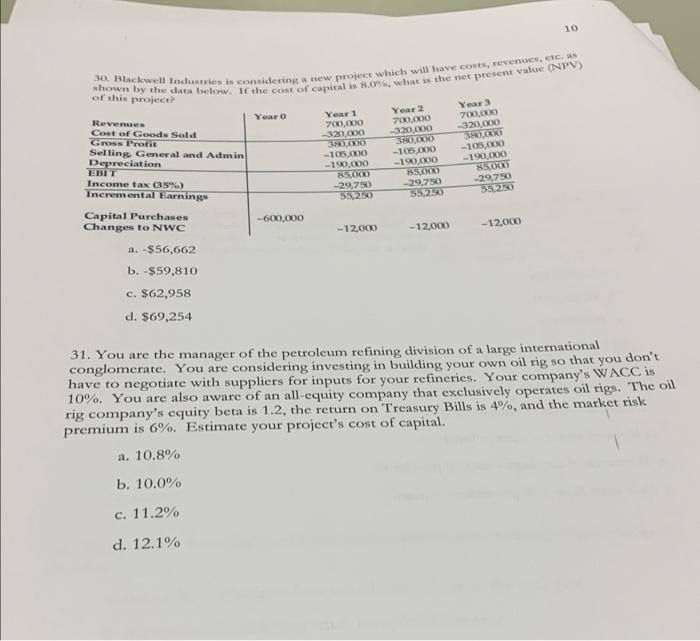

Question: v 10 shown by the data below. If the cost of capital is 8.09 what is the net prenent value (NPV) 30. Blackwell achantries is

10 shown by the data below. If the cost of capital is 8.09 what is the net prenent value (NPV) 30. Blackwell achantries is considering a new project which will have costs, revenues, etc. of this project? Year Revenues Cost of Goods Sold Gross Profit Selling General and Admin Depreciation EBIT Income tax (35%) Incremental Earnings Year 1 700.000 -320,000 30.000 -105,000 - 190.000 85000 -29,750 55230 Year 2 700.000 320.000 3000 -105.000 -190.000 85,000 ~29,750 5512330 Year 700,000 -320,000 38,00 --105,000 -190,000 85,000 -29,750 55.250 -600,00 Capital Purchases Changes to NWC a. $56,662 - 12.000 -12.000 - 12.000 b. $59,810 c. $62,958 d. $69,254 31. You are the manager of the petroleum refining division of a large international conglomerate. You are considering investing in building your own oil rig so that you don't have to negotiate with suppliers for inputs for your refineries. Your company's WACC is 10%. You are also aware of an all-equity company that exclusively operates oil rigs. The oil rig company's equity beta is 1.2, the return on Treasury Bills is 4%, and the market risk premium is 6%. Estimate your project's cost of capital. a. 10.8% b. 10.0% c. 11.2% d. 12.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts