Question: * uz Two ( 52 https://elearn.squ.edu.com/mod/quiz/attempt.php?attempt=1724867&cmid=870 SQU PORTAL ATTENDANCE * (SQU E-LEARNING SYS 0:25:13 AC 3 2.00 Royal Furniture Co. uses a job order costing

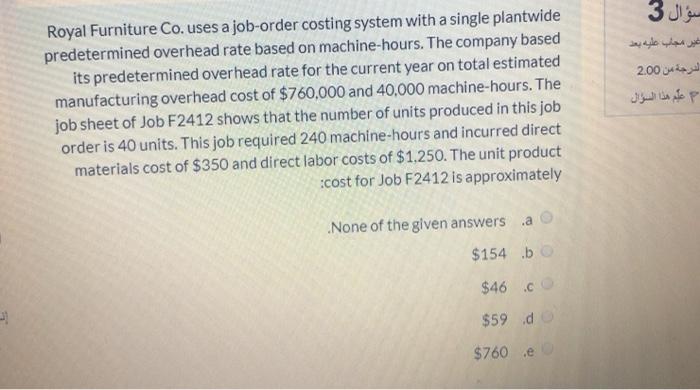

* uz Two ( 52 https://elearn.squ.edu.com/mod/quiz/attempt.php?attempt=1724867&cmid=870 SQU PORTAL ATTENDANCE * (SQU E-LEARNING SYS 0:25:13 AC 3 2.00 Royal Furniture Co. uses a job order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total estimated manufacturing overhead cost of $760,000 and 40,000 machine-hours. The Job sheet of Job F2412 shows that the number of units produced in this job order is 40 units. This job required 240 machine-hours and incurred direct materials cost of $350 and direct labor costs of $1,250. The unit product cost for Job F2412 is approximately None of the given answers a $154.b $46. $59.de $760. 4 Muscat Sayarati Co uses a lob-order costing system with a single plantwide predetermined overhead rate based on labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $350,000, variable manufacturing overhead of $6.00 per labor hour and 35,000 labor hours. The job sheet or Job G828 shows that the number of units in this job order is 45 units which MATHI ctival SUN D 2.00 hop 3 200 Royal Furniture Co. uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total estimated manufacturing overhead cost of $760,000 and 40,000 machine-hours. The job sheet of Job F2412 shows that the number of units produced in this job order is 40 units. This job required 240 machine-hours and incurred direct materials cost of $350 and direct labor costs of $1,250. The unit product :cost for Job F2412 is approximately None of the given answers a $154 .b $46.CO $59 d - $760

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts