Question: v 1 Carter, opened a business called Carter Engineering and recorded the following transactions in its first month of operations. June 1 1. Carter, the

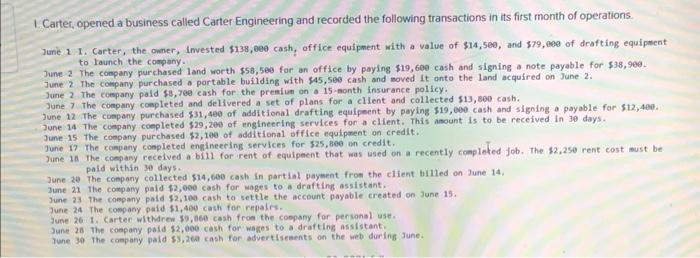

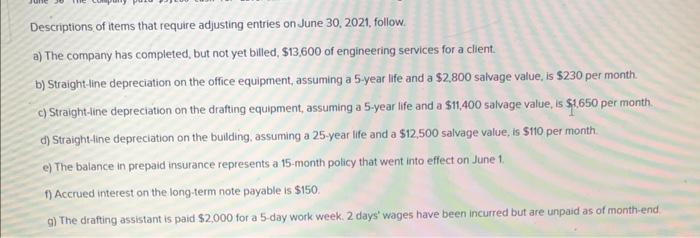

1 Carter, opened a business called Carter Engineering and recorded the following transactions in its first month of operations. June 1 1. Carter, the owner, invested $138,000 cash, affice equipment with a value of $14,500, and $79, 00e of drafting equipsent to launch the company. June. 2 The company purchased land worth $56,560 for an office by paying $19,600 cash and signing a note payable for $38,900. June 2 The company purchased a portable building with $45,500 cash and moved it onto the land acquired on June 2. June 2 The coepany pald $3,76e cash for the preaium on a 15 -month insurance pollicy. June 7 the company coapleted and dellvered a set of plans for a client and collected 513, 800 cash. June 12 The company purchased $31,400 of additional drafting equipeent by paying $19,000 cash and signing a payable for $12, 400 . June 14 The coepany coepleted $29,200 of engineering services for a client. This asount is to be received in 10 days. June 15 the company purchased 82,100 of additional office equipnent on credit. June 17 the company completed engineering services for 525 , Bee on credit. zune 16 The coppany recelved a bill for rent of equipeent that was used on a recently completed job. The 32,2se rent cost must be June 20 paid within 30 days. June 21 the company collected \$14,6e0 cash in partial paysent from the client billed on June 14. June 23 the company paid 52,000 cash for wages to a drafting assistant. zune 24 the company paid 51,400 cash for repalis. June 26 i. Carter withdren 39,060 cash froa the coopany for personal use. June 26 the coapany paid $2,000 cash for wages to a drafting assistant. June 3 a the company pald \$3, 260 cash for advertlseents on the web during June. Descriptions of items that require adjusting entries on June 30,2021 , follow. a) The company has completed, but not yet billed, $13,600 of engineering services for a client. b) Straight-line depreciation on the office equipment, assuming a 5 -year life and a $2,800 salvage value, is $230 per month. c) Straight-line depreciation on the drafting equipment, assuming a 5 -year life and a $11,400 salvage value, is \$1,650 per month. d) Straight-tine depreciation on the building, assuming a 25-year life and a $12,500 salvage value, is $110 per month. e) The balance in prepaid insurance represents a 15 -month policy that went into effect on June 1. f) Accrued interest on the long-term note payable is $150. 9) The drafting assistant is paid $2,000 for a 5 -day work week. 2 days' wages have been incurred but are unpaid as of month-end. 1 Carter, opened a business called Carter Engineering and recorded the following transactions in its first month of operations. June 1 1. Carter, the owner, invested $138,000 cash, affice equipment with a value of $14,500, and $79, 00e of drafting equipsent to launch the company. June. 2 The company purchased land worth $56,560 for an office by paying $19,600 cash and signing a note payable for $38,900. June 2 The company purchased a portable building with $45,500 cash and moved it onto the land acquired on June 2. June 2 The coepany pald $3,76e cash for the preaium on a 15 -month insurance pollicy. June 7 the company coapleted and dellvered a set of plans for a client and collected 513, 800 cash. June 12 The company purchased $31,400 of additional drafting equipeent by paying $19,000 cash and signing a payable for $12, 400 . June 14 The coepany coepleted $29,200 of engineering services for a client. This asount is to be received in 10 days. June 15 the company purchased 82,100 of additional office equipnent on credit. June 17 the company completed engineering services for 525 , Bee on credit. zune 16 The coppany recelved a bill for rent of equipeent that was used on a recently completed job. The 32,2se rent cost must be June 20 paid within 30 days. June 21 the company collected \$14,6e0 cash in partial paysent from the client billed on June 14. June 23 the company paid 52,000 cash for wages to a drafting assistant. zune 24 the company paid 51,400 cash for repalis. June 26 i. Carter withdren 39,060 cash froa the coopany for personal use. June 26 the coapany paid $2,000 cash for wages to a drafting assistant. June 3 a the company pald \$3, 260 cash for advertlseents on the web during June. Descriptions of items that require adjusting entries on June 30,2021 , follow. a) The company has completed, but not yet billed, $13,600 of engineering services for a client. b) Straight-line depreciation on the office equipment, assuming a 5 -year life and a $2,800 salvage value, is $230 per month. c) Straight-line depreciation on the drafting equipment, assuming a 5 -year life and a $11,400 salvage value, is \$1,650 per month. d) Straight-tine depreciation on the building, assuming a 25-year life and a $12,500 salvage value, is $110 per month. e) The balance in prepaid insurance represents a 15 -month policy that went into effect on June 1. f) Accrued interest on the long-term note payable is $150. 9) The drafting assistant is paid $2,000 for a 5 -day work week. 2 days' wages have been incurred but are unpaid as of month-end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts