Question: Usually, core RNOA is defined as Core operating income/NOA. But, in this case, Bill plc has been able to generate increasing operating income in

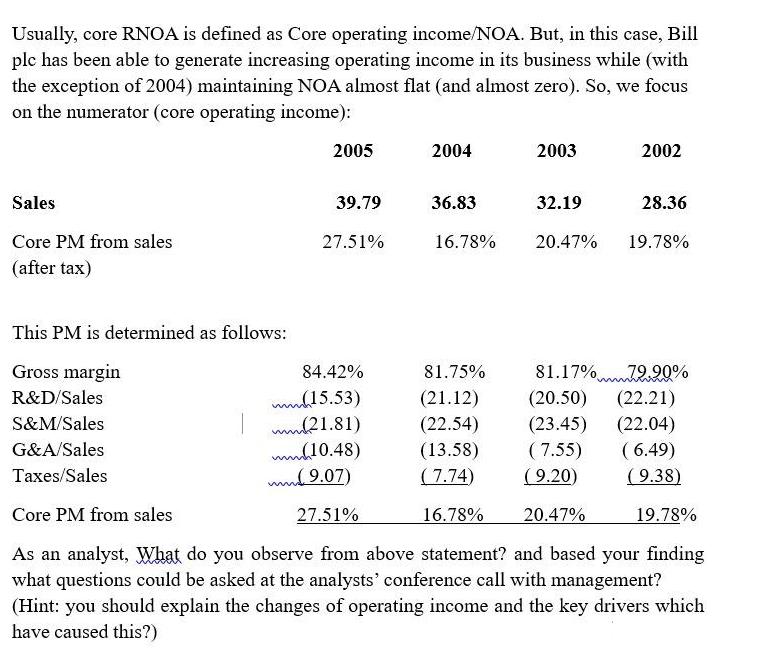

Usually, core RNOA is defined as Core operating income/NOA. But, in this case, Bill plc has been able to generate increasing operating income in its business while (with the exception of 2004) maintaining NOA almost flat (and almost zero). So, we focus on the numerator (core operating income): 2005 2004 2003 2002 Sales 39.79 36.83 32.19 28.36 Core PM from sales 27.51% 16.78% 20.47% 19.78% (after tax) This PM is determined as follows: Gross margin 84.42% 81.75% 81.17% 79.90% R&D/Sales mm(15.53) (21.12) (20.50) (22.21) S&M/Sales ww(21.81) (22.54) (23.45) (22.04) G&A/Sales mm(10.48) (13.58) (7.55) (6.49) Taxes/Sales (9.07) (7.74) (9.20) (9.38) Core PM from sales 27.51% 16.78% 20.47% 19.78% As an analyst, What do you observe from above statement? and based your finding what questions could be asked at the analysts' conference call with management? (Hint: you should explain the changes of operating income and the key drivers which have caused this?)

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Key observations Key observations Sales have increased significantly over ... View full answer

Get step-by-step solutions from verified subject matter experts