Question: ust Choose The Correct Answer. No Further Explanation Needed 1) As of December 6, 2017, BIC/USD 6) Which of following is true: - a) NPV

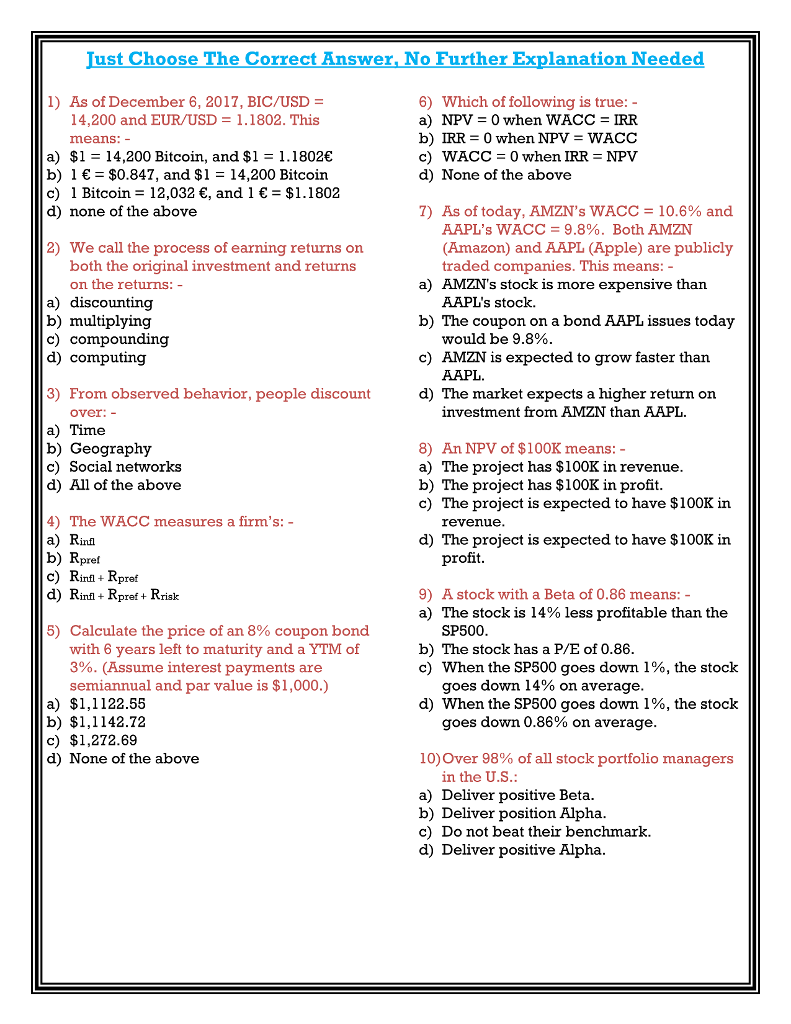

ust Choose The Correct Answer. No Further Explanation Needed 1) As of December 6, 2017, BIC/USD 6) Which of following is true: - a) NPV = 0 when WACC-IRR b) IRR = 0 when NPV = WACC c) WACC - 0 when IRR- NPV d) None of the above 14,200 and EUR/USD 1.1802. This means: a) $1 14,200 Bitcoin, and $1 = 1. 1802 b) 1- $0.847, and $1 - 14,200 Bitcoin c) I Bitcoin = 12,032 , and I -$1.1802 d) none of the above 7) As of today, AMZN's WACC-10.6% and AAPL's WACC = 9.8%. Both AMZN 2) We call the process of earning returns on (Amazon) and AAPL (Apple) are publicly both the original investment and returns traded companies. This means: - a) AMZN's stock is more expensive than on the returns a) discounting b) multiplying c) compounding d) computing AAPLi's stock. b) The coupon on a bond AAPL issues today would be 9.8%. c) AMZN is expected to grow faster than AAPL. d) The market expects a higher return on 3) From observed behavior, people discount over:- investment from AMZN than AAPL. a) Time b) Geography c) Social networks d) All of the above 8) An NPV of $100K means: - a) The project has $100K in revenue b) The project has $100K in profit c) The project is expected to have $100K in 4) The WACC measures a firm's: - revenue infl d) The project is expected to have $100K in pref profit c RinRpref d) Rinl+Rpref+ Rrisk 9) A stock with a Beta of 0.86 means: - a) The stock is 14% less profitable than the SP500 b) The stock has a P/E of 0.86 c) When the SP500 goes down 1%, the stock 5) Calculate the price of an 8% coupon bond with 6 years left to maturity and a YTM of 3%. (Assume interest payments are semiannual and par value is $1,000.) a) $1,1122.55 b) $1,1142.72 c) $1,272.69 d) None of the above goes down 14% on average d) when the SP500 goes down 1%, the stock goes down 0.86% on average 10) Over 98% of all stock portfolio managers in the U.S.: a) Deliver positive Beta b) Deliver position Alpha c) Do not beat their benchmark. d) Deliver positive Alpha

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts