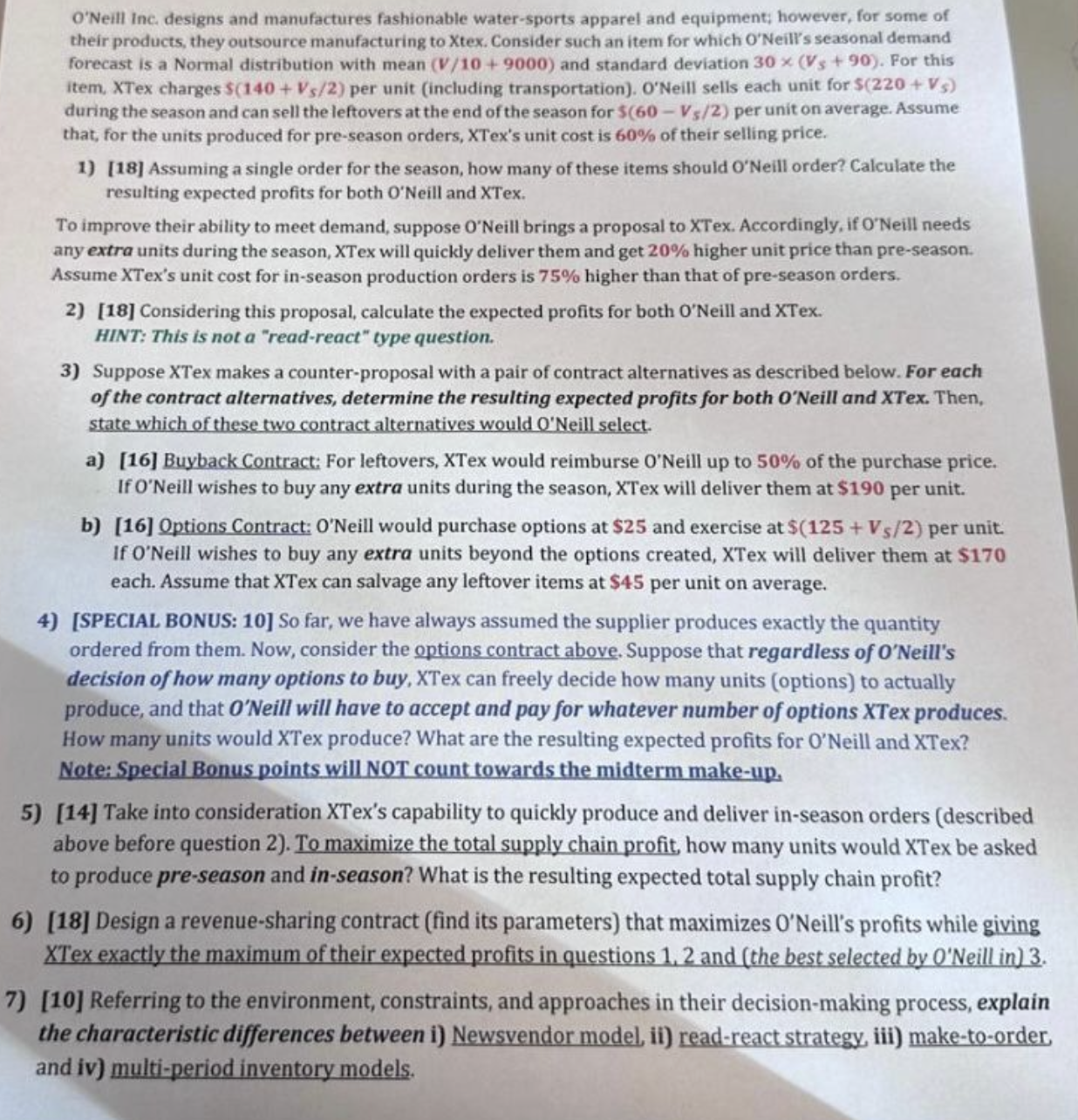

Question: V = 1 2 3 4 5 VS = 1 5 / / / / / / O'Neill Inc, designs and manufactures fashionable water -

V VS O'Neill Inc, designs and manufactures fashionable watersports apparel and equipment; however, for some of

their products, they outsource manufacturing to Xtex. Consider such an item for which O'Neill's seasonal demand

forecast is a Normal distribution with mean V and standard deviation xxVS For this

item, XTex charges $Vs per unit including transportation O'Neill sells each unit for $Vs

during the season and can sell the leftovers at the end of the season for $VS per unit on average. Assume

that, for the units produced for preseason orders, XTex's unit cost is of their selling price.

Assuming a single order for the season, how many of these items should O'Neill order? Calculate the

resulting expected profits for both O'Neill and XTex.

To improve their ability to meet demand, suppose O'Neill brings a proposal to XTex. Accordingly, if O'Neill needs

any extra units during the season, XTex will quickly deliver them and get higher unit price than preseason.

Assume XTex's unit cost for inseason production orders is higher than that of preseason orders.

Considering this proposal, calculate the expected profits for both O Neill and XTex.

HINT: This is not a "readreact" type question.

Suppose XTex makes a counterproposal with a pair of contract alternatives as described below. For each

of the contract alternatives, determine the resulting expected profits for both O'Neill and XTex. Then,

state which of these two contract alternatives would o'Neill select.

a Buyback Contract: For leftovers, XTex would reimburse O'Neill up to of the purchase price.

If O'Neill wishes to buy any extra units during the season, XTex will deliver them at $ per unit.

b Options Contract: O'Neill would purchase options at $ and exercise at $VS per unit.

If O'Neill wishes to buy any extra units beyond the options created, XTex will deliver them at $

each. Assume that XTex can salvage any leftover items at $ per unit on average.

SPECIAL BONUS: So far, we have always assumed the supplier produces exactly the quantity

ordered from them. Now, consider the options contract above. Suppose that regardless of O'Neill's

decision of how many options to buy, XTex can freely decide how many units options to actually

produce, and that O'Neill will have to accept and pay for whatever number of options XTex produces.

How many units would XTex produce? What are the resulting expected profits for O'Neill and XTex?

Note: Special Bonus points will NOT count towards the midterm makeup

Take into consideration XTex's capability to quickly produce and deliver inseason orders described

above before question To maximize the total supply chain profit, how many units would XTex be asked

to produce preseason and inseason? What is the resulting expected total supply chain profit?

Design a revenuesharing contract find its parameters that maximizes Neill's profits while giving

XTex exactly the maximum of their expected profits in questions and the best selected by 'Neill in

Referring to the environment, constraints, and approaches in their decisionmaking process, explain

the characteristic differences between i Newsvendor model, ii readreact.strategy, iii maketoorder,

and iv multiperiod inventory models.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock