Question: USU 1. The contribution margin at the breakeven point equals: a. zero b. sales. c. variable costs plus fixed costs. d. variable costs. e. fixed

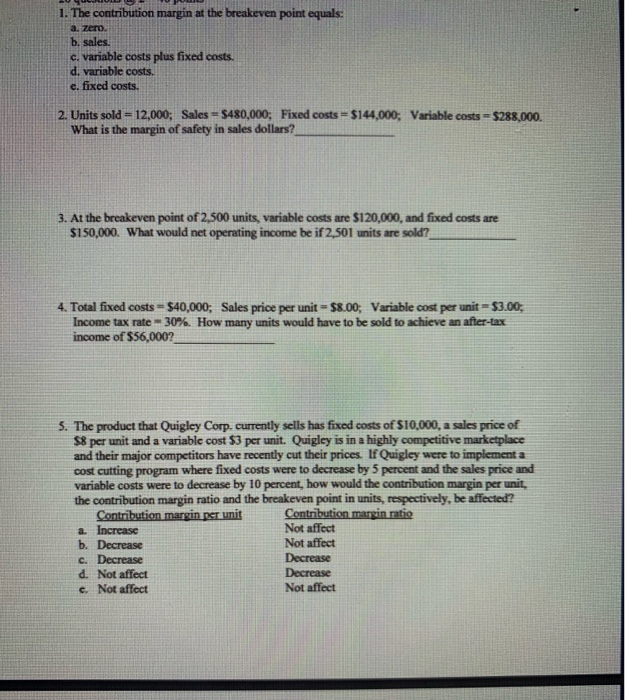

USU 1. The contribution margin at the breakeven point equals: a. zero b. sales. c. variable costs plus fixed costs. d. variable costs. e. fixed costs. 2. Units sold = 12,000; Sales = $480,000; Fixed costs = $144,000, Variable costs = $288,000. What is the margin of safety in sales dollars? 3. At the breakeven point of 2,500 units, variable costs are $120,000, and fixed costs are $150,000. What would net operating income be if 2,501 units are sold? 4. Total fixed costs = $40,000; Sales price per unit = $8.00 Variable cost per unit = $3.00, Income tax rate - 30%. How many units would have to be sold to achieve an after-tax income of $56,000? 5. The product that Quigley Corp. currently sells has fixed costs of $10,000, a sales price of 88 per unit and a variable cost $3 per unit. Quigley is in a highly competitive marketplace and their major competitors have recently cut their prices. If Quigley were to implement a cost cutting program where fixed costs were to decrease by 5 percent and the sales price and variable costs were to decrease by 10 percent, how would the contribution margin per unit the contribution margin ratio and the breakeven point in units, respectively, be affected? Contribution margin per unit Contribution margin ratio a. Increase Not affect b. Decrease Not affect c. Decrease Decrease d. Not affect Decrease c. Not affect Not affect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts