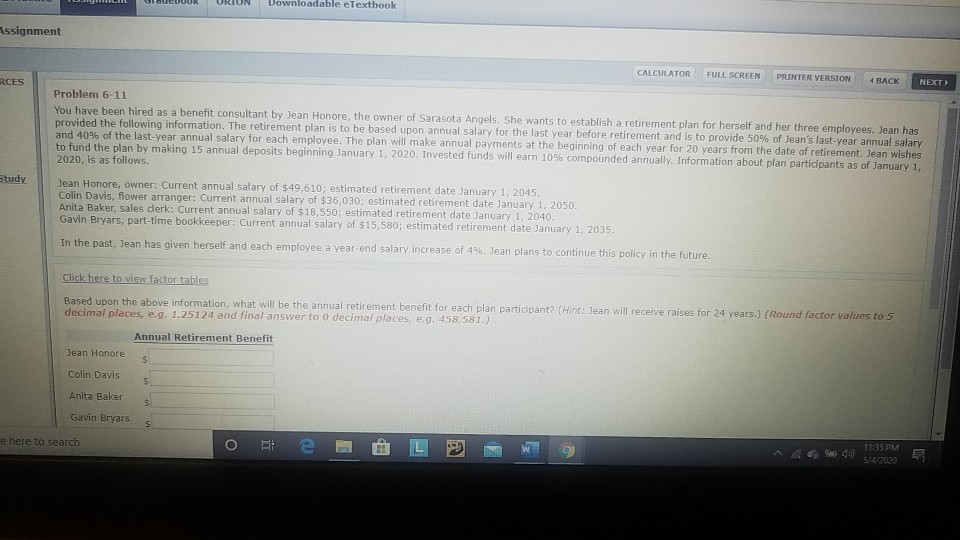

Question: UUUUUR URIUN Downloadable eTextbook Assignment CALCULATOR FULL SCREEN PRINTER VERSION RCES NEXT Problem 6-11 You have been hired as a benefit consultant by Jean Honore,

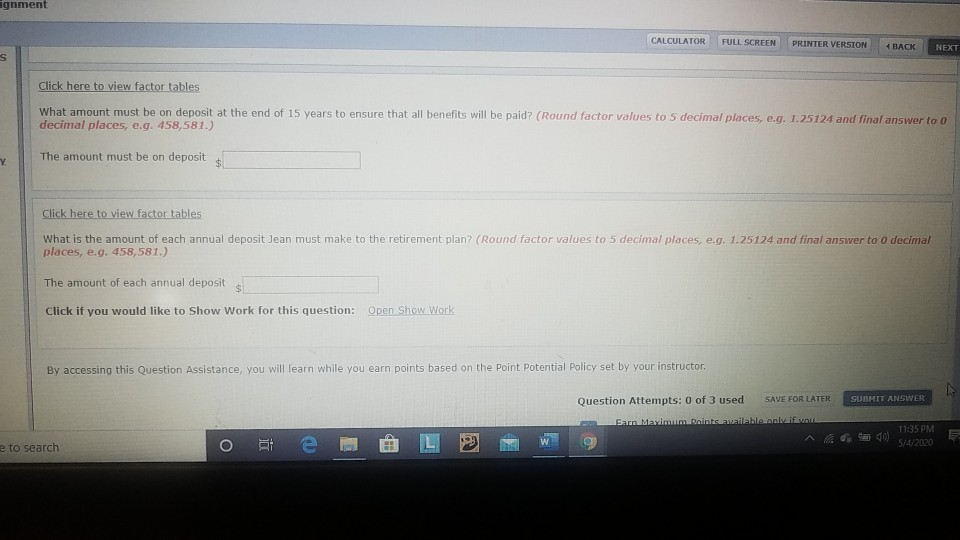

UUUUUR URIUN Downloadable eTextbook Assignment CALCULATOR FULL SCREEN PRINTER VERSION RCES NEXT Problem 6-11 You have been hired as a benefit consultant by Jean Honore, the owner of Sarasota Angels. She wants to establish a retirement plan for herself and her three employees. Jean has provided the following information. The retirement plan is to be based upon annual salary for the last year before retirement and is to provide 50% of Jean's last year annual salary and 40% of the last year annual salary for each employee. The plan will make annual payments at the beginning of each year for 20 years from the date of retirement. Jean wishes to fund the plan by making 15 annual deposits beginning January 1, 2020. Invested funds will earn 10% compounded annually. Information about plan participants as of January 1, 2020, is as follows. Study Jean Honore, owner: Current annual salary of $49,610; estimated retirement date January 1, 2045 Colin Davis, flower arranger: Current annual salary of $36,030; estimated retirement date January 1, 2050. Anita Baker, sales derk: Current annual salary of $18,550; estimated retirement date January 1, 2040. Gavin Bryars, part-time bookkeeper: Current annual salary of $15,580; estimated retirement date January 1, 2035. In the past, Jean has given herself and each employee a year-end salary increase of 4%. Jean plans to continue this policy in the future. Click here to view factor tables Based upon the above information, what will be the annual retirement benefit for each plan participant? (Hint: Jean will receive raises for 24 years.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to o decimal places, e.g. 458,581.) Annual Retirement Benefit Jean Honore Colin Davis Anita Baker Gavin Bryars e here to search o te @ LW E S 10 514/2020 ignment CALCULATOR FULL SCREEN PRINTER VERSION BACK NEXT Click here to view factor tables What amount must be on deposit at the end of 15 years to ensure that all benefits will be paid? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) The amount must be on deposit $ Click here to view factor tables What is the amount of each annual deposit Jean must make to the retirement plan? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to o decimal places, e.g. 458,581.) The amount of each annual deposit Click if you would like to Show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. SUBMIT ANSWER Question Attempts: 0 of 3 used SAVE FOR LATER Sarn Maximum Boints available onli n e a 11:35 PM 5/4/2020 e to search UUUUUR URIUN Downloadable eTextbook Assignment CALCULATOR FULL SCREEN PRINTER VERSION RCES NEXT Problem 6-11 You have been hired as a benefit consultant by Jean Honore, the owner of Sarasota Angels. She wants to establish a retirement plan for herself and her three employees. Jean has provided the following information. The retirement plan is to be based upon annual salary for the last year before retirement and is to provide 50% of Jean's last year annual salary and 40% of the last year annual salary for each employee. The plan will make annual payments at the beginning of each year for 20 years from the date of retirement. Jean wishes to fund the plan by making 15 annual deposits beginning January 1, 2020. Invested funds will earn 10% compounded annually. Information about plan participants as of January 1, 2020, is as follows. Study Jean Honore, owner: Current annual salary of $49,610; estimated retirement date January 1, 2045 Colin Davis, flower arranger: Current annual salary of $36,030; estimated retirement date January 1, 2050. Anita Baker, sales derk: Current annual salary of $18,550; estimated retirement date January 1, 2040. Gavin Bryars, part-time bookkeeper: Current annual salary of $15,580; estimated retirement date January 1, 2035. In the past, Jean has given herself and each employee a year-end salary increase of 4%. Jean plans to continue this policy in the future. Click here to view factor tables Based upon the above information, what will be the annual retirement benefit for each plan participant? (Hint: Jean will receive raises for 24 years.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to o decimal places, e.g. 458,581.) Annual Retirement Benefit Jean Honore Colin Davis Anita Baker Gavin Bryars e here to search o te @ LW E S 10 514/2020 ignment CALCULATOR FULL SCREEN PRINTER VERSION BACK NEXT Click here to view factor tables What amount must be on deposit at the end of 15 years to ensure that all benefits will be paid? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) The amount must be on deposit $ Click here to view factor tables What is the amount of each annual deposit Jean must make to the retirement plan? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to o decimal places, e.g. 458,581.) The amount of each annual deposit Click if you would like to Show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. SUBMIT ANSWER Question Attempts: 0 of 3 used SAVE FOR LATER Sarn Maximum Boints available onli n e a 11:35 PM 5/4/2020 e to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts