Question: UUSING FORMULA PLZ Problem 11-10 (algorithmic) Question Help A nationwide motel chain is considering locating a new motel in Bigtown, USA. The cost of building

UUSING FORMULA PLZ

UUSING FORMULA PLZ

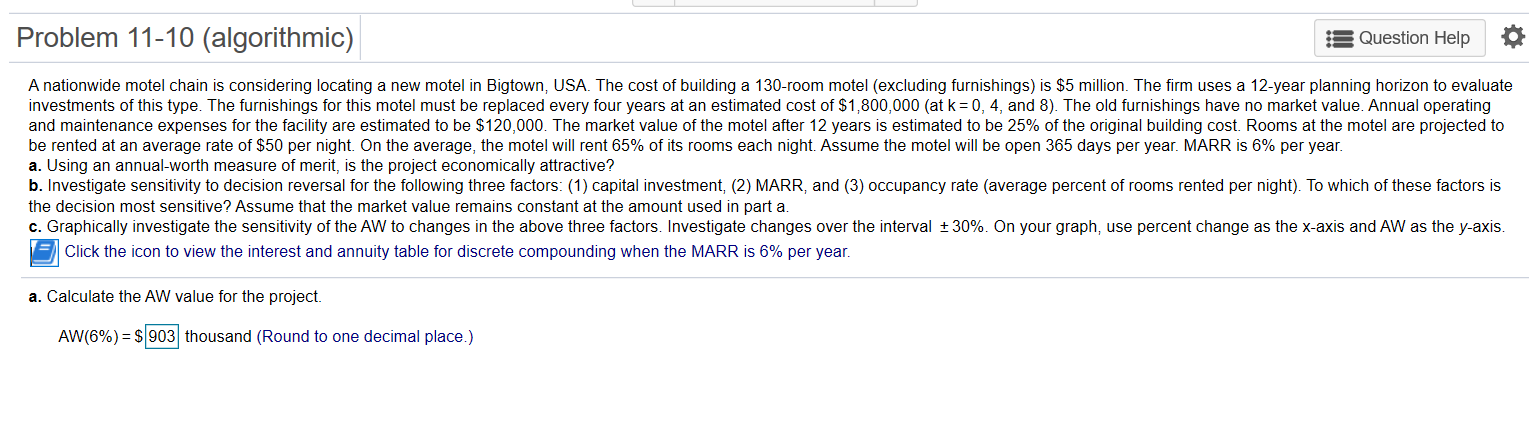

Problem 11-10 (algorithmic) Question Help A nationwide motel chain is considering locating a new motel in Bigtown, USA. The cost of building a 130-room motel (excluding furnishings) is $5 million. The firm uses a 12-year planning horizon to evaluate investments of this type. The furnishings for this motel must be replaced every four years at an estimated cost of $1,800,000 (at k = 0, 4, and 8). The old furnishings have no market value. Annual operating and maintenance expenses for the facility are estimated to be $120,000. The market value of the motel after 12 years is estimated to be 25% of the original building cost. Rooms at the motel are projected to be rented at an average rate of $50 per night. On the average, the motel will rent 65% of its rooms each night. Assume the motel will be open 365 days per year. MARR is 6% per year. a. Using an annual-worth measure of merit, is the project economically attractive? b. Investigate sensitivity to decision reversal for the following three factors: (1) capital investment, (2) MARR, and (3) occupancy rate (average percent of rooms rented per night). To which of these factors is the decision most sensitive? Assume that the market value remains constant at the amount used in part a. c. Graphically investigate the sensitivity of the AW to changes in the above three factors. Investigate changes over the interval + 30%. On your graph, use percent change as the x-axis and AW as the y-axis. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 6% per year. a. Calculate the AW value for the project. AW(6%) = $903 thousand (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts