Question: Utilize the reading material below: After utilizing the reading material above. What are some possible ways that corporate accountants might be able to change their

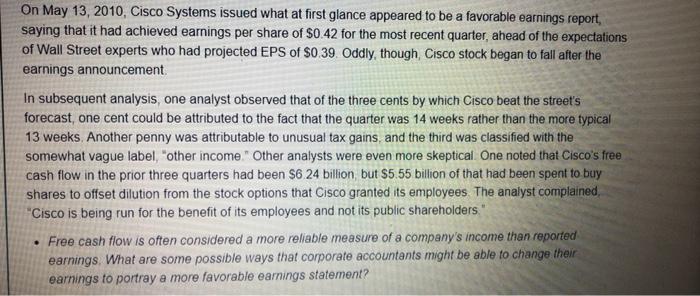

On May 13, 2010, Cisco Systems issued what at first glance appeared to be a favorable earnings report, saying that it had achieved earnings per share of $0.42 for the most recent quarter, ahead of the expectations of Wall Street experts who had projected EPS of $0.39. Oddly, though, Cisco stock began to fall after the earnings announcement In subsequent analysis, one analyst observed that of the three cents by which Cisco beat the street's forecast, one cent could be attributed to the fact that the quarter was 14 weeks rather than the more typical 13 weeks. Another penny was attributable to unusual tax gains, and the third was classified with the somewhat vague label, other income. Other analysts were even more skeptical One noted that Cisco's free cash flow in the prior three quarters had been $6 24 billion but $5.55 billion of that had been spent to buy shares to offset dilution from the stock options that Cisco granted its employees The analyst complained "Cisco is being run for the benefit of its employees and not its public shareholders." Free cash flow is often considered a more reliable measure of a company's income than reported earnings. What are some possible ways that corporate accountants might be able to change their earnings to portray a more favorable earnings statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts