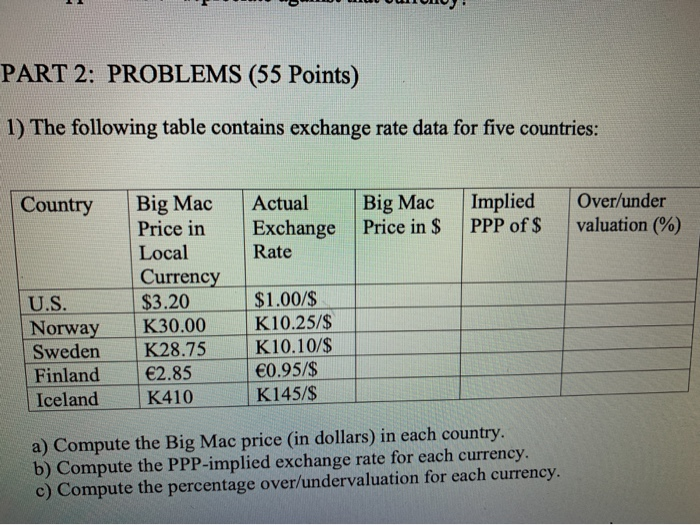

Question: UUUUUU PART 2: PROBLEMS (55 Points) 1) The following table contains exchange rate data for five countries: Country Actual Exchange Rate Big Mac Price in

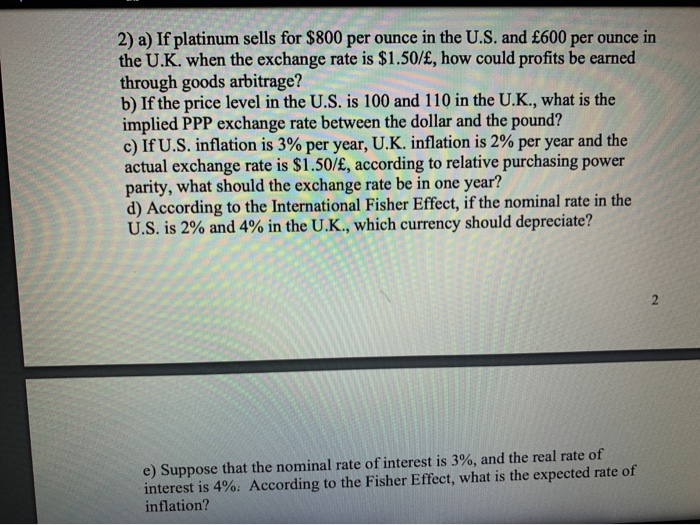

UUUUUU PART 2: PROBLEMS (55 Points) 1) The following table contains exchange rate data for five countries: Country Actual Exchange Rate Big Mac Price in $ Implied PPP of $ Big Mac Price in Local Currency $3.20 Over/under valuation (%) U.S. Norway Sweden Finland Iceland K28.75 2.85 K410 $1.00/$ K10.25/$ K10.10/$ 0.95/$ K145/$ a) Compute the Big Mac price (in dollars) in each country. b) Compute the PPP-implied exchange rate for each currency. c) Compute the percentage over/undervaluation for each currency. 2) a) If platinum sells for $800 per ounce in the U.S. and 600 per ounce in the U.K. when the exchange rate is $1.50/, how could profits be earned through goods arbitrage? b) If the price level in the U.S. is 100 and 110 in the U.K., what is the implied PPP exchange rate between the dollar and the pound? c) If U.S. inflation is 3% per year, U.K. inflation is 2% per year and the actual exchange rate is $1.50/, according to relative purchasing power parity, what should the exchange rate be in one year? d) According to the International Fisher Effect, if the nominal rate in the U.S. is 2% and 4% in the U.K., which currency should depreciate? e) Suppose that the nominal rate of interest is 3%, and the real rate of interest is 4%: According to the Fisher Effect, what is the expected rate of inflation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts