Question: UTease comprehensive question i Saved Help Save & Exit Check my 5 Actual selling allu administrative CUSis In addition, all over- or underapplied overhead and

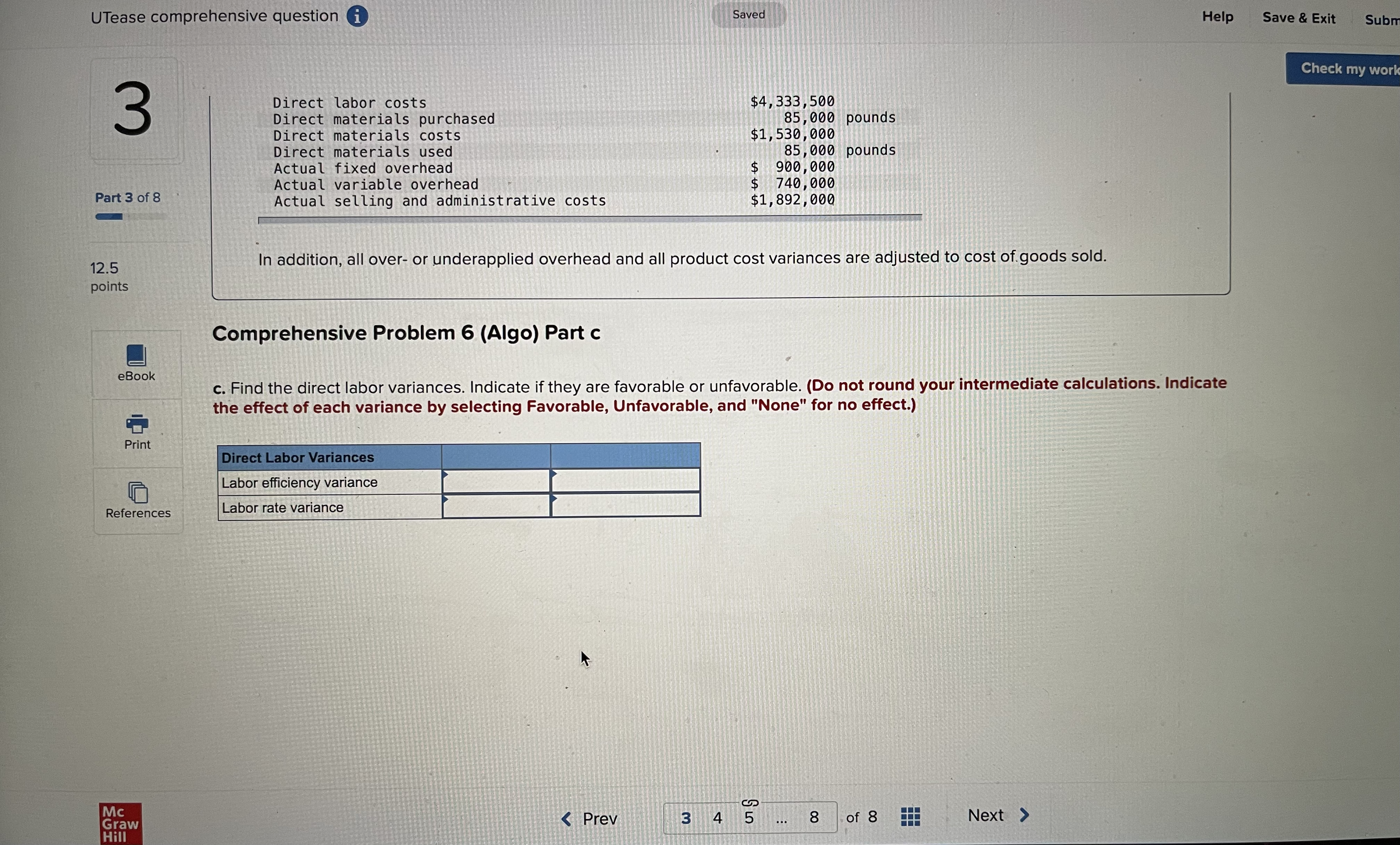

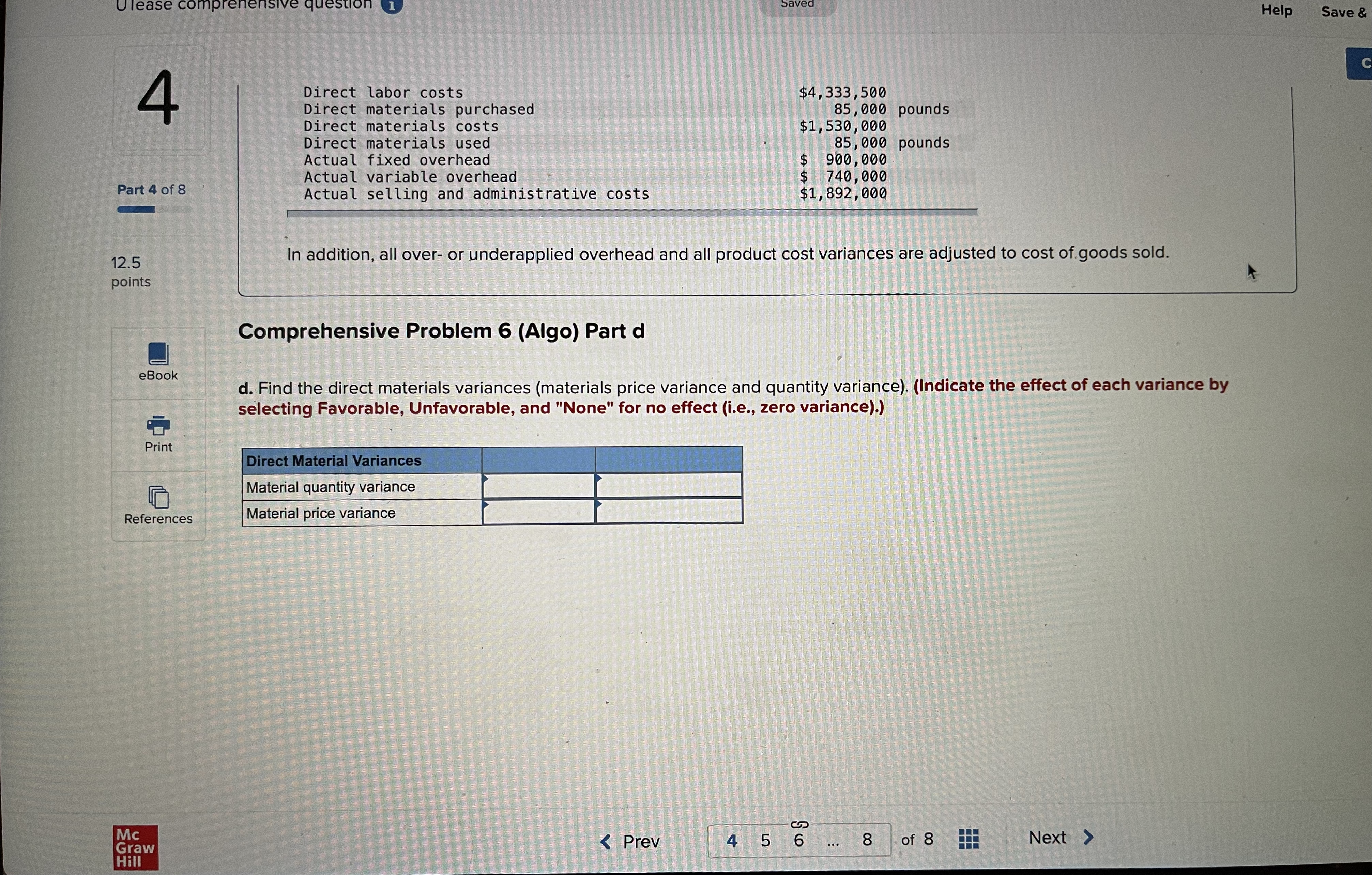

UTease comprehensive question i Saved Help Save & Exit Check my 5 Actual selling allu administrative CUSis In addition, all over- or underapplied overhead and all product cost variances are adjusted to cost of goods sold. Part 5 of 8 Comprehensive Problem 6 (Algo) Part e 12.5 points e-1. Find the total over- or underapplied (both fixed and variable) overhead. e-2. Would cost of goods sold be a larger or smaller expense item after the adjustment for over- or underapplied overhead? Complete this question by entering your answers in the tabs below. eBook Req E1 Req E2 Print Find the total over- or underapplied (both fixed and variable) overhead. References overhead 5 Check my work Actual selling and administrative costs $1, 892, 600 In addition, all over- or underapplied overhead and all product cost variances are adjusted to cost of goods sold. Part 5 of 8 Comprehensive Problem 6 (Algo) Part e 12.5 points e-1. Find the total over- or underapplied (both fixed and variable) overhead. e-2. Would cost of goods sold be a larger or smaller expense item after the adjustment for over- or underapplied overhead? eBook Complete this question by entering your answers in the tabs below. Req E1 Req E2 Print Would cost of goods sold be a larger or smaller expense item after the adjustment for over- or underapplied overhead? References Would cost of goods sold be a larger or smaller expense item? Req E1 Req E2 Mc 5 6 7 8 of 8 Next > Graw Prev 1 2 ... Mc GrawChe 8 Expected sales activity: 24,000 units at $500 per unit Desired ending inventories: 16% of sales Assume this is the first year of operations for the Dubuque plant. During the year, the company had the following activity. Part 8 of 8 Units produced 27,000 Units sold 25 , 500 Unit selling price 495 12.5 Direct labor hours worked 53, 500 points Direct labor costs $4, 333, 500 Direct materials purchased 85, 000 pounds Direct materials costs $1, 530, 000 Direct materials used 85 , 000 pounds Actual fixed overhead 900, 000 TA TA Actual variable overhead 740, 000 eBook Actual selling and administrative costs $1, 892, 000 Print In addition, all over- or underapplied overhead and all product cost variances are adjusted to cost of goods sold. References Comprehensive Problem 6 (Algo) Part i i. Assume that under the investment center evaluation plan the plant manager will be awarded a bonus based on ROI. If the manager has the opportunity in the coming year to invest in new equipment for $700,000 that will generate incremental earnings of $65,000 per year, would the manager undertake the project? Yes No Mc Graw UTease comprehensive question i Check Units produced 27, 000 Units sold 25 , 500 Unit selling price 495 Direct labor hours worked 53 , 500 Direct labor costs $4, 333, 500 Part 7 of 8 Direct materials purchased 85, 000 pounds Direct materials costs $1, 530, 000 Direct materials used 85, 000 pounds Actual fixed overhead 900, 000 12.5 Actual variable overhead 740, 000 points Actual selling and administrative costs $1, 892, 000 In addition, all over- or underapplied overhead and all product cost variances are adjusted to cost of goods sold. eBook Comprehensive Problem 6 (Algo) Part h Print h. Assume Utease Corporation is planning to change its evaluation of business operations in all plants from the profit center format to the investment center format. If the average invested capital at the Dubuque plant is $9,290,000, compute the return on investment References (ROI) for the first year of operations. Use the DuPont method of evaluation to compute the return on sales (ROS) and capital turnover (CT) for the plant. (Round your percentage answers to 2 decimal places (i.e., 0.1234 should be considered as 12.34.)) ROI % ROS % Capital turnover % Mc 6 Expected sales activity: 24,000 units at $500 per unit Desired ending inventories: 16% of sales Part 6 of 8 Assume this is the first year of operations for the Dubuque plant. During the year, the company had the following activity. Units produced 27 , 000 12.5 Units sold 25 , 500 points Unit selling price 495 Direct labor hours worked 53 , 500 Direct labor costs $4, 333 , 500 Direct materials purchased 85, 000 pounds Direct materials costs 30 , 000 Direct materials used 85, 000 pounds eBook Actual fixed overhead 900, 000 tA tA Actual variable overhead 740 , 000 Actual selling and administrative costs $1, 892 , 000 Print In addition, all over- or underapplied overhead and all product cost variances are adjusted to cost of goods sold. References Comprehensive Problem 6 (Algo) Part f f. Calculate the actual plant operating profit/loss for the year. Operating profit Mc UTease comprehensive question i Che 2 mutual val LauLE UVEllItau I TU , JUU Actual selling and administrative costs $1, 892, 000 In addition, all over- or underapplied overhead and all product cost variances are adjusted to cost of goods sold. Part 2 of 8 Comprehensive Problem 6 (Algo) Part b 12.5 points b. Prepare a budgeted responsibility income statement for the Dubuque plant for the coming year. DUBUQUE PLANT eBook Budgeted Income Statement Upcoming Year Ending December 31 Print $ 0 Operating expenses: References Total operating expenses 0 0 Mc Graw B eztomheducationcom I iLii I, M Assignment Print View Comprehensive Problem 6 (Algo) [The follow9 information applies to the questions displayed below] Utease Corporation has several production plants nationwide A newly opened plant In Dubuque produces and sells one product. The plant' Is treated for responsibility accounting purposes as a prot center. Tl-I standard costs for a production unit, with overhead applied based on direct labor hours, are as follows Manufacturing costs (perunit based on expected activity of28,000 units or 56,000 direct labor hours): Direct materials (3.0 pounds at $18) $ 54.00 Direct labor (2.0 hours at $80) 160.00 Variable overhead (2.0 hours at $15) 30.00 Fixed overhead (2.0 hours at $25) 50.00 Standard cost per unit $ 294.00 Budgeted selling and administrative costs: Variable $ 8 per unit i-'Ixed $1.200,000 In.\" ,t Expected sales activity 24,000 units at $500 per unit Desired ending inventories: 16% of sales Assume this is the rst year of operations for the Dubuque plant. During the year. the company had the following activity, 27,000 25,500 $ 495 53,500 $ 4.333.500 85,000 $ 1,530,000 $ $ $ Units produced Units sold Unit selling price Direct labor hours worked Direct labor costs Direct materials purchased Direct materials costs Direct materials used Actual xed overhead Actual variable overhead Actual selling and administrative costs 85,000 900,000 740,000 1,892,000 In addition, all over- or underapplied overhead and all product cost variances are adjusted to cost of goods sold. UTease comprehensive question i Saved Help Save & Exit Subn Check my work 3 Direct labor costs $4, 333 , 500 Direct materials purchased 85, 000 pounds Direct materials costs $1, 530, 000 Direct materials used 85, 000 pounds Actual fixed overhead 900 , 000 Actual variable overhead 740, 000 Part 3 of 8 Actual selling and administrative costs $1, 892, 000 12.5 In addition, all over- or underapplied overhead and all product cost variances are adjusted to cost of goods sold. points Comprehensive Problem 6 (Algo) Part c eBook c. Find the direct labor variances. Indicate if they are favorable or unfavorable. (Do not round your intermediate calculations. Indicate the effect of each variance by selecting Favorable, Unfavorable, and "None" for no effect.) Print Direct Labor Variances Labor efficiency variance References Labor rate variance Mc Graw U lease comp Help Save & 4 Direct labor costs $4, 333 , 500 Direct materials purchased 85, 000 pounds Direct materials costs $1, 530, 000 Direct materials used 85 , 000 pounds Actual fixed overhead 900, 000 Actual variable overhead 740, 000 Part 4 of 8 Actual selling and administrative costs $1, 892, 000 12.5 In addition, all over- or underapplied overhead and all product cost variances are adjusted to cost of goods sold. points Comprehensive Problem 6 (Algo) Part d eBook d. Find the direct materials variances (materials price variance and quantity variance). (Indicate the effect of each variance by selecting Favorable, Unfavorable, and "None" for no effect (i.e., zero variance).) Print Direct Material Variances Material quantity variance References Material price variance Mc Graw

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts