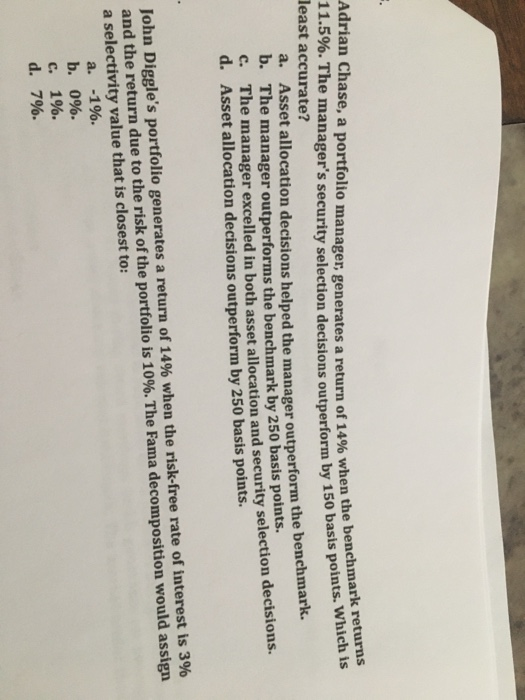

Question: utperform by 150 basis points. Which is Adrian Chase, a portfolio manager, generates a return of 1 11.5%. The manager's security selection decisions outperform by

utperform by 150 basis points. Which is Adrian Chase, a portfolio manager, generates a return of 1 11.5%. The manager's security selection decisions outperform by 150 wa anager, generates a return of 14% when the benchmark returns least accurate? a. Asset allocation decisions helped the manager outperform the bence b. The manager outperforms the benchmark by 250 basis points. c. The manager excelled in both asset allocation and security selection de d. Asset allocation decisions outperform by 250 basis points. John Diggle's portfolio generates a return of 14% when the risk-free rate of interest is 3% and the return due to the risk of the portfolio is 10%. The Fama decomposition would assign a selectivity value that is closest to: a. -1%. b. 0%. c. 1%. d. 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts