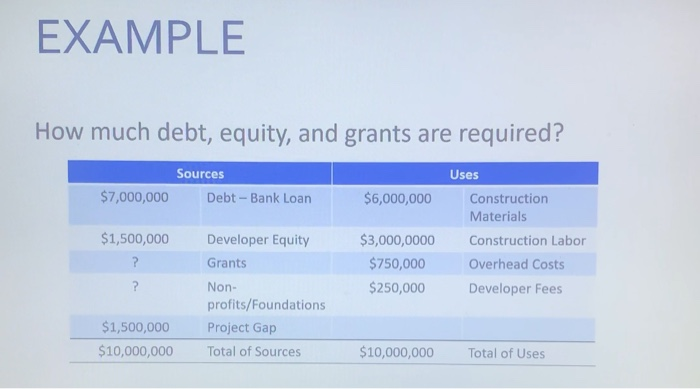

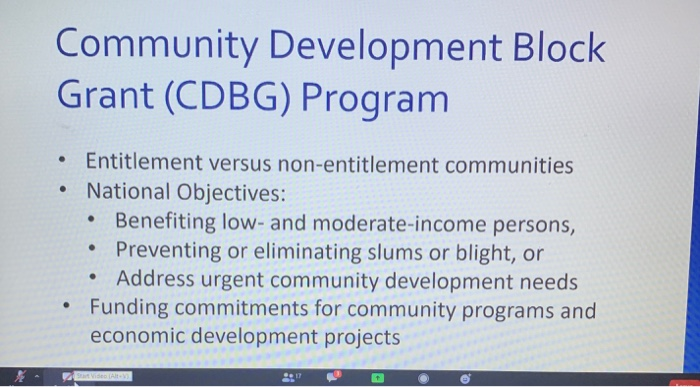

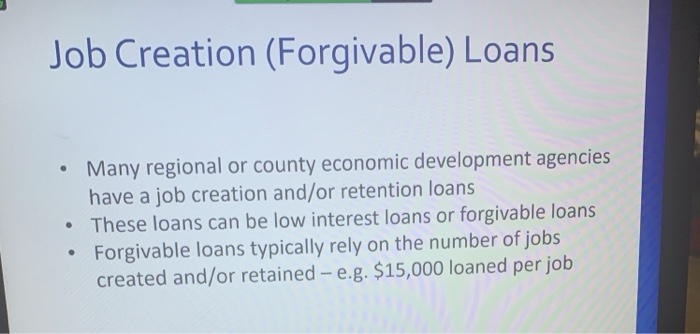

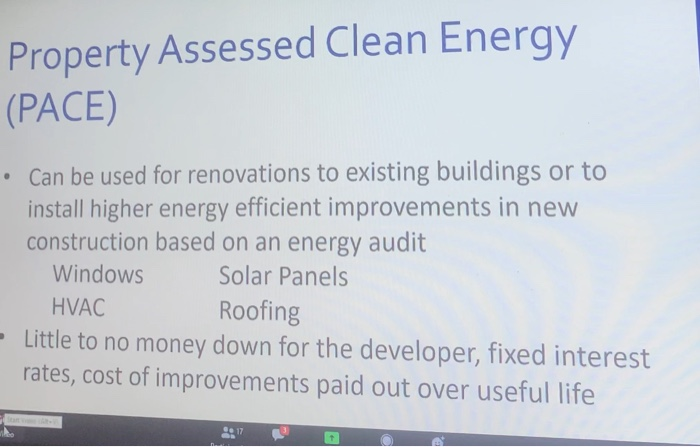

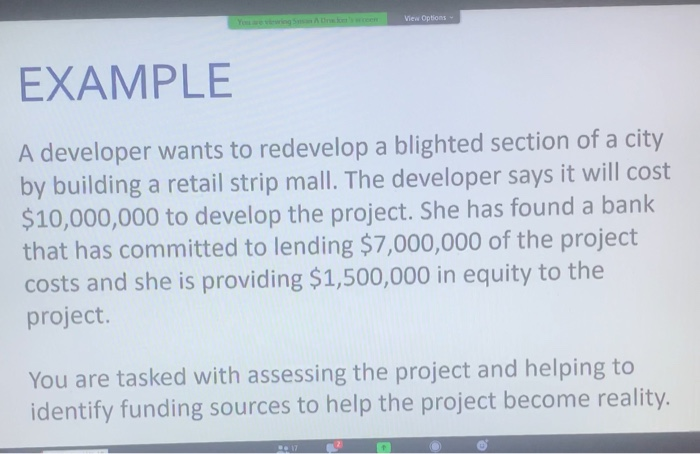

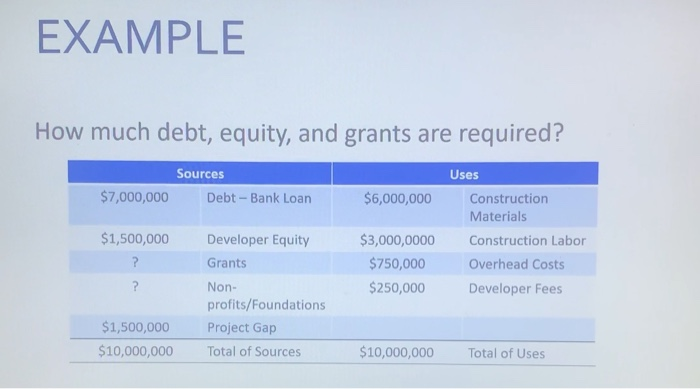

UST 425 - Economic Development Finance Extra Credit Assignment You are the economic development director for the city of Newstown. You are approached by a developer who is proposing to redevelop a blighted and abandoned city block of your downtown. The city block needs to be purchased and cleared of the remaining buildings on the site. The redevelopment proposal is a $25 million mix-use redevelopment project, with retail and office uses on the first floor and two floors of apartment units above. The developer has a commitment from a technology firm that it will move its headquarters and its 50 employees to the new building. Half of the building's proposed 50 apartment units will be for low and moderate income families. The developer commits to hiring contractors paying prevailing wages. Your job, as the city's economic development director, is to help the developer understand how the project could be financed using the city's financial incentives available. Items to note: Newstown is an entitlement city, receiving over $7m in CDBG funds annually. Based on previous commitments, the city can provide no more than $2M toward the deal. You have performed a preliminary "but-for analysis that suggests TIF financing is a possibility The estimated assessment value (EAV) is $1.5M and the estimated value of the property after the improvements is $14.5M The developer has $2M in equity to contribute to the project. The local county government will provide a forgivable loan in the amount of $25,000 per job created. The local workforce development board will provide support of up to 25% of total labor costs in support of contractors who pay prevailing wages. Assignment Using the information above, complete a sources and uses table for the project proposal. Is there a project op? if there is a project gap, discuss ways to close that project gap Sources Uses S S $ $ $ S 9,000,000.00 Construction materials 7,600,000.00 Labor (all labor paid prevailing wages) 650,000.00 Site Acquisition 1,500,000.00 Site Clearance 750.000,00 Developer Costs 500,000.00 Overhead and Miscellaneous Costs 20,000,000.00 EXAMPLE How much debt, equity, and grants are required? $7,000,000 Sources Debt - Bank Loan $6,000,000 $1,500,000 ? $3,000,0000 $750,000 $250,000 Uses Construction Materials Construction Labor Overhead Costs Developer Fees Developer Equity Grants Non- profits/Foundations Project Gap Total of Sources ? $1,500,000 $10,000,000 $10,000,000 Total of Uses Community Development Block Grant (CDBG) Program . Entitlement versus non-entitlement communities National Objectives: Benefiting low- and moderate-income persons, Preventing or eliminating slums or blight, or Address urgent community development needs Funding commitments for community programs and economic development projects . Job Creation (Forgivable) Loans Many regional or county economic development agencies have a job creation and/or retention loans These loans can be low interest loans or forgivable loans Forgivable loans typically rely on the number of jobs created and/or retained - e.g. $15,000 loaned per job Property Assessed Clean Energy (PACE) Can be used for renovations to existing buildings or to install higher energy efficient improvements in new construction based on an energy audit Windows Solar Panels HVAC Roofing - Little to no money down for the developer, fixed interest rates, cost of improvements paid out over useful life View Options EXAMPLE A developer wants to redevelop a blighted section of a city by building a retail strip mall. The developer says it will cost $10,000,000 to develop the project. She has found a bank that has committed to lending $7,000,000 of the project costs and she is providing $1,500,000 in equity to the project. You are tasked with assessing the project and helping to identify funding sources to help the project become reality. EXAMPLE How much debt, equity, and grants are required? $7,000,000 Sources Debt - Bank Loan $6,000,000 $1,500,000 ? Developer Equity Grants Non profits/Foundations Project Gap Total of Sources $3,000,0000 $750,000 $250,000 Uses Construction Materials Construction Labor Overhead Costs Developer Fees ? $1,500,000 $10,000,000 $10,000,000 Total of Uses UST 425 - Economic Development Finance Extra Credit Assignment You are the economic development director for the city of Newstown. You are approached by a developer who is proposing to redevelop a blighted and abandoned city block of your downtown. The city block needs to be purchased and cleared of the remaining buildings on the site. The redevelopment proposal is a $25 million mix-use redevelopment project, with retail and office uses on the first floor and two floors of apartment units above. The developer has a commitment from a technology firm that it will move its headquarters and its 50 employees to the new building. Half of the building's proposed 50 apartment units will be for low and moderate income families. The developer commits to hiring contractors paying prevailing wages. Your job, as the city's economic development director, is to help the developer understand how the project could be financed using the city's financial incentives available. Items to note: Newstown is an entitlement city, receiving over $7m in CDBG funds annually. Based on previous commitments, the city can provide no more than $2M toward the deal. You have performed a preliminary "but-for analysis that suggests TIF financing is a possibility The estimated assessment value (EAV) is $1.5M and the estimated value of the property after the improvements is $14.5M The developer has $2M in equity to contribute to the project. The local county government will provide a forgivable loan in the amount of $25,000 per job created. The local workforce development board will provide support of up to 25% of total labor costs in support of contractors who pay prevailing wages. Assignment Using the information above, complete a sources and uses table for the project proposal. Is there a project op? if there is a project gap, discuss ways to close that project gap Sources Uses S S $ $ $ S 9,000,000.00 Construction materials 7,600,000.00 Labor (all labor paid prevailing wages) 650,000.00 Site Acquisition 1,500,000.00 Site Clearance 750.000,00 Developer Costs 500,000.00 Overhead and Miscellaneous Costs 20,000,000.00 EXAMPLE How much debt, equity, and grants are required? $7,000,000 Sources Debt - Bank Loan $6,000,000 $1,500,000 ? $3,000,0000 $750,000 $250,000 Uses Construction Materials Construction Labor Overhead Costs Developer Fees Developer Equity Grants Non- profits/Foundations Project Gap Total of Sources ? $1,500,000 $10,000,000 $10,000,000 Total of Uses Community Development Block Grant (CDBG) Program . Entitlement versus non-entitlement communities National Objectives: Benefiting low- and moderate-income persons, Preventing or eliminating slums or blight, or Address urgent community development needs Funding commitments for community programs and economic development projects . Job Creation (Forgivable) Loans Many regional or county economic development agencies have a job creation and/or retention loans These loans can be low interest loans or forgivable loans Forgivable loans typically rely on the number of jobs created and/or retained - e.g. $15,000 loaned per job Property Assessed Clean Energy (PACE) Can be used for renovations to existing buildings or to install higher energy efficient improvements in new construction based on an energy audit Windows Solar Panels HVAC Roofing - Little to no money down for the developer, fixed interest rates, cost of improvements paid out over useful life View Options EXAMPLE A developer wants to redevelop a blighted section of a city by building a retail strip mall. The developer says it will cost $10,000,000 to develop the project. She has found a bank that has committed to lending $7,000,000 of the project costs and she is providing $1,500,000 in equity to the project. You are tasked with assessing the project and helping to identify funding sources to help the project become reality. EXAMPLE How much debt, equity, and grants are required? $7,000,000 Sources Debt - Bank Loan $6,000,000 $1,500,000 ? Developer Equity Grants Non profits/Foundations Project Gap Total of Sources $3,000,0000 $750,000 $250,000 Uses Construction Materials Construction Labor Overhead Costs Developer Fees ? $1,500,000 $10,000,000 $10,000,000 Total of Uses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts