Question: ut {0} Homework: Lab #2 Question 16, Problem 9-17b > HW Score: 32.68%, 17.65 of 54 points Points: 0 of 4 Save Fin You are

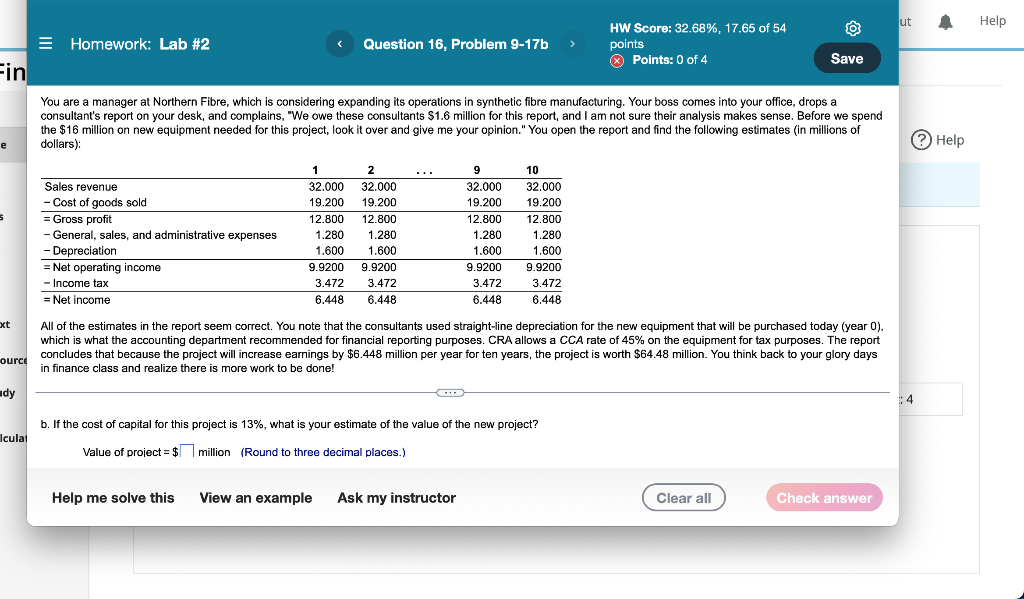

ut {0} Homework: Lab #2 Question 16, Problem 9-17b > HW Score: 32.68%, 17.65 of 54 points Points: 0 of 4 Save Fin You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.6 million for this report, and I am not sure their analysis makes sense. Before we spend the $16 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): (?) Help e 1 2 9 10 Sales revenue 32.000 32.000 32.000 32.000 19.200 19.200 - Cost of goods sold 19.200 19.200 5 = Gross profit 12.800 12.800 12.800 12.800 - General, sales, and administrative expenses 1.280 1.280 1.280 1.280 - Depreciation 1.600 1.600 1.600 1.600 = Net operating income 9.9200 9.9200 9.9200 9.9200 - Income tax 3.472 3.472 3.472 3.472 = Net income 6.448 6.448 6.448 6.448 xt All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today (year 0), which is what the accounting department recommended for financial reporting purposes. CRA allows a CCA rate of 45% on the equipment for tax purposes. The report concludes that because the project will increase earnings by $6.448 million per year for ten years, the project is worth $64.48 million. You think back to your glory days in finance class and realize there is more work to be done! ource dy #4 b. If the cost of capital for this project is 13%, what is your estimate of the value of the new project? Iculat Value of project = $ million (Round to three decimal places.) Help me solve this View an example Ask my instructor Clear all Check answer Help ut {0} Homework: Lab #2 Question 16, Problem 9-17b > HW Score: 32.68%, 17.65 of 54 points Points: 0 of 4 Save Fin You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.6 million for this report, and I am not sure their analysis makes sense. Before we spend the $16 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): (?) Help e 1 2 9 10 Sales revenue 32.000 32.000 32.000 32.000 19.200 19.200 - Cost of goods sold 19.200 19.200 5 = Gross profit 12.800 12.800 12.800 12.800 - General, sales, and administrative expenses 1.280 1.280 1.280 1.280 - Depreciation 1.600 1.600 1.600 1.600 = Net operating income 9.9200 9.9200 9.9200 9.9200 - Income tax 3.472 3.472 3.472 3.472 = Net income 6.448 6.448 6.448 6.448 xt All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today (year 0), which is what the accounting department recommended for financial reporting purposes. CRA allows a CCA rate of 45% on the equipment for tax purposes. The report concludes that because the project will increase earnings by $6.448 million per year for ten years, the project is worth $64.48 million. You think back to your glory days in finance class and realize there is more work to be done! ource dy #4 b. If the cost of capital for this project is 13%, what is your estimate of the value of the new project? Iculat Value of project = $ million (Round to three decimal places.) Help me solve this View an example Ask my instructor Clear all Check answer Help

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts